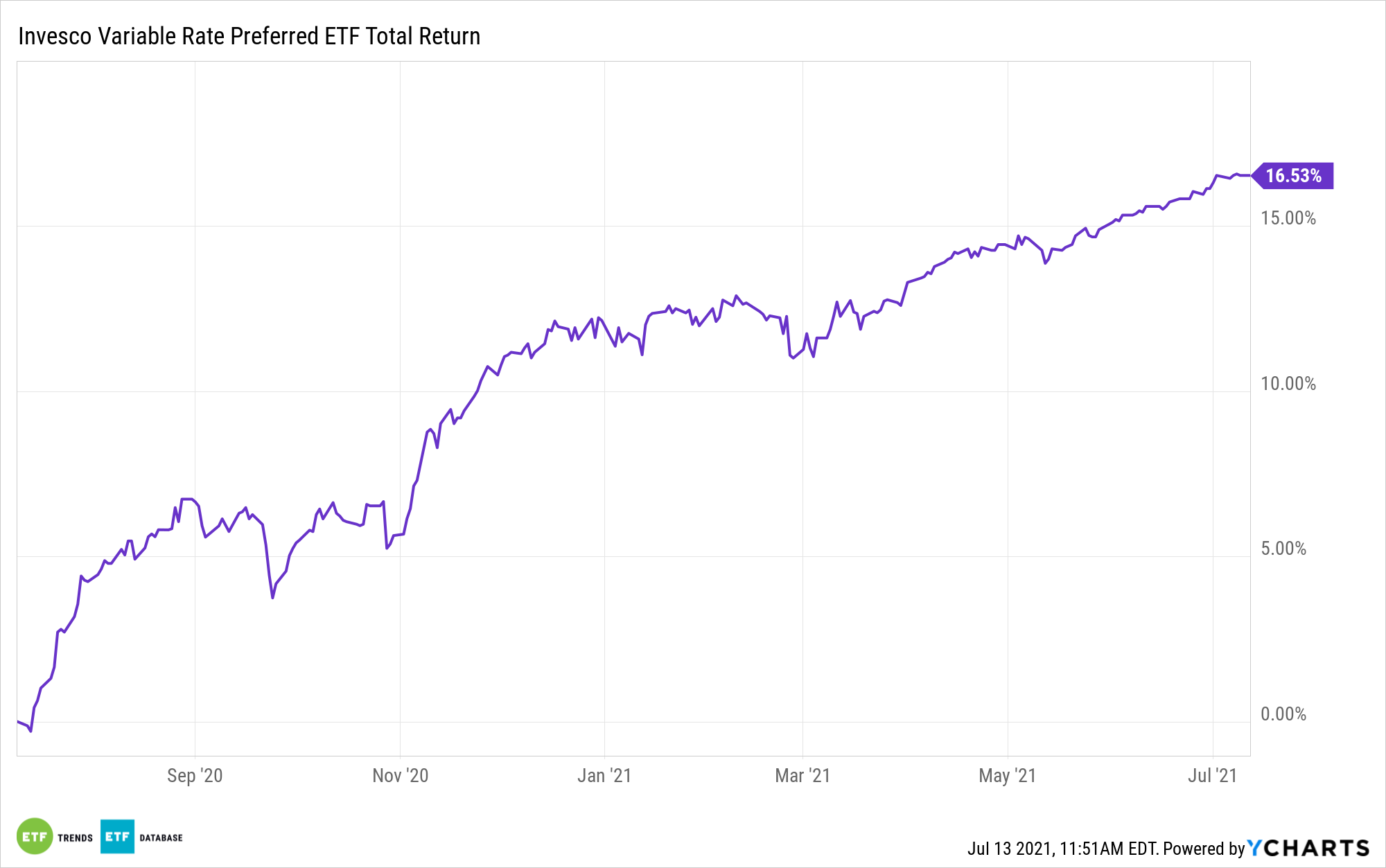

Bond prices are pushing higher, which in turn is pushing yields lower, but there are options available in preferred securities with assets like the Invesco Variable Rate Preferred ETF (VRP).

“Globally, the preferred securities universe represents a fixed-income asset class of approximately $850 billion,” an Invesco analysis noted. “Typically, investors choose preferred securities for their relatively high rates of income, quality and good liquidity. Preferreds may offer attractive total-return potential and modest correlations with other fixed-income asset classes as well.”

The fund is based on the ICE Variable Rate Preferred & Hybrid Securities Index (Index). The ETF will generally invest at least 90% of its total assets in fixed rate preferred securities in the U.S. market by financial companies.

The index is designed to track the performance of floating and variable rate investment grade and below investment grade U.S. dollar preferred stock, as well as certain types of hybrid securities that determined by the index provider, comparable to preferred stocks, that are issued by corporations in the U.S. market. The fund does not purchase all of the securities in the index; instead, the fund utilizes a “sampling” methodology to seek to achieve its investment objective.

“Preferred securities are fixed-income investments, but with certain equity characteristics such as deeper subordination to other debt instruments within a company’s capital structure,” the Invesco analysis said. “Despite preferreds’ long stated lives, abundant fixed-to-floating-rate preferred instruments can significantly diminish interest-rate risk in diversified portfolios. Since many preferreds pay qualified dividends, preferreds can also offer significant tax advantages.”

Countering Record-Low Yields

The case for VRP is even more compelling given the record-low yields of the current market environment. The notion that inflation could be adding to the downward push on yields, including riskier debt.

“A rally in corporate debt rated below investment grade has pushed yields to record lows around 4.57%, according to ICE Bank of America data through Thursday, while consumer prices rose 5% in May compared with a year earlier,” a Wall Street Journal report noted. “That marks the first time on record junk-bond yields have dropped below the rate of inflation, according to Bespoke Investment Group.”

Countering this with alternative sources of income like preferred securities is certainly an option for investors. This is where VRP comes into play—the fund comes with an expense ratio of 0.50%.

“Today, in our view, preferred securities offer attractive value, given their historically wide credit spreads, regulatory reforms that are catalyzing their performance and driving improved fundamentals, and a global refinancing wave from the largest issuers of preferred securities: banking and insurance companies,” the Invesco analysis continued.

For more news and information, visit the Innovative ETFs Channel.