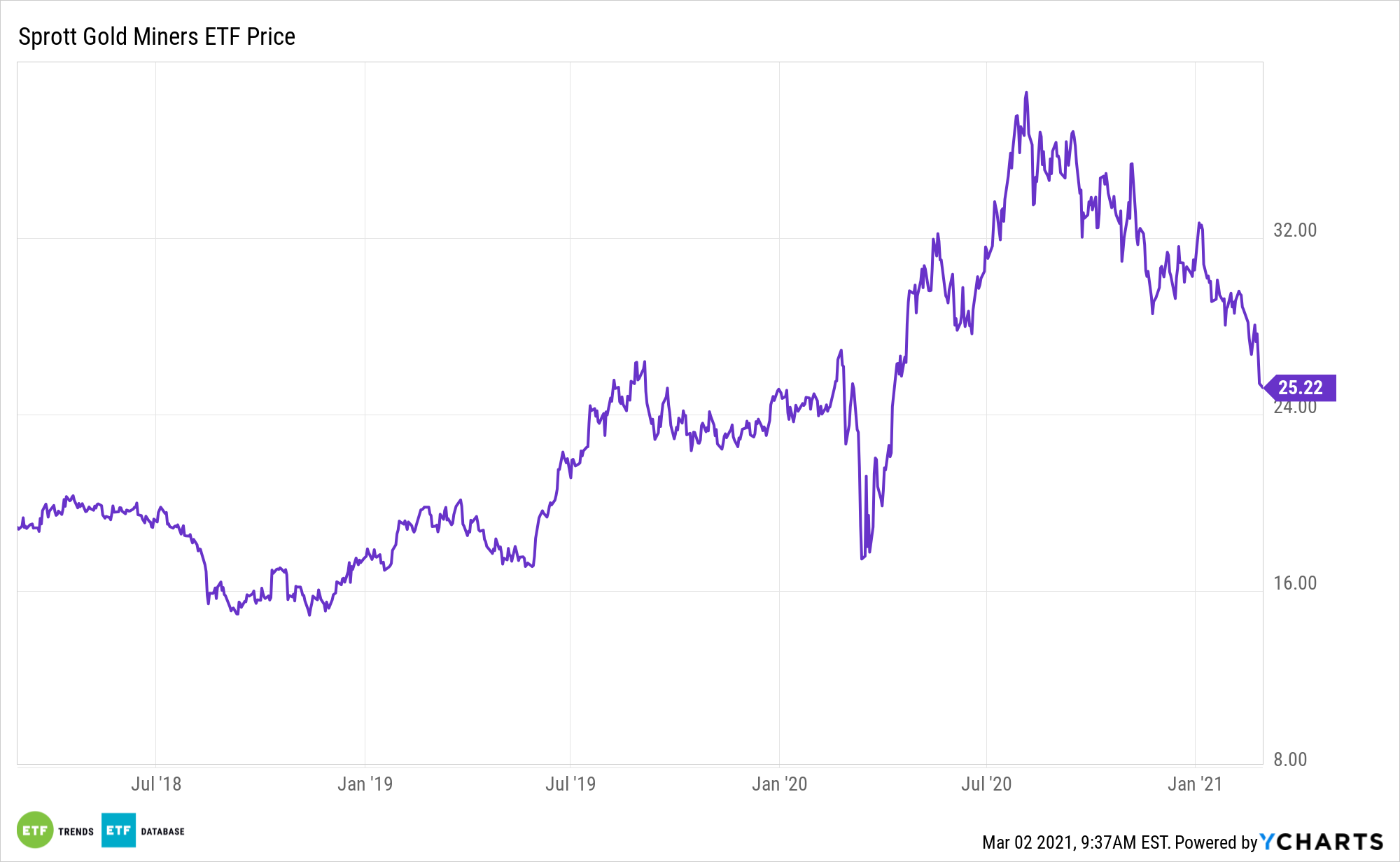

Gold bullion itself doesn’t offer investors dividends or interest payments, meaning it’s a zero income asset, but investors can get some income via gold miners and exchange traded funds such as the Sprott Gold Miners ETF (NYSEArca: SGDM).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

What makes SGDM compelling in today’s low interest rate environment is that larger gold miners are becoming credible dividend growth ideas.

“Miners of the precious metal are expected to more than double dividends this year to outpace the 75% hike of copper producers, according to Bloomberg dividend annual forecasts for Bloomberg Intelligence industry groups,” reports Bloomberg.

SGDM: Footing the Income Bill

Due to SGDM’s unique methodology – one that eschews weighting by market capitalization – the Sprott ETF is positioned to help investors capitalize on rising payouts by miners.

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of their balance sheets as measured by long-term debt to equity. By focusing on balance sheet strength, the fund has greater exposure to companies with a lower long-term debt to equity ratios. These organizations are better-prepared when weathering economic downturns.

“Producers of bullion have done a better job of rewarding investors with dividend hikes than copper companies in the past couple years, thanks to their ability to generate excess cash from higher gold prices,” adds Bloomberg. “AngloGold Ashanti Ltd. boosted its dividend more than fivefold this week after record gold prices boosted earnings, following similar moves by rivals including Newmont Corp.”

Dividend-paying stocks can also help insulate investors from a broad market pullback. That’s particularly true of this model portfolio’s components, which, by virtue of their quality traits, tend to display less volatility in rough markets. Dividend growth is also meaningful today because payout growers typically weather rising rates. That’s extremely pertinent with Treasury yields climbing.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.