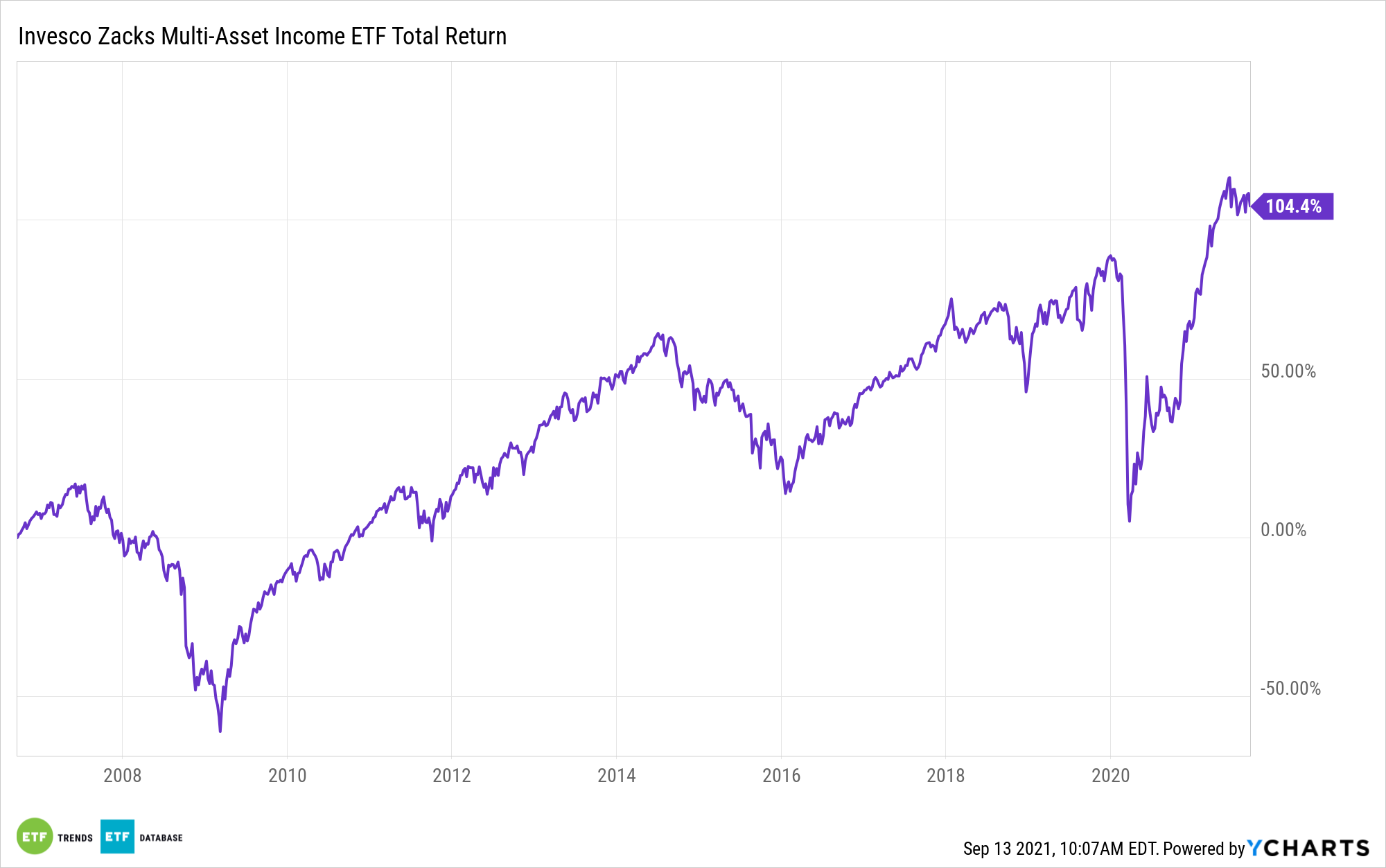

Given the current low-rate environment, it’s not enough these days to draw income from one asset class like bonds. One ETF can pull income from a variety of sources: Invesco Zacks Multi-Asset Income ETF (CVY).

As a Schroders article put it succinctly: “Investors seeking income are facing a different investment landscape now to in the past. Gone are the days of savings accounts offering high rates of interest, and safe government bonds with inflation-beating yields. Investors seeking higher real returns (i.e. returns that outpace inflation) instead may need to turn to different, higher-risk asset classes, such as corporate bonds or equities.”

This is where a fund like CVY can sift through a variety of opportunities and pool these income sources into one fund. In essence, the ETF is an estuary of income streams whether the source is traditional bonds or dividends or something else.

Per the fund description, CVY is based on the Zacks Multi-Asset Income Index (Index). The Fund will invest at least 90% of its total assets in securities and depositary receipts that comprise the Index.

The Index is comprised of domestic and international companies, including U.S.-listed common stocks, American depositary receipts (ADRs) paying dividends, real estate investment trusts (REITs), master limited partnerships (MLPs), closed-end funds, and traditional preferred stocks. The Index is computed using the gross total return, which reflects dividends paid.

Why a Multi-Asset Income Strategy?

A multi-asset income strategy gives investors a variety of income sources that allow for diversification. While one income stream may dry up, another can slot in and keep the income stream flowing.

“As the name implies, these contain investments ranging across many different asset classes, including equities, bonds, cash, real estate and infrastructure,” the Schroder article noted.

“In the case of multi-asset income funds, the emphasis will typically be on those asset classes producing a ‘natural’ income, in particular high-yielding bonds, emerging market debt, real estate securities offering a rental income and high dividend-paying equities,” the article added.

In addition, more diversification can be had by investing outside the U.S. CVY pulls income sources from other countries for further diversification, including Canada, Brazil, and the United Kingdom.

Furthermore, the ETF tilts its holdings towards mostly value. As of September 9, the fund’s allocations skew mostly towards large-cap, mid-cap, and small-cap value.

For more news, information, and strategy, visit the Innovative ETFs Channel.