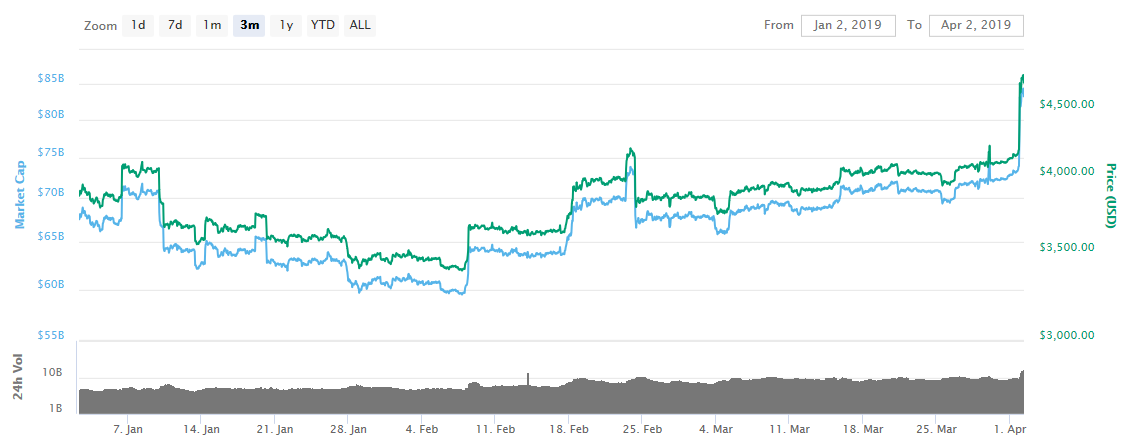

Leading digital currency Bitcoin touched past $5,000, hitting its highest level since November with analysts citing investor interest after it went above the $4,200 price mark.

Bitcoin, the largest cryptocurrency based on market size, is up almost 14 percent within the last 24 hours. It was languishing in the $3,000 price range for the last few months before making its move higher.

“The Bitcoin market and crypto market in general continues to be small relative to the rest of the markets — and emotional,” said Jehan Chu, managing partner at blockchain investment and advisory firm Kenetic Capital. “It’s still very much subject to waves of enthusiasm. I don’t think today is anything special.”

While the uptick is certainly a boon to traders, it may discourage casual investors with its volatility and price swings. Nonetheless, as the prospects of a Bitcoin exchange-traded fund (ETF) are looming, it could be more closely-watched given its latest price increase.

“Events such as today’s will probably be seen negatively, or viewed as this market doesn’t conform to the trading of traditional instruments,” said Dave Chapman, CEO of crypto exchange ANXONE. “We have to realize that this asset class is only a decade old, and it only started getting mainstream attention five years ago.” Related: Bitcoin May Not Need an ETF to Rally This Year

Related: Bitcoin May Not Need an ETF to Rally This Year

SEC Decision Pending on Bitcoin ETF

A recent Bitwise report peeled back the layers of Bitcoin trading and found that most bitcoin trading is faked by unregulated exchanges–a red mark on a cryptocurrency industry that is trying to obtain some legitimacy, especially on Wall Street where digital currency-based exchange-traded funds are pending with the Securities Exchange Commission (SEC). However, the story could be slanted in favor of digital currencies.

Per a story by the Wall Street Journal referencing the Bitwise report, “Nearly 95% of all reported trading in bitcoin is artificially created by unregulated exchanges, a new study concludes, raising fresh doubts about the nascent market following a steep decline in prices over the past year.”

On the other hand, Bitwise, a provider of index and cryptoasset funds, said it met with the SEC with regard to its application for a crypto-based ETF. On the surface, the report might cast more doubt on a cryptocurrency industry that is a lightning rod for manipulation, but it also shows regulators what is real and what isn’t in terms of cryptocurrency trading.

In essence, excluding the artificial trading will also highlight the real trading where an efficient market is actually taking place.

“People looked at cryptocurrency and said this market is a mess, that’s because they were looking at data that was manipulated,” said Matthew Hougan, global head of research at Bitwise. “When you cut away the echo chamber of these nonsense numbers, it should be an efficient, well-arbitraged market.”

The SEC will decide on the Bitwise Bitcoin ETF in mid-May.

For more market trends, visit ETF Trends.