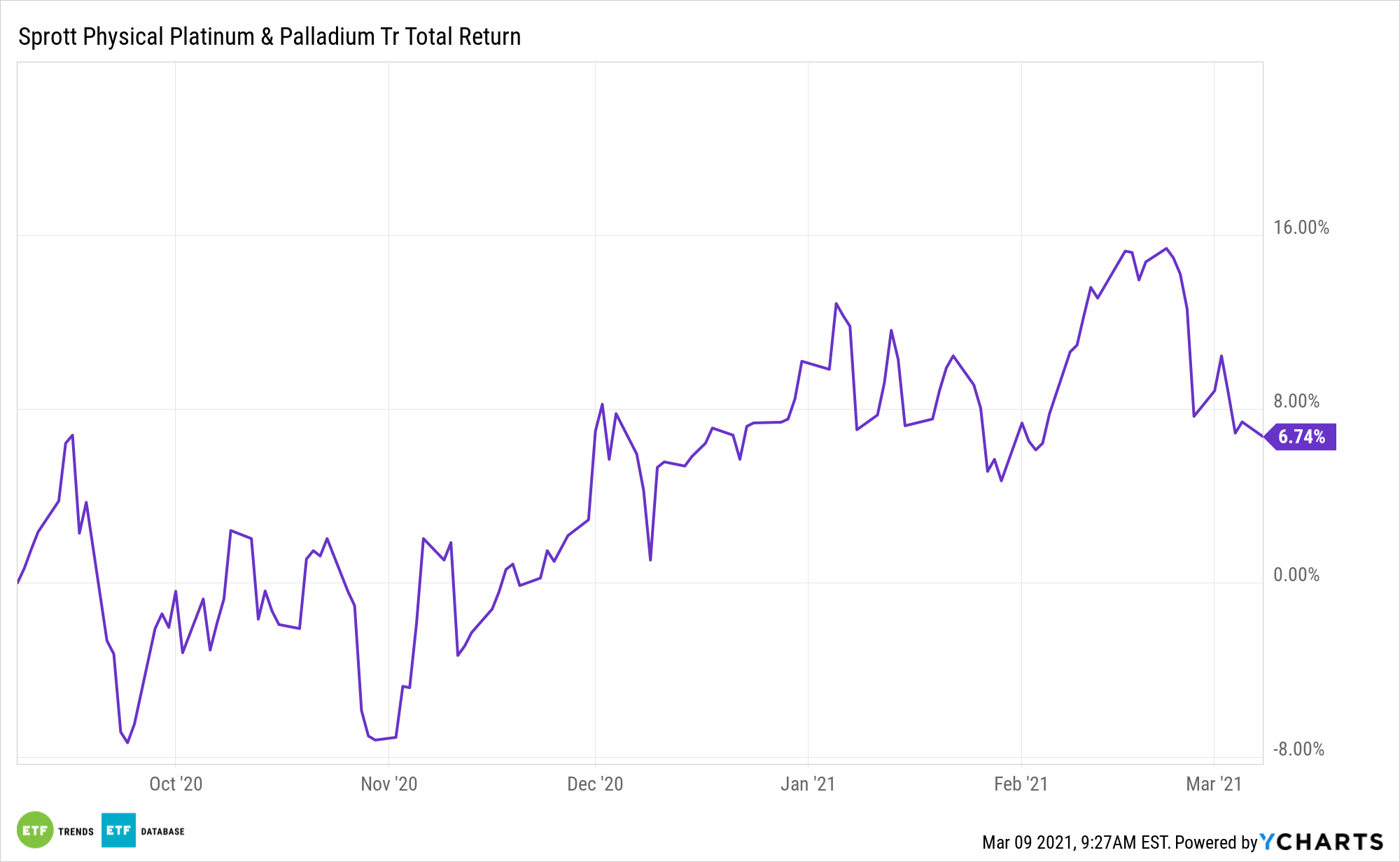

When it comes to precious metals and the clean energy equation, silver gets most of the attention, but there’s utility with platinum and the Sprott Physical Platinum and Palladium Trust (NYSEArca: SPPP).

SPPP provides “a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The Trust offers a number of compelling advantages over traditional exchange-traded platinum and palladium funds,” according to the issuer.

“As the coronavirus pandemic brought worldwide economies to a standstill in 2020 platinum demand fell by one million ounces, according to the World Platinum Investment Council, an industry group,” reports Pippa Stevens for CNBC. “But supply fell by 1.3 million ounces amid Covid-related disruptions as well as outages at some key plants. Ultimately platinum demand — which averages about eight million ounces per year — was pushed into a deficit.”

Economists and market analysts argue that a Biden administration will contribute to tighter environmental regulations and a focus on green energy technology, which may mean tighter regulation on car emissions and increased demand for palladium and platinum in catalytic converters. That adds to the case for SPPP.

SPPP Is the Right Investment Vehicle for Precious Metals

“Also fueling platinum’s gains is investors’ belief that it will benefit from the energy transition. Platinum can be used in fuel cells for electric vehicles, as well as to produce green hydrogen. Hydrogen has been proposed as an alternative fuel source for decades, but its high cost, among other things, has prohibited it from taking off,” according to CNBC.

The return to lower interest rates around the world has also continued to support demand for physical assets, which tend to exhibit an inverse relationship to interest rates since investors are less apt to hold raw materials when bonds offer higher yields in a rising rate environment. Though it’s not an exchange traded fund, SPPP offers tax benefits too.

SPPP “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars,” notes Sprott.

“President Joe Biden has outlined an ambitious $2 trillion climate bill and countries around the world are announcing carbon-neutral targets. Given the trillions that will be required to meet these targets,” concludes CNBC.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.