ETF investors seeking a pure play on the communications sector can look to funds like the Invesco S&P 500 Equal Weight Communication Services ETF (EWCO).

EWCO, which is up about 20% year-to-date, seeks to track the investment results of the S&P 500® Equal Weight Communication Services Plus Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is composed of all of the components of the S&P 500® Communication Services Plus Index, an index that contains the common stocks of all companies included in the S&P 500® Index that are classified as members of the communication services sector, as defined according to the Global Industry Classification Standard (GICS). The fund uses a mix of allocation styles, but primarily operates within large cap value, blend, and growth, with some mid cap value and blend styles added in.

Diversification and Higher Returns

An Invesco “Strategy Insights” report recently highlighted the benefits of using an equal-weighted investment approach. A couple of those include diversification potential and historically higher returns when comparing the S&P 500 Index and S&P 500 Equal Weight Index (EWI).

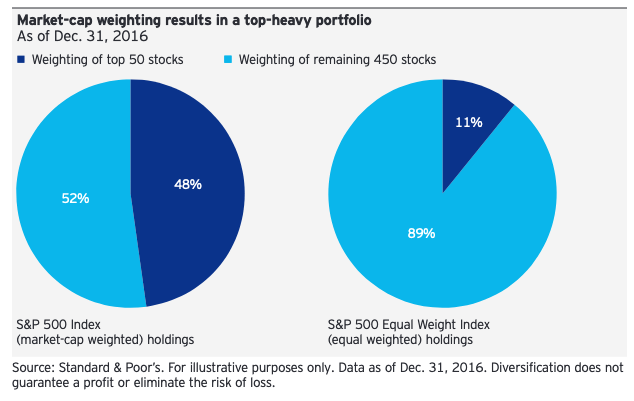

“Due to market-cap weighting, performance of the S&P 500 Index can be dominated by a small number of stocks,” the report said. “The 50 largest securities in the index represent nearly 50% of its weight, leaving the next 450 stocks to account for the remaining 50%. The top 50 stocks in the S&P EWI, on the other hand, comprise just 11% of that index.”

“Equal weighting means every stock has the same potential influence on the returns of the S&P EWI, whereas in the S&P 500 Index, a stock with a weight of 2% has 10 times the influence of one with a weight of just 0.2%,” the report noted.

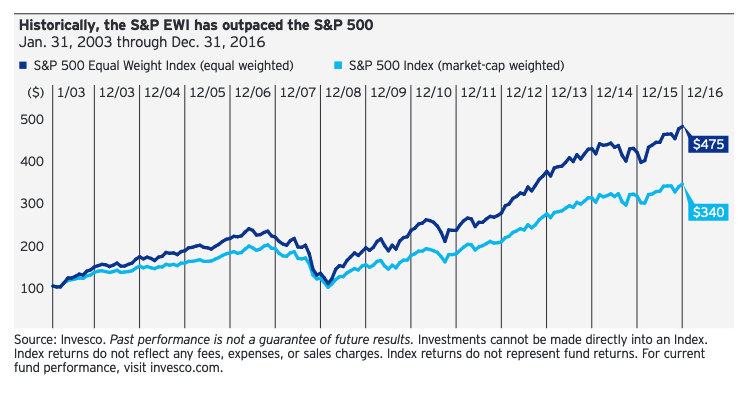

Of course, investors want to know just how well the strategy as held up over time. Thus far, history is on its side.

“The S&P EWI has also outpaced the S&P 500, historically. Investments of $100 on Jan. 31, 2003 would have grown to $475 by Dec. 31, 2016 for the S&P EWI, but only $340 for the S&P 500,” the report said further. “Greater exposure to smaller capitalization stocks with higher growth rates may help to explain this difference.”

“Companies worth hundreds of billions of dollars, like the largest stocks in the S&P 500, may find continued above-average growth difficult since ‘trees don’t grow to the sky,'” the report added.

For more news and information, visit the Innovative ETFs Channel.