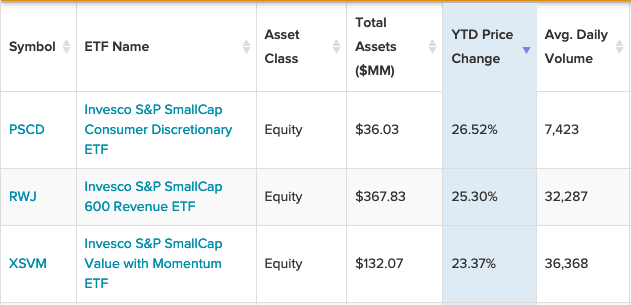

Small caps have been having a strong run over the past few months, with the Russell 2000 index up almost 35% within that time frame. This is carrying over into 2021, with three small cap funds from ETF provider Invesco seeing strong gains.

Invesco S&P SmallCap Consumer Discretionary ETF (PSCD): offers exposure to the consumer discretionary sector of the U.S. economy, making PSCD one of many options available for accessing a sector that includes restaurants, automakers, and retailers. Given the sector-specific focus of PSCD, this fund might have tremendous appeal to those building a long-term, buy-and-hold portfolio. Many PSCD holdings are already included in small cap equity funds.

This ETF may be useful for those looking to establish a tactical tilt towards the consumer discretionary sector, perhaps in anticipation of a bull market. The fund is up almost 60% the past few months.

Invesco S&P SmallCap 600 Revenue ETF (RWJ): RWJ seeks to track the investment results of the S&P Small Cap 600 Revenue-Weighted Index. The fund will invest at least 90% of its total assets in the securities that comprise the index.

The index is designed to measure the performance of positive revenue-producing constituent securities of the S&P Small Cap 600. The Parent index is comprised of common stocks of approximately 600 small-capitalization companies that generally represent the small cap universe of the U.S. equity market.

In the same 3-month time frame, RWJ boasts the best performance of the three funds–up almost 70%.

Invesco S&P SmallCap Value with Momentum ETF (XSVM): At a total expense ratio of 0.39%, XSVM seeks to track the investment results (before fees and expenses) of the S&P Small Cap 600 High Momentum Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

Strictly in accordance with its guidelines and mandated procedures, the index provider compiles, maintains, and calculates the underlying index, which is designed to track the performance of approximately 120 stocks in the S&P SmallCap 600® Index that have the highest ‘value’ and ‘momentum’ scores.

XSVM is up almost 60% the past few months:

“The number one reason small caps are rallying is President-elect Joe Biden. Mr. Biden has fashioned himself as President Main Street,” Boris Schlossberg, managing director of FX strategy at BK Asset Management, told CNBC’s “Trading Nation.”

“The market is going to believe that he is going to try to do everything in his power, both from a financial point of view and also from a regulatory point of view, too, to make things much easier for small caps as we go forward,” Schlossberg said.

For more news and information, visit the Innovative ETFs Channel.