Hedge funds remain cautious on gold, even as they grow increasingly bullish on silver, show data from from the Commodity Futures Trading Commission.

As reported by Kitco, the latest Commitments of Traders report revealed that some hedge funds and money managers kicked the tires on gold, drawn in by declines in U.S. 10-year bond yields. However, this renewed speculation wasn’t enough to drive gold prices above $1,800/oz.

Nevertheless, many market analysts remain bullish about gold’s long-term prospects, and some believe it is only a matter of time before the critical $1,800/oz resistance point is breached. Doing so won’t come without some volatility, though.

“Following aggressive long exposure reductions, a downward trending USD along with declining real yields across the curve prompted money managers to finally start to increase their net long gold positions during the reporting period. ” TD Securities analysts wrote in a report issued last Friday.

Georgette Boele, senior precious metals strategist at ABN AMRO, said, “long gold is still a crowded trade,” noting that the position remains elevated and will remain a risk to the market.

Meanwhile, silver has managed to break above $26/oz, with the market supporting that level. As a result, the gold-silver ratio continues to shrink.

Some analysts expect that a recovering economy and an inevitable pivot to greener, environmentally friendly technology will continue to bolster silver. The silver market has seen its net length expand for three consecutive weeks and remains optimally positioned to continue to grow.

For investors interested in precious metals, the Sprott Physical Silver Trust (PSLV) offers a closed-end trust that invests in silver bullion. Relative to its peer group, SPLV has been one of the top performing ETFs in the field.

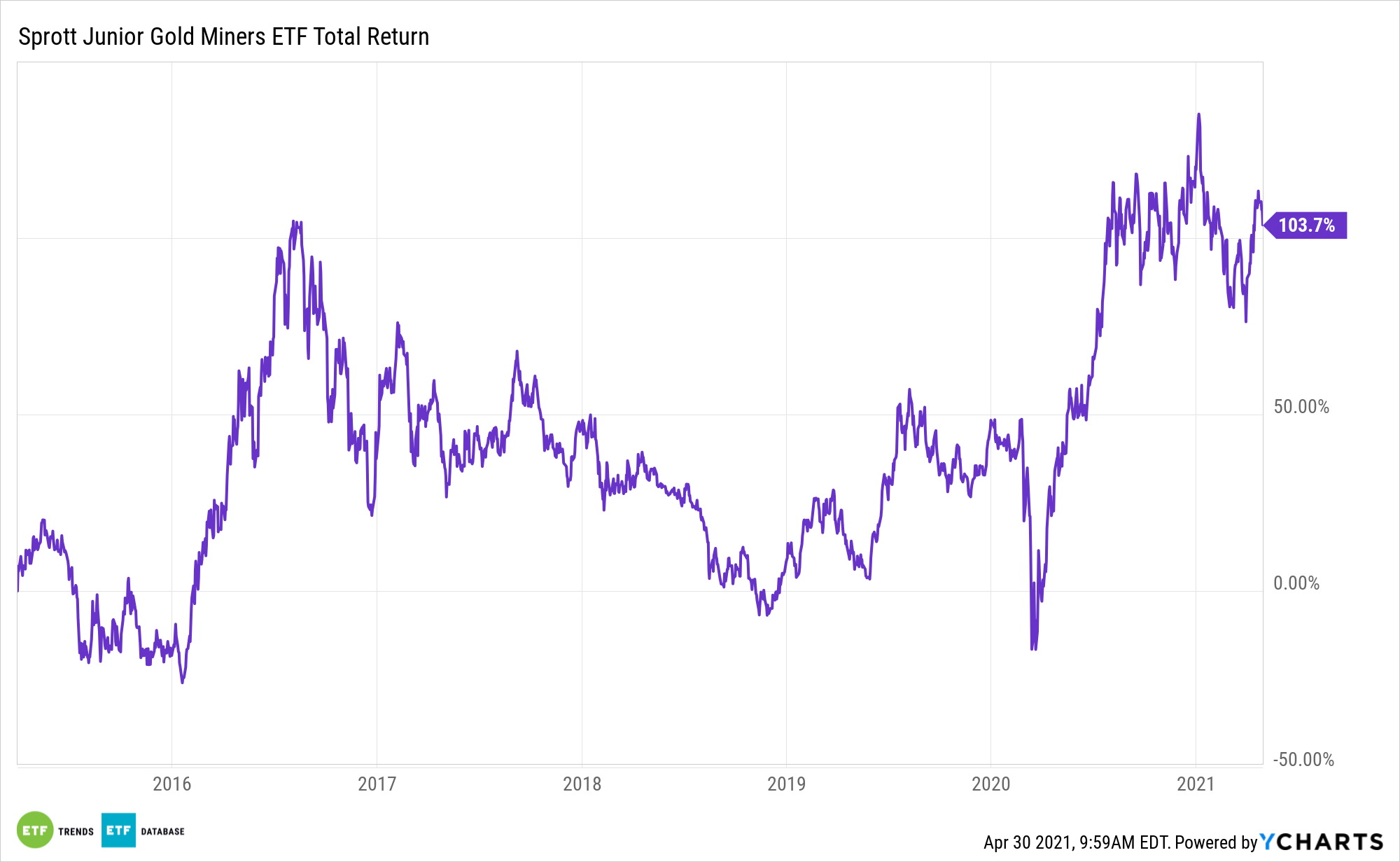

Meanwhile, the Sprott Gold Miners ETF (SGDM) offers an equity play with actively managed exposure to gold and silver miners, while the Sprott Junior Gold Miners ETF (SGDJ) tracks junior gold miners.

For more information, please visit the Gold & Silver Investing Channel.