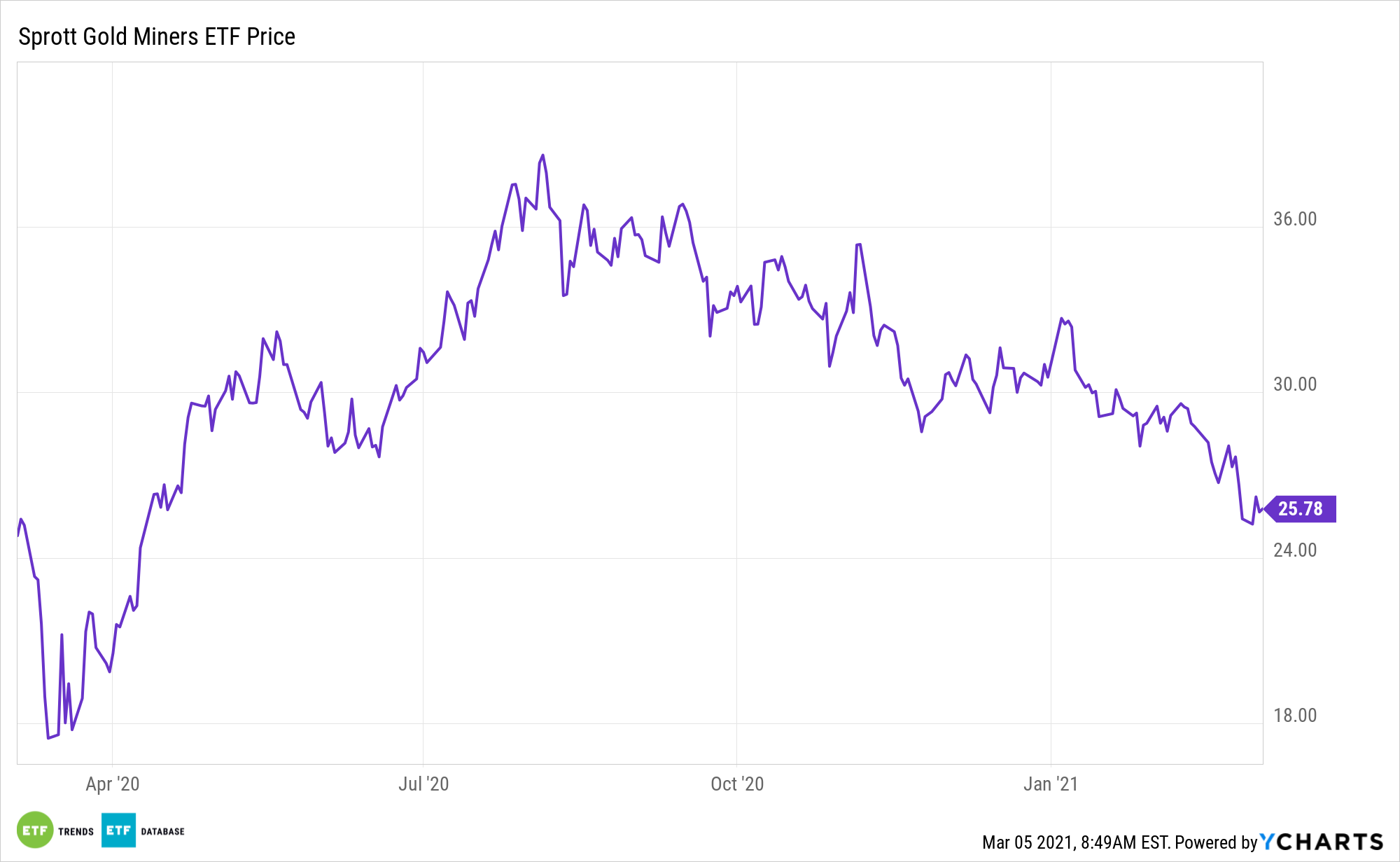

As is being widely reported, rising Treasury yields are slamming gold and silver prices. On the bright side, more favorable pricing is availing itself with the Sprott Gold Miners ETF (NYSEArca: SGDM), and that’s worth considering as inflation ticks higher.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Historically, gold is one of the premier inflation-fighting assets. Inflation fears are further reflected by a sharp rise in benchmark Treasury yields, which may be partially attributed to expectations for greater inflation.

“While gold has historically served as a refuge during periods of extreme price inflation and deflation, the risk of extreme levels of price inflation currently remains low,” according to State Street research. “Instead, investors should concentrate on the risk of monetary led inflation (originating from dovish policies and higher liquidity) leading to US dollar (USD) weakness – and the potential benefits gold could offer in that environment.”

Fight Inflation with SGDM

It’s no secret that gold has been a major beneficiary during the coronavirus pandemic as a viable safe haven asset amid all the uncertainty in the capital markets. But investors don’t actually have to get pure-play gold exposure in order to reap the benefits of the precious metal—enter gold miners.

SGDM takes on added allure as an inflation-fighting tool.

“Another type of inflation that gold investors should be tracking is monetary inflation,” notes State Street. “While closely linked to fiat currency devaluation, there is an important distinction to highlight as it relates to rising financial asset valuations. Central banks globally have continued to add debt to their balance sheets in response to the COVID-19 pandemic.”

SGDM is comprised of global gold miners, with a notable tilt toward Canadian and U.S. mining companies. Stock fundamentals like cost deflation across the mining industry, share valuations below the long-term average, and rising M&A are all supportive of the miner’s space as well.

“While gold serves as a strong store of value over time, its sensitivity to moderate price inflation has historically been more limited. In contrast, compared to other real assets such as infrastructure and natural resources, gold’s correlation – and more importantly its beta to monthly changes in CPI – is actually the lowest,” concludes State Street.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.