Small-cap movement in indexes like the Russell 2000 can portend to a wider move in the broad market. Right now, investors are dialing up the risk again, which could mean more gains from the major indexes. Investors who don’t have small-cap exposure just yet can look to the iShares Russell 2000 ETF (IWM) for exposure.

IWM seeks to track the investment results of the Russell 2000® Index, which measures the performance of the small-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index.

It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index. With its relatively low 0.19% expense ratio, IWM gives investors:

- Exposure to small public U.S. companies

- Access to 2000 small-cap domestic stocks in a single fund

- Use to diversify a U.S. stock allocation and seek long-term growth in your portfolio

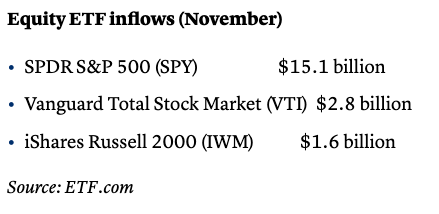

According to data from ETF.com, IWM has been seeing keen interest from investors as of late due to the vaccine rally–proof that large caps can’t have all the fun when positive news hits the market. As a CNBC article noted, “Inflows into plain-vanilla equity ETFs like the S&P 500 (SPY), Vanguard Total Stock Market (VTI), and the Russell 2000 (IWM) have been particularly strong this month.”

Aside from a vaccine rally, what’s moving the markets of late? One variable is the expectation of higher earnings, especially in technology equities.

“Animating the strong inflows into stocks: A belief that earnings for market leaders like technology will stay strong in 2021 but that beaten-up sectors like energy, banks, and industrials will also see a 2021 rebound that brings earnings back to 2019 levels — and beyond,” the article added. “Earnings estimates for the S&P 500 are expected to be down 16% this year but are expected to rebound in 2021 to levels slightly above the 2019 historic highs.”

“We have higher estimates for next year,” Mike Wilson from Morgan Stanley told CNBC’s “Closing Bell.”

“We’re around $175 for the S&P 500, we have a $183 bull case, so I think we’re probably leaning toward that bull case with these vaccines getting out there faster than maybe we were expecting, so $180 in earnings power next year is a big number,” Wilson said.

For more news and information, visit the Innovative ETFs Channel.