Commodities saw another monthly gain in May, partially driven by record inflation, export embargos, and import bans. According to Fiona Boal, head of commodities and real assets at S&P Dow Jones Indices, the S&P GSCI closed the month up 5.1%, bringing the index’s year-to-date performance to 47%.

The war in Ukraine has disrupted global food supplies to an unprecedented degree, driving up fears about food security. A prime example is the tightening global wheat supply picture. Ukraine is considered Europe’s breadbasket and roughly one-third of global exports of wheat come from Ukraine and Russia.

Severe restrictions on wheat exports from this region combined with worsening harvest prospects in China, parts of Europe, and the U.S., as well as an export ban by major producer India, have tightened stocks and exacerbated global food supply concerns.

These continued disruptions to the flow of agricultural commodities out of Ukraine and Russia pushed grain markets higher. In fact, global wheat prices have skyrocketed: the S&P GSCI Wheat was up 3.1% in May and 39.2% YTD.

Commodities ETFs Surging

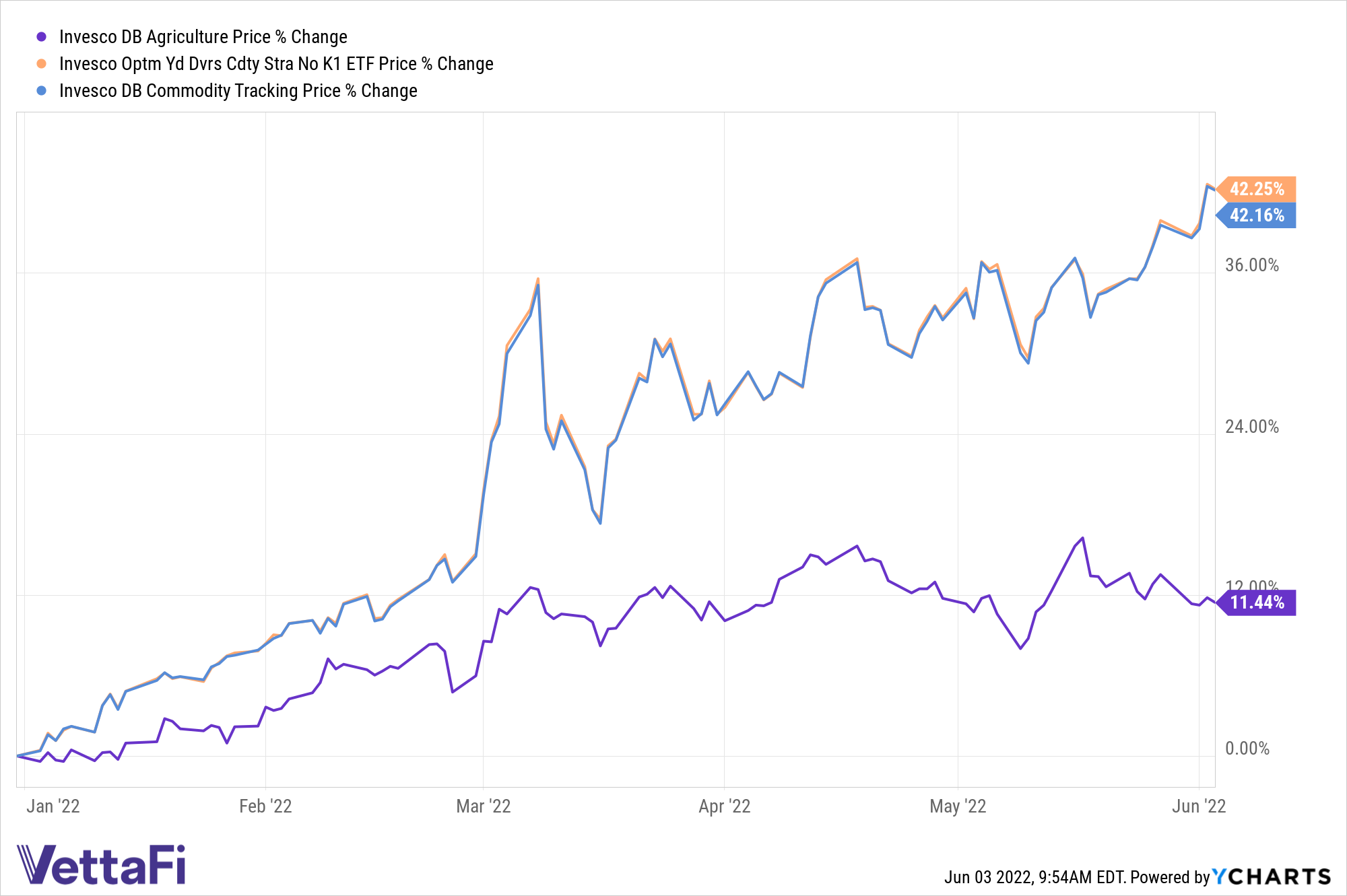

Commodities ETFs like the Invesco DB Agriculture Fund (DBA), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), and the Invesco DB Commodity Index Tracking Fund (DBC) are seeing strong year-to-date gains in this environment.

DBA is a combination of futures within several areas of agriculture, including wheat, soybeans, coffee, corn, cattle, cocoa, sugar, hogs, and cotton. It invests in a diversified basket of various agricultural natural resources and seeks to track changes in the level of the DBIQ Diversified Agriculture Index Excess Return plus the interest income from its holdings of primarily U.S. Treasury securities and money market income.

The index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities. The fund and the index are rebalanced and reconstituted annually in November. DBA is up more than 11% for the year.

Meanwhile, PDBC seeks long-term capital appreciation and seeks to achieve its investment objective by investing in a combination of financial instruments that are economically linked to the world’s most heavily traded commodities. It offers exposure to commodity futures without the tax hassle of a K-1.

The fund also attempts to avoid “negative roll yield,” which could erode returns over time. PDBC has gained more than 42% year-to-date.

DBC seeks to track changes in the level of the DBIQ Diversified Agriculture Index Excess Return, plus the interest income from the fund’s holdings of primarily U.S. Treasury securities and money market income less the fund’s expenses.

DBC is ideally positioned in an environment of stagflation, as the ETF allocates about 24% of its weight to Brent and West Texas Intermediate crude contracts. The fund also devotes about 21% of its weight to such soft commodities as wheat and corn. Like PDBC, DBC has also enjoyed a year-to-date gain of more than 42%.

For more news, information, and strategy, visit the Innovative ETFs Channel.