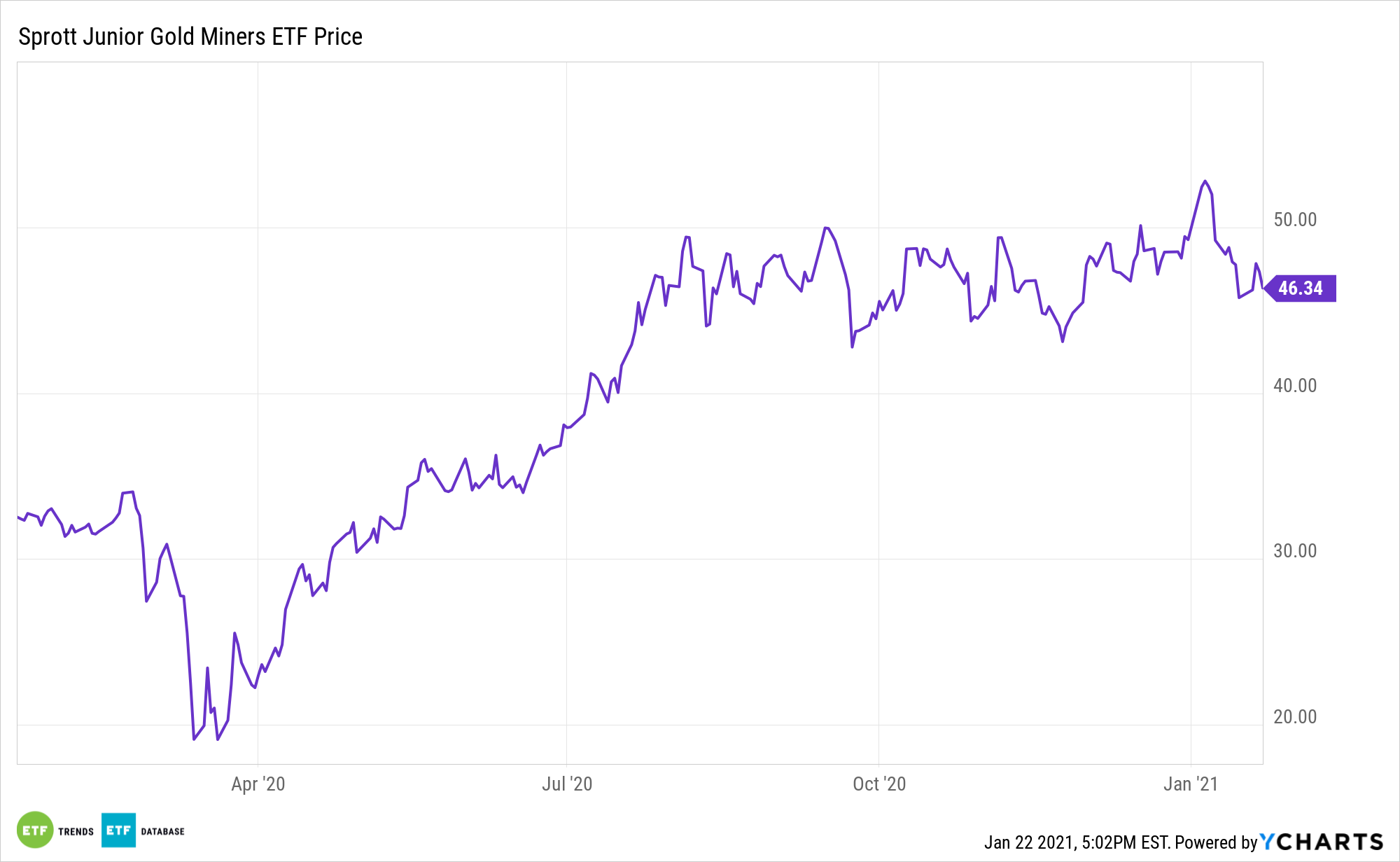

As small cap equities continue to surge, investors may want to consider sprinkling in some gold with the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ).

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. SDGJ focuses on price momentum, which helps identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures.

With miners increasingly profitable, SGDJ could be a preferred play on bullion this year.

“We’re not bullish gold, but we’re not 100% bearish either,” James Hyerczyk writes in FX Empire. “Our work suggests a rangebound trade for much of this year with support being provided by fiscal stimulus from the government and monetary stimulus from the Federal Reserve. Inflation fears may be providing some support as aggressive speculative buyers bet that inflation will be driven by more U.S. fiscal stimulus under President-elect Joe Biden, but as prices inflate, the chances of the Fed ending their bond buying spree will rise. This too supports the notion of a rangebound trade,” Hyerczyk added.

Not Good, Golden

The small cap SGDJ uses a momentum-based strategy that “emphasizes small- to mid-sized gold producers with the highest revenue growth and exploration companies with the strongest stock price momentum,” according to the issuer.

Gold has also found greater support from safe-haven demand and a more dovish outlook from major global central banks, notably the Federal Reserve’s shift toward interest rate cuts to combat slowing growth. Importantly, miners are proving adept at managing costs.

SGDM, which has nearly $256 million in assets under management, tracks the Solactive Gold Miners Custom Factors Index. That benchmark features stocks listed on major domestic and Canadian exchanges.

“The Index uses a transparent, rules-based methodology that is designed to emphasize larger-sized gold companies with the highest revenue growth, free cash flow yield and the lowest long-term debt to equity. The Index is reconstituted on a quarterly basis to reflect the companies with the highest factor scores,” according to Sprott.

For more news, information, and strategy visit ETF Trends

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.