With a U.S.-China trade war still weighing in the balance for the capital markets, investors can forge on irrespective of trade negotiation results with China technology-focused exchange-traded funds (ETFs). A key metric to look at is the FTSE China A Innovative Enterprises Index, otherwise known as “China’s Nasdaq.”

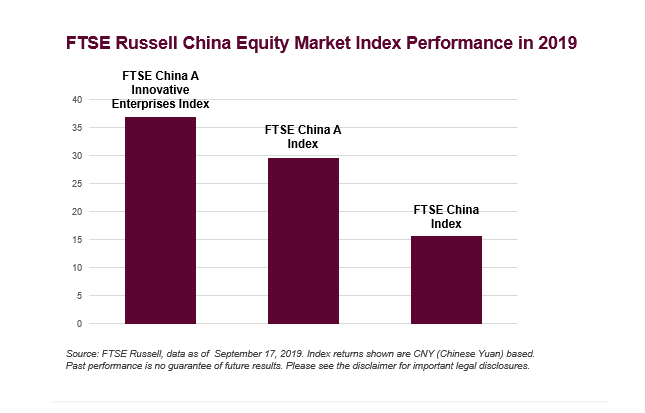

Created in 2009 by the Shenzhen Stock Exchange, the ChiNext Board has been referred to as “China’s Nasdaq” for the innovative and growth-oriented Chinese firms it has attracted over the last decade. And this growth potential has been recognized in 2019, as reflected by a nearly 37% (CNY) year-to-date return for the FTSE China A Innovative Enterprises Index.

FTSE Russell compared performance for this Index, which was launched in 2017 as a way for global investors to track the performance of fast-growing ChiNext stocks listed on the Shenzhen Stock Exchange, relative to the FTSE China A Index and the FTSE China Index.

“As the FTSE China A Innovative Enterprises Index returns this year have illustrated, opportunity can be found in innovative ChiNext Board companies. Our FTSE China A Innovative Enterprises Index was designed to provide broad exposure to ChiNext stocks across the full market capitalization spectrum, giving investors exposure to the full China equity opportunity set,” said Penny Ning Pan, director, product management at FTSE Russell.

After global equity markets opened on September 23, 2019, FTSE Russell implemented the second of three tranches in phase one of its China A Shares implementation toward adding 25% of the investable market cap of eligible large, mid and small cap China A Shares to the FTSE Global Equity Index Series and its derived indexes. FTSE Russell’s phase one China A Share inclusion has included ChiNext stocks from the start.

For more information about the FTSE China indexes and the China A Shares implementation timeline, go to the FTSE Russell website.

- Invesco China Technology ETF (NYSEArca: CQQQ): CQQQ is based on the AlphaShares China Technology Index, which is designed to measure the performance of the investable universe of publicly-traded information technology companies open to foreign investment that are based in mainland China, Hong Kong or Macau.

- Global X MSCI China Information Technology ETF (CHIK): CHIK tries to reflect the performance of the large- and mid-capitalization segments of the MSCI China Index that are classified in the Information Technology Sector as per the Global Industry Classification System.

- KraneShares CSI China Internet Fund (NasdaqGM: KWEB): KWEB tracks a portfolio of Chinese internet and internet-related companies. The portfolio includes Chinese internet companies that provide similar services as Google, Facebook, Twitter, eBay and Amazon.

For more market trends, visit ETF Trends.