As we try to make sense of today’s markets, financial advisors will have to juggle their client’s stress and one’s wellbeing.

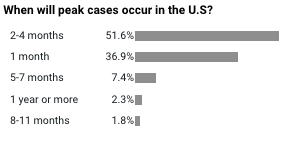

In the recent webcast, Unknown Waters: Insights to Help Manage Portfolios and Stress, Carl Tannenbaum, Executive Vice President/Chief Economist, Northern Trust, underscored stress from coronavirus fears and a new normal with more staying at home as the coronavirus is still in the early throes as it follows a more geometric progression or exponential fashion.

The pandemic is already harming the economy. Consumers are being confined to quarters, they are not eating out, and tourists are no longer traveling. Consequently, the services industries are taking a hit with an immense number of layoffs. Tannenbaum warned that we would likely see an increased number of filings to unemployment ahead. Meanwhile, smaller businesses may struggle with cash flow issues and loans due.

For financial advisors and money managers, there is increased pressure to maintain liquidity and meet regulatory requirements. The Federal Reserve has already taken aggressive action to mitigate the fallout in financial markets, providing billions of dollars at near-zero rates to central banks dealing with a shortage in U.S. dollars and launching a new lending facility to backstop money-market funds.

However, Tannenbaum argued that to get the economy going, we need the fiscal side. Specifically, he believed that we need a much broader assistance program for small businesses and industries, adding that Washington D.C. is critical to the recovery effort.

For those worried about a potential economic downturn due to the diminished economic activity, Tannenbaum assured that history has shown many recessions were short and shallow.

When it comes to asset allocation, Tannenbaum pointed out that many financial advisors have clients geared toward long-term and not month over month; so this short-term volatility is just another blip in the long-term trend. History also suggests that people who take the long-term view are well rewarded.

Where Things Are Headed

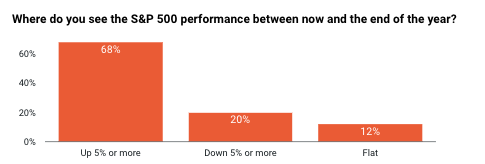

Looking ahead, Tannenbaum and the rest of the Northern Trust team believe that the stress will likely go through early summer, but the markets may see restoration and normal economic pattern toward the fourth quarter

“One of the key themes now is to weather the storm,” Ari Levy, Founder and CEO, SHIFT, said.

Levy outlined a level of fear and anxiety, along with ways to better prepare in these more trying times. Specifically, he believed advisors should find a structure and a routine. Many are now working at home with multiple inputs from kids and family. In this type of new work environment, it is essential to focus on consistent structure and routine.

Additionally, at home, people can do simple things to help boost immunity. For example, take the necessary hours of sleep and working out to diminish cortisol levels or the so-called stress hormone. What you drink or eat also matters as he strongly discourages drinking at night, which would disrupt sleep patterns, increase anxiety, and reduce the immune system.

Levy also argued that people working at home should also create rules for when work stops or making sure there are work hours is specifically important. This helps give you permission to stop working when at home. At the work office, there is a start and end time, but working at home, the times are totally blended.

Financial advisors who are interested in learning more about portfolio management tips can watch the webcast here on demand.