As 2019 comes to a close, it’s time to take one more look at the best-performing ETFs. Based on this list, it’s clear that semiconductor, precious metals, and energy industries have all benefited greatly from yet another terrific year.

Even with various news, events and economic uncertainty heading into 2020, the markets remain a part of the longest bull run in history.

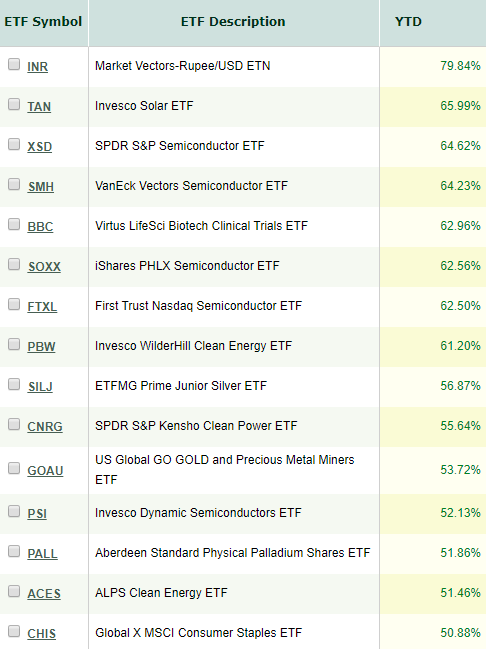

Here are the 10 best performing (non-leveraged) ETFs of 2019 according to XTF.com data, as of Dec. 30, 2019:

1. Market Vectors-Rupee/USD ETN (INR) – up 79.84% YTD

The Market Vectors-Indian Rupee/USD ETN seeks to track the performance of the S&P Indian Rupee Total Return Index (SPCBINR), less investor fees. Investors may trade the ETN on an exchange at market price or receive, at maturity or upon early redemption, a cash payment from the issuer based on Index performance, fewer investor fees. INR provides exposure to the rupee market in the form of a single securities transaction. It also allows for participation in the currency of one of the world’s largest and most important countries. The fund is achieved by currency forward contracts plus short term deposits.

2. Invesco Solar ETF (TAN) – up 65.99% YTD

The Invesco Solar ETF is based on the MAC Global Solar Energy Index. The fund will invest at least 90% of its total assets in the securities, American depositary receipts (ADRs) and global depositary receipts (GDRs) that comprise the Index. The Index is comprised of companies in the solar energy industry. The index is computed using the net return, which withholds applicable taxes for non-resident investors. The fund and the Index are rebalanced quarterly.

3. SPDR S&P Semiconductor ETF (XSD) – up 64.62%

The investment seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of an index derived from the semiconductor segment of a U.S. total market composite index. In seeking to track the performance of the S&P Semiconductor Select Industry Index, the fund employs a sampling strategy. It generally invests substantially all, but at least 80%, of its total assets in the securities comprising the index. The index represents the semiconductors segment of the S&P Total Market Index. The fund is non-diversified.

4. VanEck Vectors Semiconductor ETF (SMH) – up 64.23% YTD

The VanEck Vectors Semiconductor ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS US Listed Semiconductor 25 Index (MVSMHTR), which is intended to track the overall performance of companies involved in semiconductor production and equipment. The Index seeks to track the most liquid companies in the industry based on market capitalization and trading volume. Additionally, the index methodology favors the largest companies in the industry. As far as the portfolio goes, it may include both domestic and U.S. listed foreign companies allowing for enhanced industry representation.

5. Virtus LifeSci Biotech Clinical Trials ETF (BBC) – up 62.96%

The investment seeks investment results that correspond, before fees and expenses, to the price and yield performance of the LifeSci Biotechnology Clinical Trials Index. Under normal market conditions, the fund will invest not less than 80% of its assets in component securities of the index. The index seeks to track the performance of the common stock of U.S. exchange-listed biotechnology companies with a primary product offering (the “lead drug”) that is typically in the Phase 1, Phase 2 or Phase 3 clinical trial stage of development, but prior to receiving marketing approval.

6. iShares PHLX Semiconductor ETF (SOXX) – up 62.56% YTD

The iShares PHLX Semiconductor ETF seeks to track the investment results of an index composed of U.S. equities in the semiconductor sector. To expand on this, SOXX features exposure to U.S. companies that design, manufacture, and distribute semiconductors. The fund is also targeted access to domestic semiconductor stocks. It’s used to express a sector view.

7. First Trust Nasdaq Semiconductor ETF (FTXL) – up 62.5% YTD

The First Trust Nasdaq Semiconductor ETF’s investment objective is to seek investment results generally corresponding to the price and yield, before the fund’s fees and expenses, of an index called the Nasdaq US Smart Semiconductor Index. The fund seeks to replicate the holdings and weightings of the Nasdaq US Smart Semiconductor Index so as to generate performance results 95% correlated to that of the Nasdaq US Smart Semiconductor Index. The Nasdaq US Smart Semiconductor Index is a modified factor weighted index created and administered by Nasdaq, designed to provide exposure to US companies within the semiconductor industry.

8. Invesco WilderHill Clean Energy ETF (PBW) – up 61.2% YTD

The Invesco WilderHill Clean Energy ETF is based on the WilderHill Clean Energy Index. The fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index is composed of stocks of companies that are publicly traded in the United States and engaged in the business of the advancement of cleaner energy and conservation. The fund and the Index are rebalanced and reconstituted quarterly.

9. ETFMG Prime Junior Silver ETF (SILJ) – up 56.87% YTD

The fund seeks to provide investment results that correspond generally to the price and yield performance of the ISE Junior Silver Index. The fund will invest at least 80% of its total assets in the component securities of the Underlying Index and in American Depositary Receipts and Global Depositary Receipts.

10. SPDR S&P Kensho Clean Power ETF (CNRG) – 55.64% YTD

CNRG seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Kensho Clean Power Index. The fund also seeks to track an index utilizing artificial intelligence and a quantitative weighting methodology to capture companies whose products and services are driving the innovation behind the clean energy sector, which includes the areas of solar, wind, geothermal, and hydroelectric power. Additionally, it may provide an effective way to pursue long-term growth potential by investing in a portfolio of companies involved in the transition to lower emission generating power supply.

11. US Global GO GOLD and Precious Metal Miners ETF (GOAU) – up 53.72% YTD

The U.S. Global GO GOLD and Precious Metal Miners ETF provides investors access to companies engaged in the production of precious metals either through active (mining or production) or passive (owning royalties or production streams) means.

12. Invesco Dynamic Semiconductors ETF (PSI) – up 52.13% YTD

The Invesco Dynamic Semiconductors ETF is based on the Dynamic Semiconductor Intellidex Index. The fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Intelldiex Index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action, and value. The Underlying Intellidex Index is comprised of common stocks of 30 US semiconductors companies. These are companies that are principally engaged in the manufacture of semiconductors. The fund and the index are rebalanced and reconstituted quarterly.

13. Aberdeen Standard Physical Palladium Shares ETF (PALL) – up 51.86% YTD

PALL seeks to reflect the performance of the price of Palladium bullion. The fund is designed for investors who want a cost-effective and convenient way to invest and gain exposure to physical Palladium.

14. ALPS Clean Energy ETF (ACES) – up 51.46% YTD

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S. and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector. The fund takes a different approach than what is seen in other traditional clean energy ETFs. Many of the legacy funds in this space focus on one alternative energy concept, such as solar or wind power. On the other hand, ACES offers exposure to seven clean energy themes, including, solar, wind, smart grids, biofuels, geothermal, electric vehicles and fuel cells.

15. Global X MSCI Consumer Staples ETF (CHIS) – up 50.88% YTD

CHIS seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Consumer Staples 10/50 Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index. The underlying index tracks the performance of companies in the MSCI China Index that are classified in the consumer staples sector, as defined by the index provider. The fund is non-diversified.

Related Articles:

10 Most Read ETF Strategist Articles of 2019

10 Best Fixed Income ETFs of 2019

Chart via XTF.com – 10 best performing (non-leveraged ETFs) of 2019 according to XTF.com data, as of Dec. 30, 2019.