“Notwithstanding the wide array of bullish considerations… the number one game changer for gold could be a loss of faith in the U.S. Federal Reserve Board.” Sprott’s managing director and senior portfolio manager John Hathaway writes in the latest Sprott Insight blog.

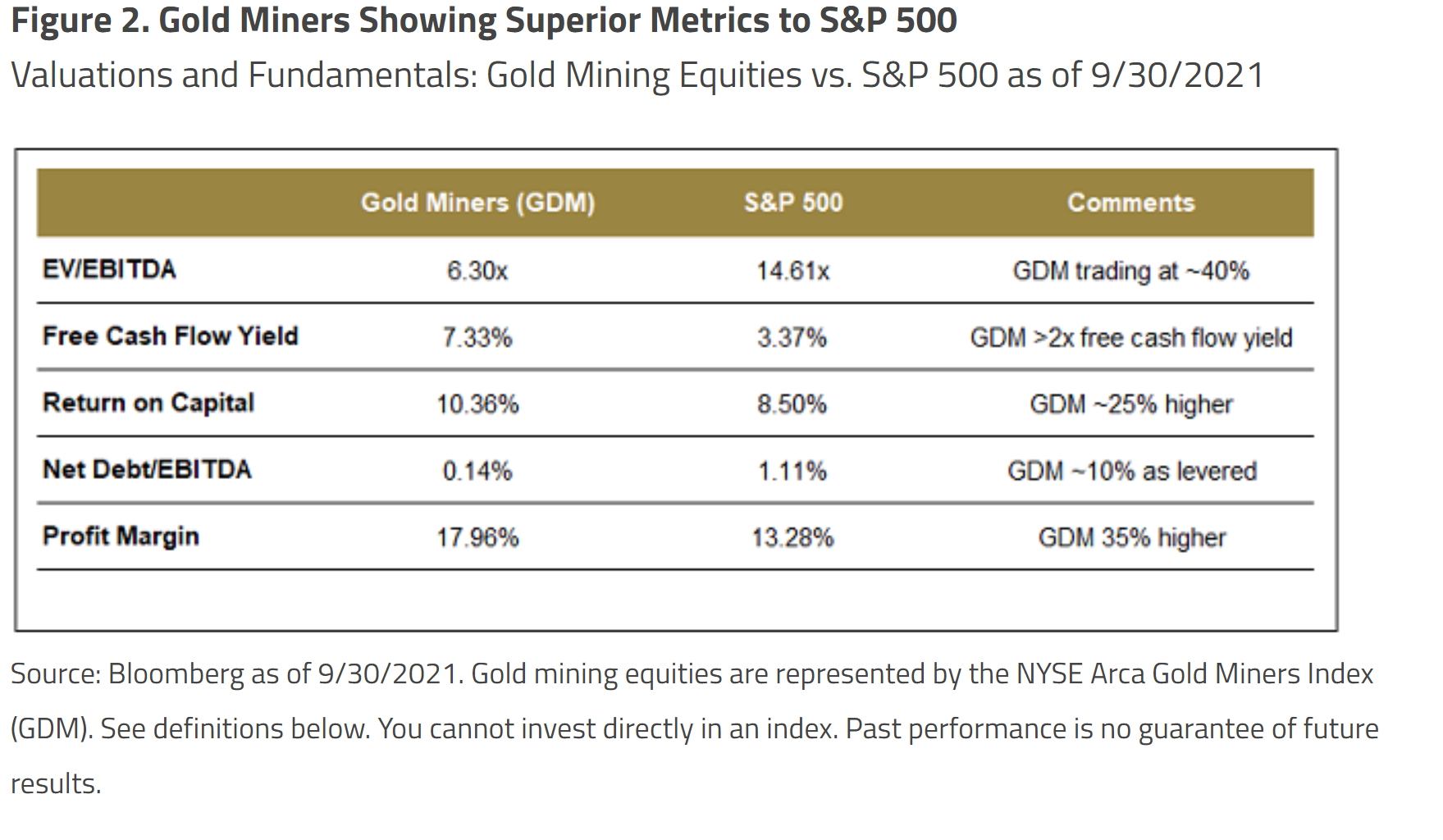

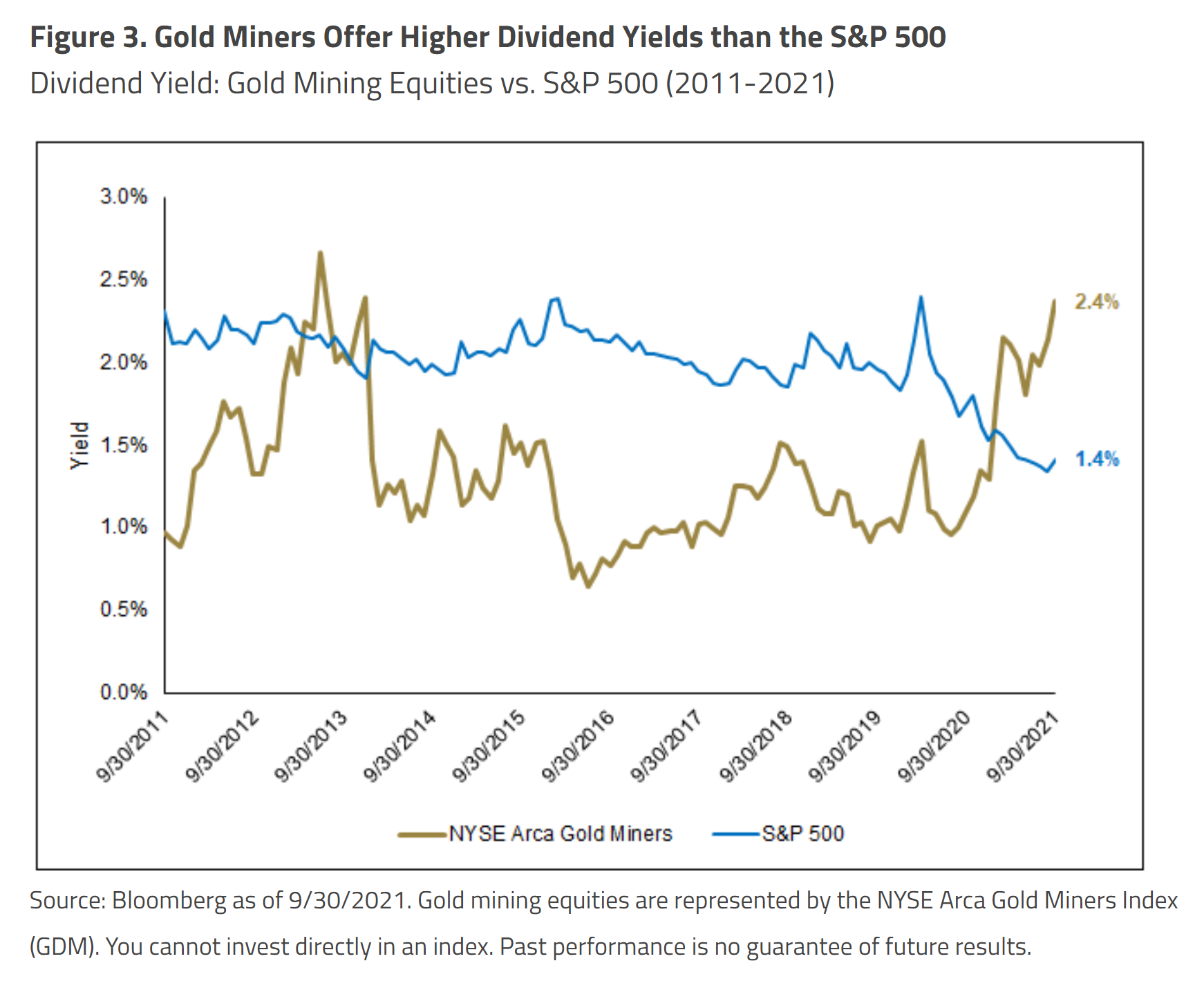

Hathaway sees inflation as intransient, countering assessments from the Fed. Real interest rates remain deeply negative, and the average return for gold under such conditions is 21.12%. Physical gold purchases are on the rise in China and India, and gold mining equities are generating record cash flow while still trading at value.

The bearish case for gold depends on a number of assumptions that Hathaway counters. The first is that tapering is different than raising interest rates. Hathaway notes that “They’re the same thing — both restrictive monetary policies are designed to accomplish similar outcomes.” Other assumptions include the beliefs that an increase in borrowing costs can be absorbed by the global economy, a 2022 slowdown is not in the cards, financial asset valuations are impervious to rising rates, and that inflation is transitory. Hathaway sees multiple signs of weakness in the economy, from employment reports to consumer sentiment, and doesn’t see tapering as being effective at stemming inflation.

All of this could set the Fed up for a game of chicken that it can’t really win. Hathaway writes, “Chairman Powell also knows that the Fed cannot afford to reverse course as quickly as in 2018 — when it attempted balance sheet normalization and rate hikes — without again embarrassing the institution. Therefore, the Fed may this time stick to its guns and attempt to ride out market adversity, an unpopular decision, especially if the already weakening economy slows further. The Fed can only lose the upcoming game of chicken and it will be interesting to see how it narrates its way out of this predicament. The question is, how much market and economic damage precedes the inevitable pivot?”

Gold and Gold Miners Are Still Undervalued

Hathaway pins the blame for disinterest in gold mostly on the seemingly endless equity bull market, saying, “Risks unperceived at market peaks can begin to multiply faster than investors can react. An unraveling of the current speculative euphoria, at a time when precious metals fundamentals have rarely been more solid, would constitute a near perfect environment for gold and gold miners.”

Gold mining companies are displaying tremendous amounts of financial health while also being shorted, over-sold, and largely ignored. This could be excellent news for the Sprott Gold Miners ETF (SGDM) and the Sprott Junior Gold Miner’s ETF (SGDJ). With November carved out as the start of the tapering timeline and potential unmasking of longstanding market assumptions, movement on the gold front feels like it could turn quite favorable in the near-term after.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.