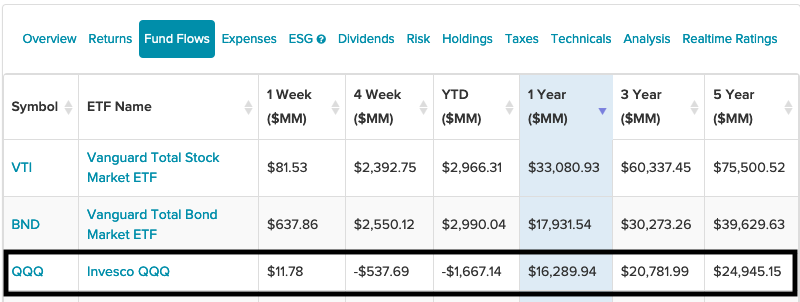

Just when the technology trade might have appeared to be losing steam after a decade-long bull run, Covid-19 hits and big tech is back in the spotlight. That’s playing right into bullish outcomes for a pair of innovative funds: the Invesco QQQ Trust (QQQ) and the Invesco NASDAQ 100 ETF (QQQM).

QQQ has been a long-time favorite for traders with its high volume, which makes it one of the most liquid funds on the ETF playing field. The mini version of QQQ, the QQQM, is still a relatively new kid on the block, but it also tracks a popular index in the Nasdaq 100.

“The Nasdaq-100 and S&P 500 are two of the most popular equity indexes in the US,” a Nasdaq article noted. “The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between Dec. 31, 2007 and December. 31, 2020, according to Nasdaq Global Indexes.”

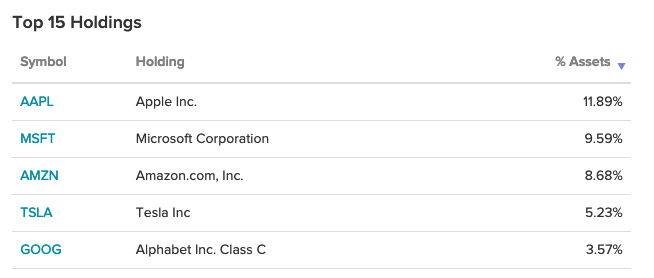

The QQQ holds a who’s who in big tech. The top five holdings, which comprise almost 40% of the fund, have been strong performers during the pandemic.

Apple, Microsoft, Amazon, and Google have thrived recently, while electric automaker Tesla is seeing strength from an increasing demand in electric vehicles, which should only strengthen as the world moves toward more clean energy.

Tesla stock is the strongest performer among the top five, with a gain of over 370% the past year. The largest holding, Apple, is up 42% the last 12 months.

Go Long With QQQM

QQQM is essentially a carbon copy of QQQ, but is meant for the buy-and-hold investor.

While the Nasdaq 100 does have exposure to blue chip tech names, it also has a growth component, which makes ideal for long-term investors.

“The Nasdaq-100 is heavily allocated towards top performing industries such as Technology, Consumer Services, and Health Care,” adds Nasdaq. “The growth of companies in these industries has continued to be strong. Given the way technology is influencing the world and making companies more efficient, this trend is more than likely to continue going forward.”

For more news and information, visit the Innovative ETFs Channel.