Low volatility strategy can help investors during market drawdowns. Invesco offers four exchange traded funds (ETFs) that can help.

Volatility is a statistical measurement of the magnitude of up-and-down asset price fluctuations over time.

“As the name implies, low-volatility strategies focus on stocks with a history of lower volatility than their peers,” Invesco explains on its website.

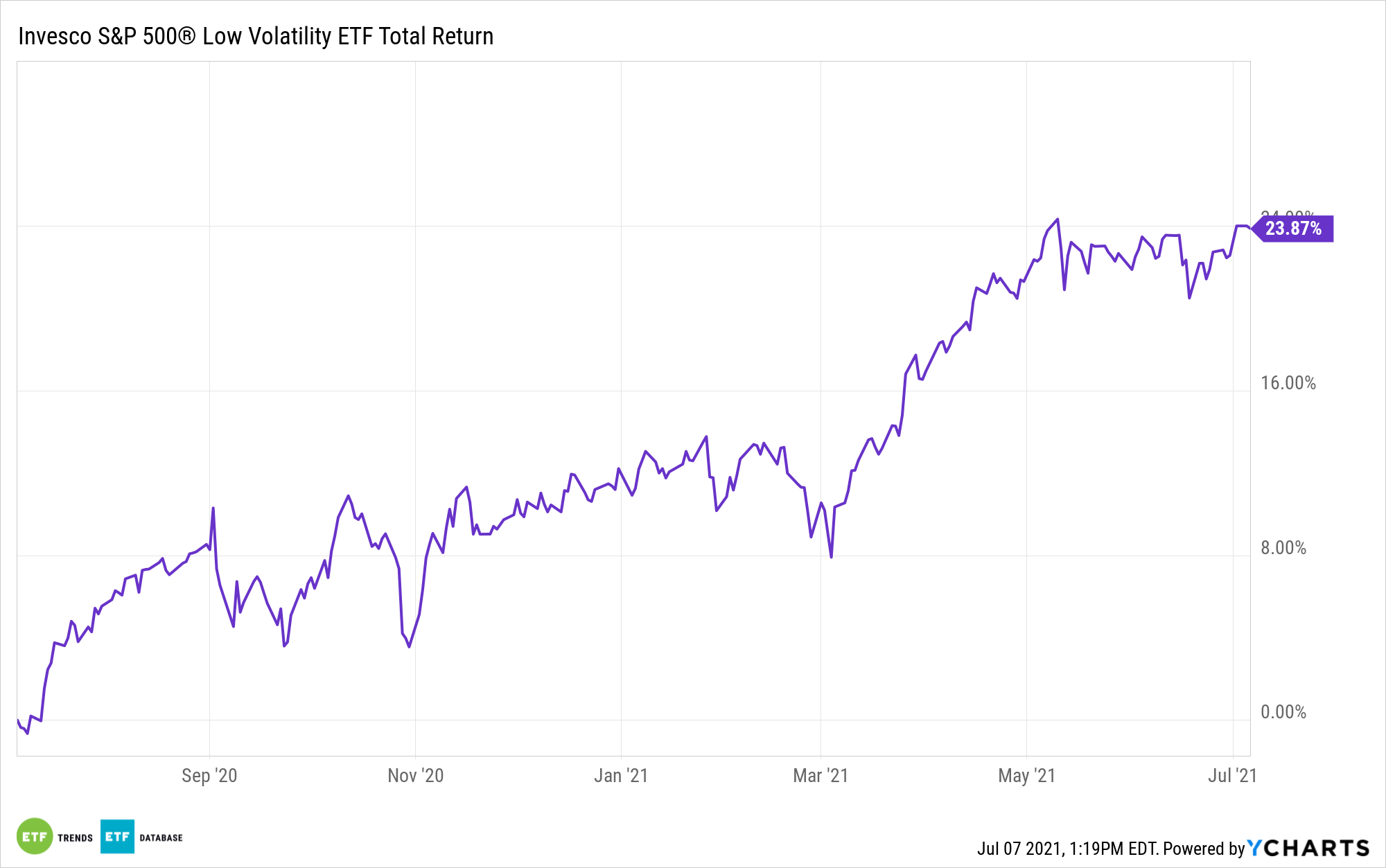

For a low volatility strategy when purely trading the S&P 500, there’s the Invesco S&P 500 Low Volatility ETF (SPLV). The fund is based on the S&P 500® Low Volatility Index and seeks to invest at least 90% of its total assets in common stocks that comprise the Index.

The index is compiled, maintained, and calculated by Standard and Poor’s and consists of the 100 stocks from the SP 500 Index with the lowest realized volatility over the past 12 months. The fund comes with a low expense ratio of 0.25%.

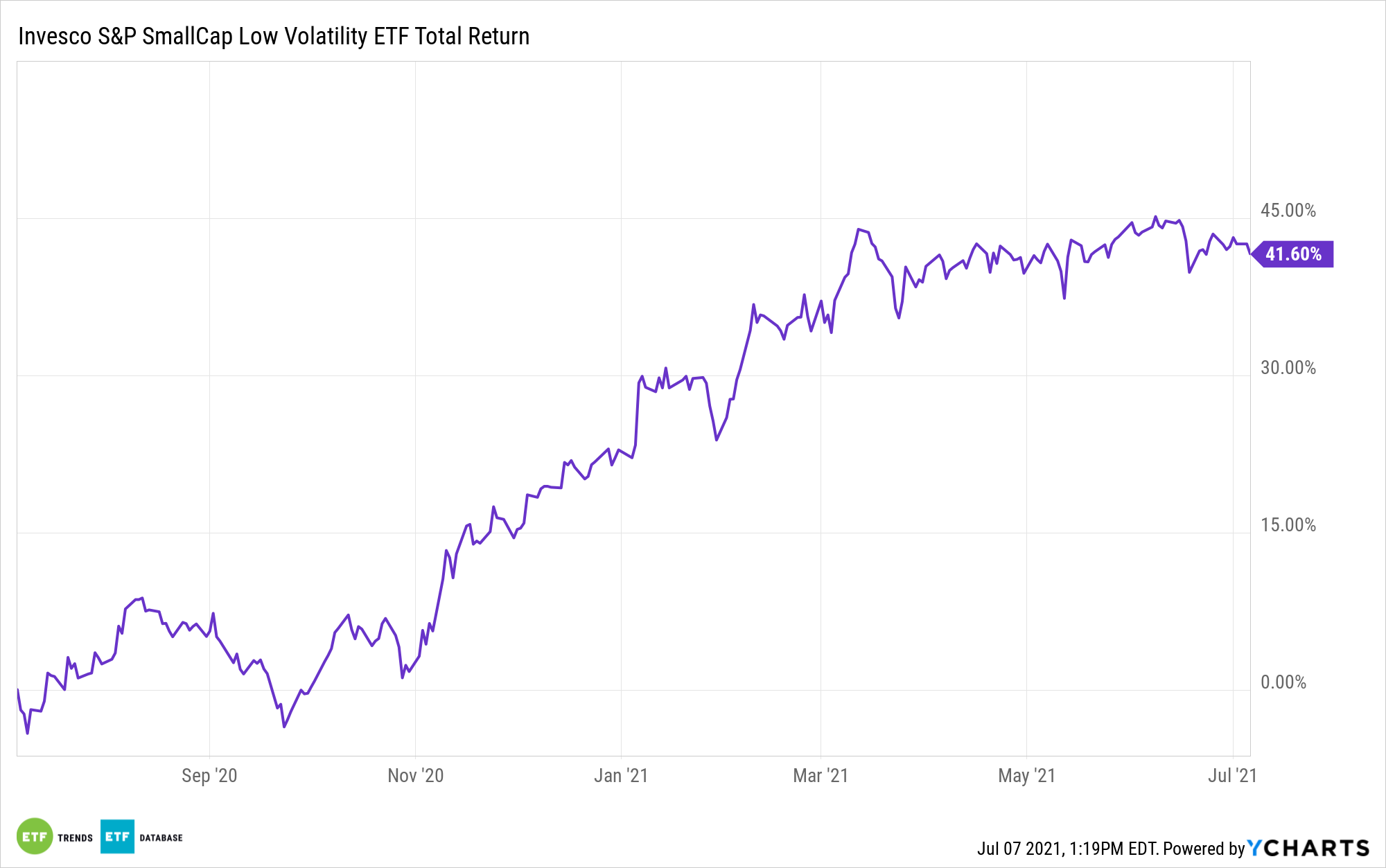

Small caps can be subjected to large market swings, which makes the Invesco S&P SmallCap Low Volatility ETF (XSLV) another prime choice for volatility protection. As per the fund description, XSLV seeks to track the investment results of the S&P SmallCap 600 Low Volatility Index.

The low volatility strategy also doesn’t come at a high cost. XSLV’s expense ratio comes in 40 basis points below its category average for similar funds.

Mid Caps and a Multifactor Approach

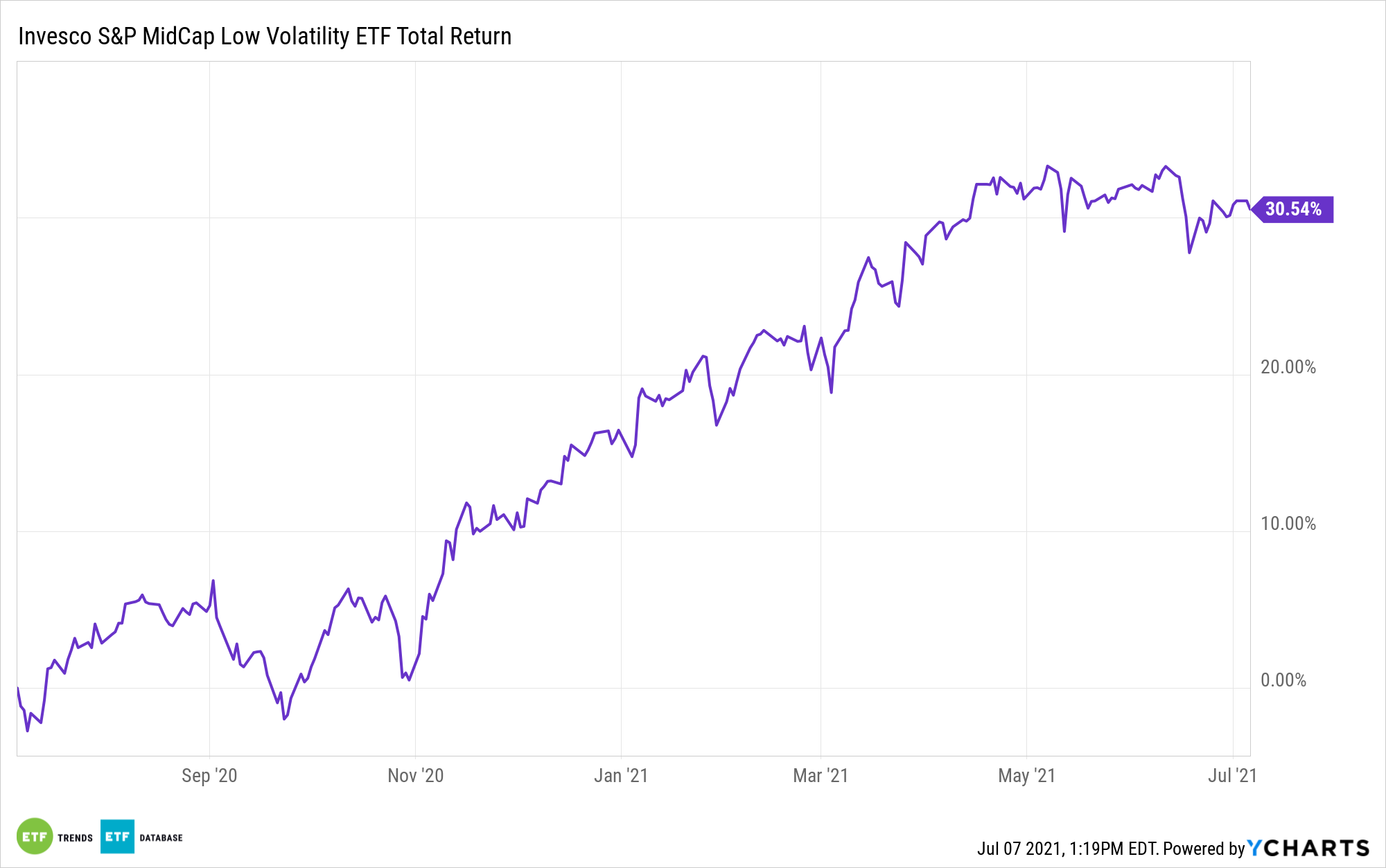

Mid cap volatility protection can be had with funds like the Invesco S&P MidCap Low Volatility ETF (XMLV). The fund seeks to track the investment results of the S&P MidCap 400 Low Volatility Index.

Strictly in accordance with its procedures and mandated guidelines, the index provider selects for inclusion in the underlying index the 80 securities that it has determined have the lowest volatility over the past 12 months out of the 400 medium capitalization securities that are contained in the S&P MidCap 400 Index.

A multi-factor approach can also help to prevent concentration risk in one factor. One ETF in this arena is the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL).

OMFL seeks to track the investment results of the Russell 1000 Invesco Dynamic Multifactor Index. This underlying index is designed to select equity securities from within the Russell 1000® Index, which measures the performance of the 1,000 largest-capitalization companies in the United States.

For more news and information, visit the Innovative ETFs Channel.