Multinational investment bank Goldman Sachs estimates full-year corporate earnings in 2018 to be $159 per share, which equates to $9 more than their original earnings forecast–a result of faster-than-expected economic growth. Despite this optimism in earnings, Goldman Sachs Chief U.S. Equity Strategist David J. Kostin tamped down the idea that increased earnings in the short-term will translate to higher stock prices in the long-term.

“The US economy is growing, corporate profits are rising, and stock prices should continue to climb through 2019,” said Kostin. “However, the appreciation potential will be constrained by tightening monetary policy, a flattening yield curve, rising trade tensions, and the upcoming mid-term Congressional elections.”

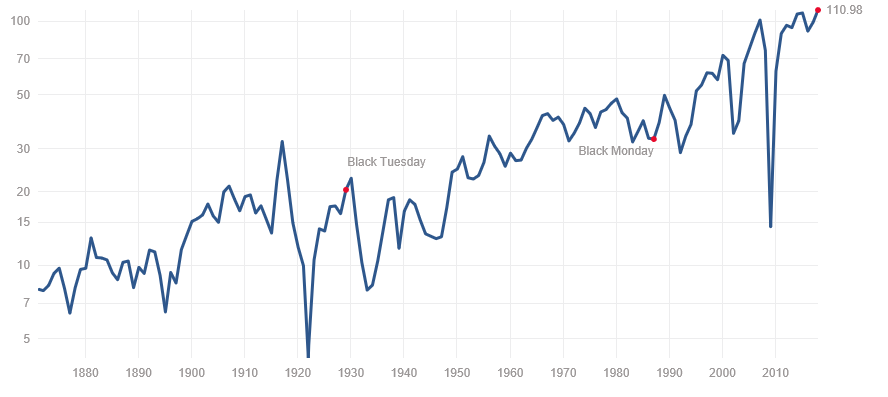

Kostin’s statements come at a time when earnings per share have risen exponentially, particularly since the Financial Crisis of 2007-08. Since then, earnings per share have resumed its upward trajectory as evidenced in the following chart.

![]()