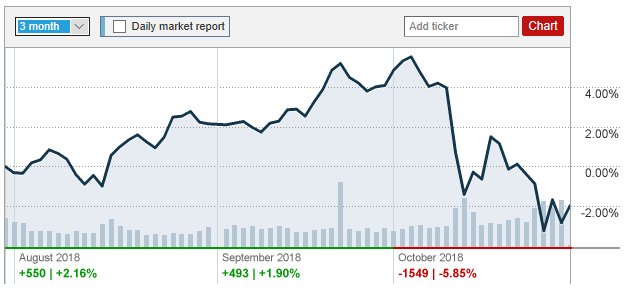

Investors have every right to fret about U.S. equities, especially with the Dow Jones Industrial Average down 6.7% thus far in October as of Friday, while the S&P 500 and Nasdaq Composite are both down 8.8% and 10.9, respectively. Nonetheless, Goldman Sachs’ chief U.S. equity strategist David Kostin is expecting the market pain to be temporary with a 6% rebound coming before the end of 2018.

“The recent sell-off has priced too sharp of a near-term growth slowdown,” said Kostin. “We expect continued economic and earnings growth will support a rebound in the S&P 500.”

Amid third-quarter earnings reports last week, the Dow experienced four out of five losing sessions last week as technology stocks continued to sell off, signaling a sign that the decade-long bull run could finally be coming to a close. The S&P 500 followed the Nasdaq into a market correction phase, dropping 3.9% to almost match the Nasdaq’s 3.8% drop in what’s been a volatile October for U.S. equities.

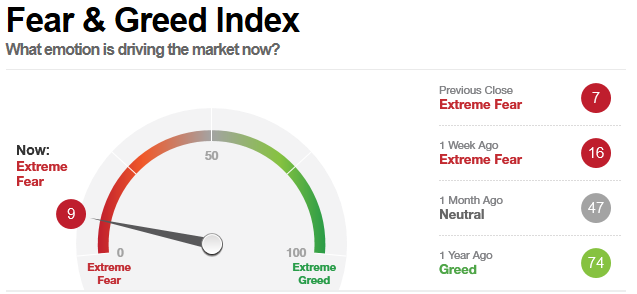

Kostin’s words should certainly induce a calming effect for U.S. equity investors, especially when CNN’s Fear & Greed Index is tilted sharply to the left into “extreme fear” territory.

Other market analysts’ assessment are in accordance with Goldman Sachs as Chris Verrone, head of technical research at Strategas Research Partners, sees a floor in the latest sell-offs. According to Verrone, the major indexes have reached “within the ballpark of a tradeable low.”