Metals precious and industrial have been strong performers in 2020, and that could spill over into 2021, putting four Invesco ETFs in the spotlight.

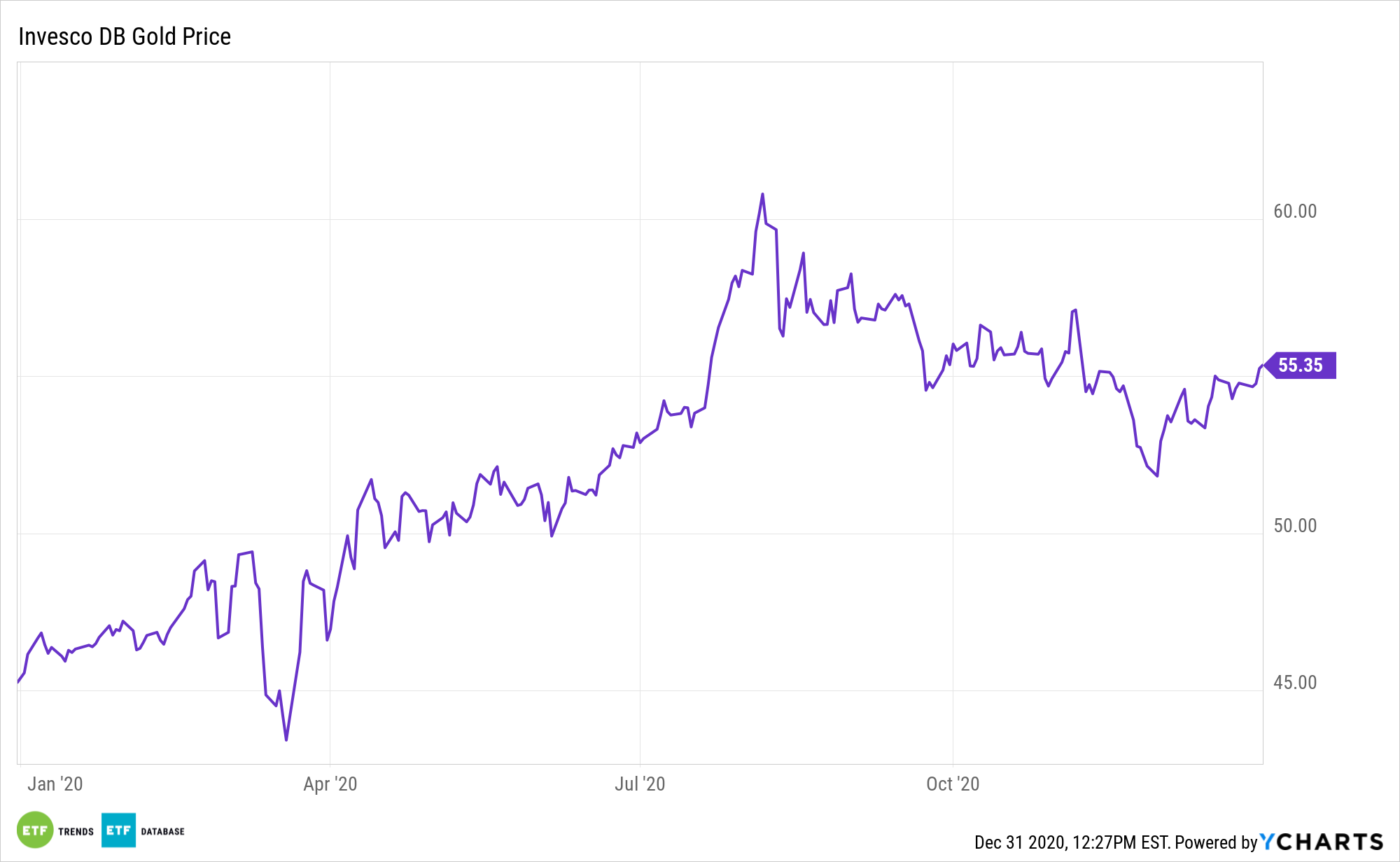

You can’t have a conversation about precious metals without mentioning gold. The Invesco DB Gold (DGL) is up 22%.

DGL seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Gold Index Excess Return™ (DBIQ Opt Yield Gold Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses. The Fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures.

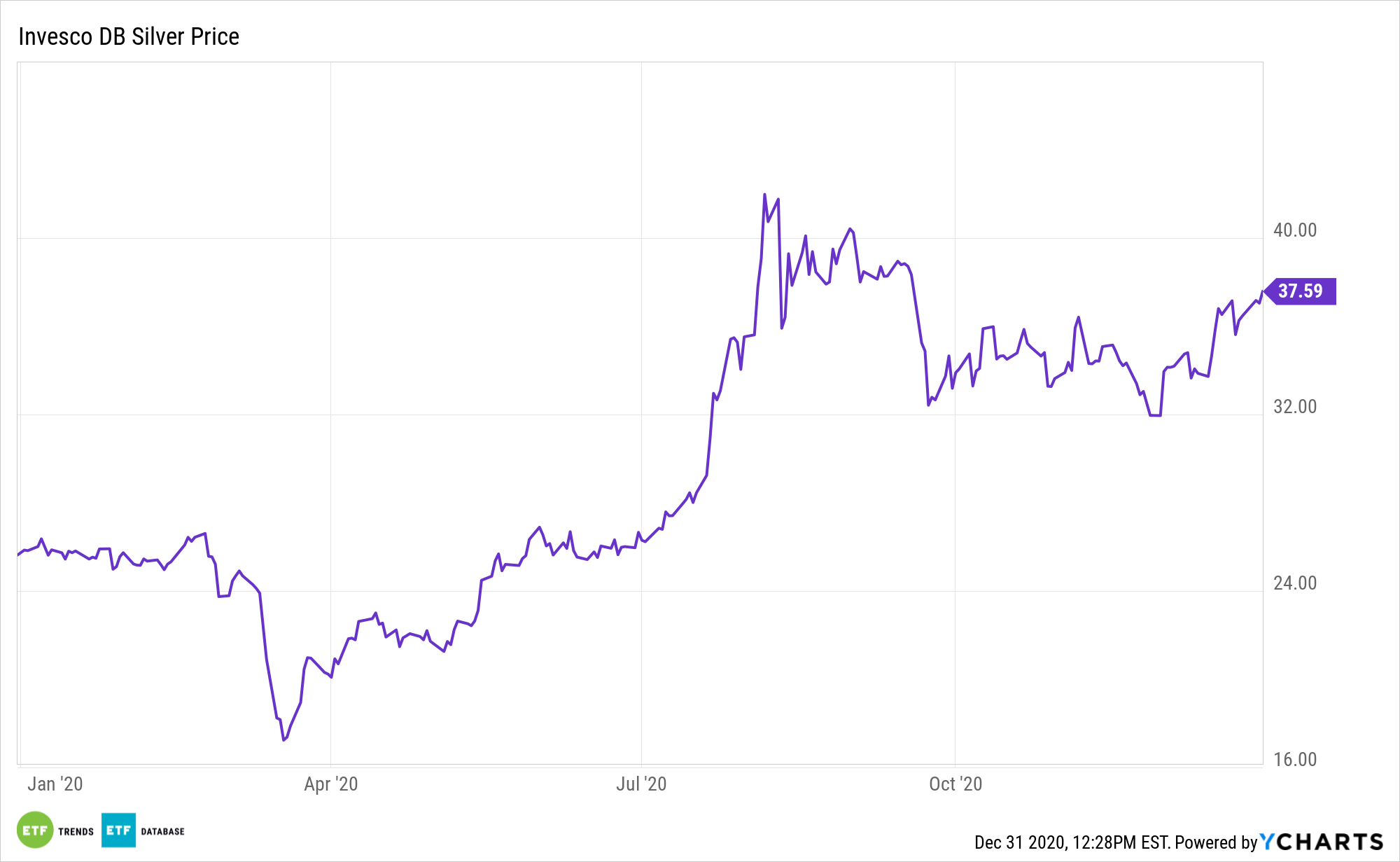

Leading the pack is the Invesco DB Silver Fund (DBS), which is up almost 50%. Some analysts are even thinking that silver could outpace gold in the new year.

The fund seeks to track the DBIQ Optimum Yield Silver Index Excess Return⢠(DBIQ-OY SI ERâ¢), which is intended to reflect the changes in market value of silver. The single index Commodity consists of Silver. The fund holds Treasury Securities, money market mutual funds and T-Bill ETFs for margin and/or cash management purposes only.

Broad ETF Options in Metals

ETF investors looking for broad exposure to metals can check out funds like the Invesco DB Precious Metals Fund (DBP). DBP is up almost 30%.

DBP seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Precious Metals Index Excess ReturnTM (DBIQ Opt Yield Precious Metals Index ER or Index) over time plus the income from the Fund’s holdings of US Treasury securities, money market funds and T-Bill ETFs, less the Fund’s expenses. The Fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures.

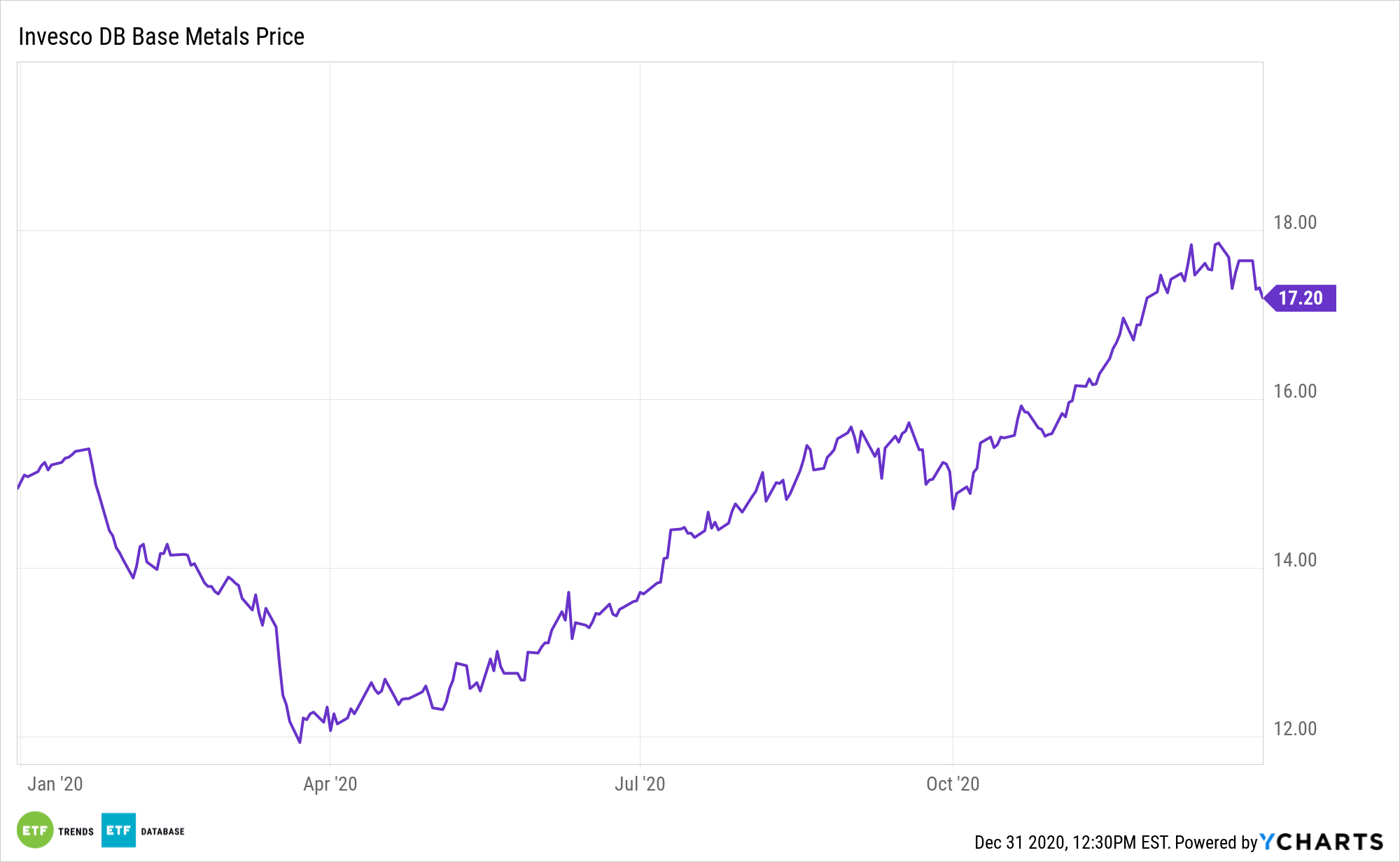

Another fund worth considering is the Invesco DB Base Metals Fund (DBB), which is up about 16%. The ETF seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index Excess Return™ (DBIQ Opt Yield Industrial Metals Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses.

For more news and information, visit the Innovative ETFs Channel.