With global economies improving on the hopes of a Covid-19 vaccine, investors are renewing their faith in the capital markets once more. Yet with heavy trading volume more volatility could be on the way, an issue the Invesco S&P 500® Downside Hedged ETF (PHDG) easily sidesteps.

The ETF is an actively managed fund that seeks to achieve positive total returns in rising or falling markets that are not directly correlated to broad equity or fixed-income market returns. PHDG seeks to achieve its investment objective by using a quantitative, rules-based strategy that seeks to obtain returns that exceed the S&P 500 Dynamic VEQTOR Index.

The Index provides investors with broad equity market exposure with an implied volatility hedge by dynamically allocating between equity, volatility, and cash. The index allows investors to receive exposure to the equity and volatility of the S&P 500 Index in a dynamic framework.

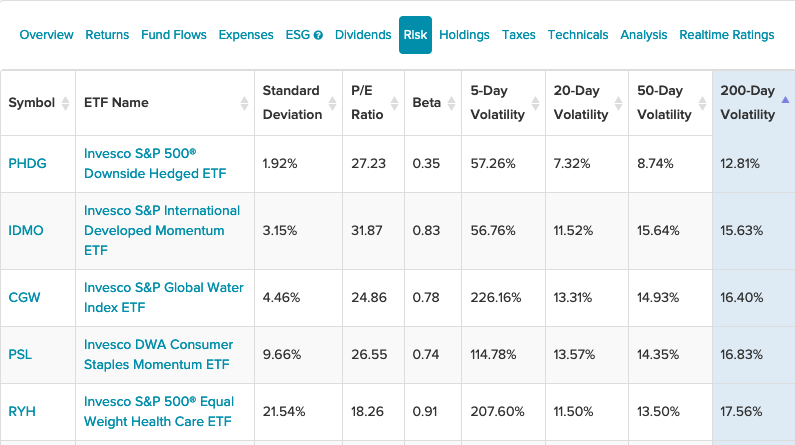

Among the list of low-volatility ETFs that also posted double-digit gains within the past year, PHDG stood head and shoulders above the rest of distinguished Invesco ETFs. Its 200-day volatility came in at 12.81%, to top the list of funds screened out via the intuitive ETF Database screener.

Looking at PHDG’s one-year chart, the fund is up 16.47%, besting the S&P 500’s 13.17%. A visual representation of PHDG and the S&P 500 highlights the disparity between both charts.

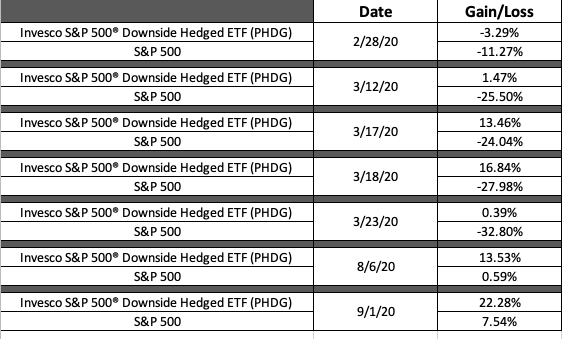

The push and pull of market forces was particularly noticeable during the end of February and through March of 2020. While the S&P 500 fell, PHDG counteracted the index by posting gains.

PHDG: Protecting Downside, Capturing Upside

On March 18th, as the pandemic sell-offs were in full swing, PHDG gained 16.84% while the S&P 500 lost about 28%. Even when the S&P 500 reached a bottom-of-the-barrel low of a 32.8% loss on March 23,2020, PHDG was still able to eke out a gain of 0.39%.

Even as the sell-offs started to ease, the fund was still able to capture upside, making PHDG a multi-purpose tool to mute downtrends and still capture market gains in an upswing. This was apparent on August 8, 2020, which saw the S&P 500 gain 0.59% while PHDG was up 13.53%.

For more news and information, visit the Innovative ETFs Channel.