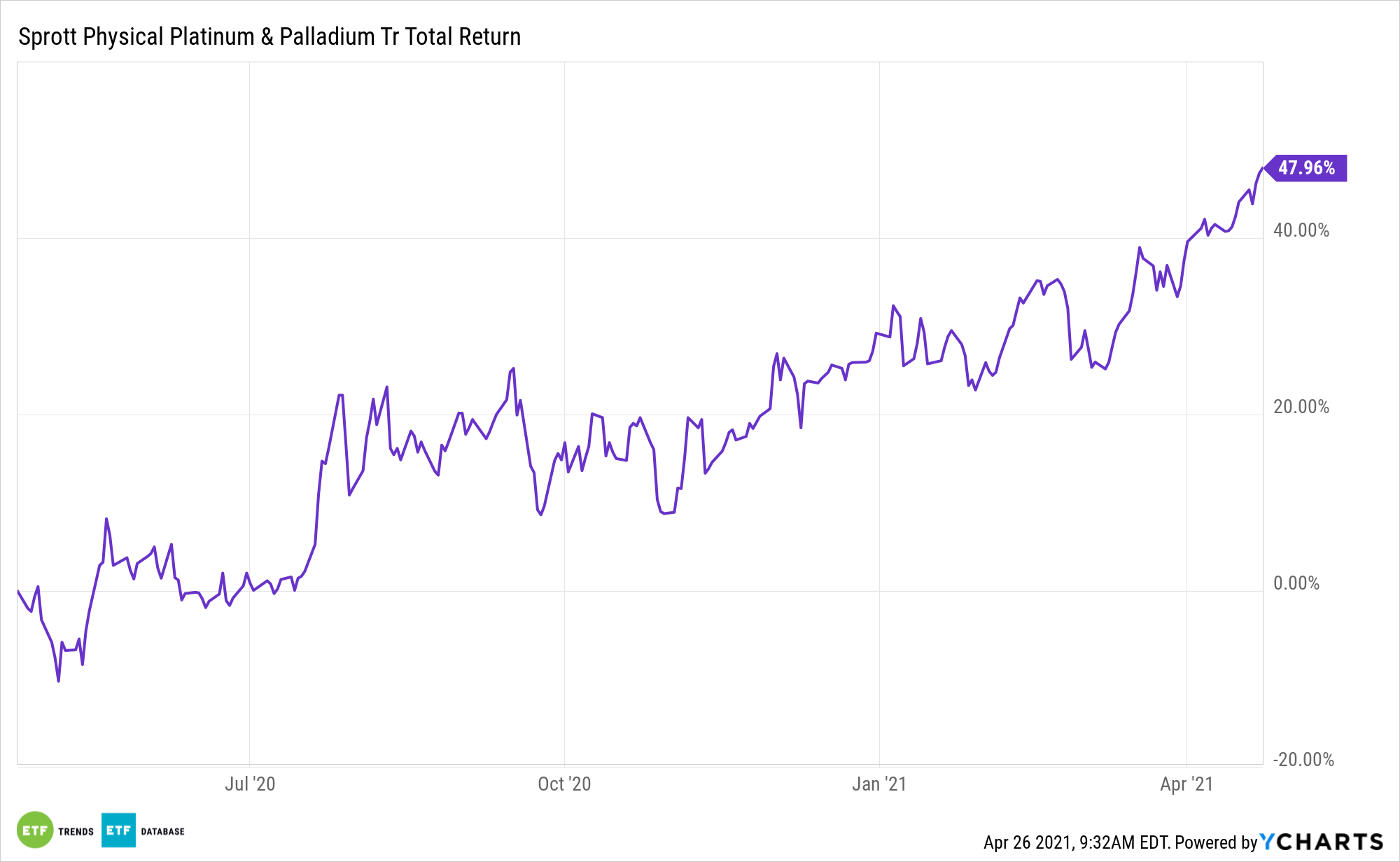

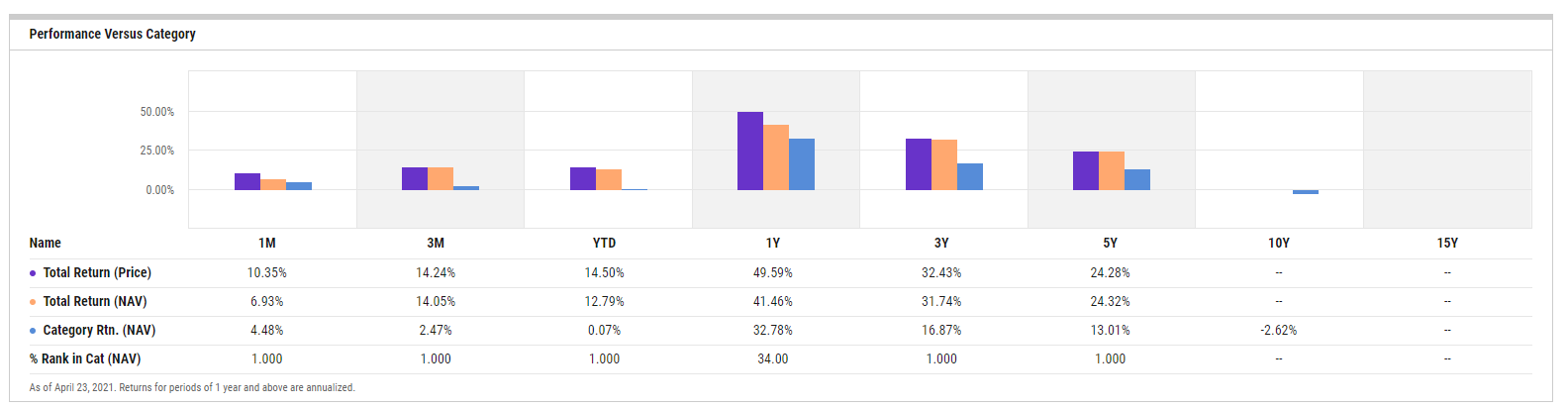

Amid strong demand, palladium prices are notching record highs, fueling the Sprott Physical Platinum and Palladium Trust (NYSEArca: SPPP) in the process.

SPPP provides “a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The Trust offers a number of compelling advantages over traditional exchange-traded platinum and palladium funds,” according to the issuer.

A variety of factors have palladium flirting with the previously unthinkable $3,000 an ounce mark.

“Palladium extended its blistering rally to an all-time high within striking distance of $3,000 on Friday on supply concerns and bets for improving demand,” reports Reuters.

Palladium and Platinum

With the global economy healing and automobile demand hot, SPPP is soaring, as the metal is used to produce catalytic converters. Automobile manufacturing demand is expected to send palladium to another supply deficit.

“We’re expected to outstrip supply for multiple years out,” said Phillip Streible, chief market strategist at Blue Line Futures in Chicago, in an interview with Reuters.

But SPPP isn’t solely dependent on palladium upside. The trust is getting a lift from platinum, which notched its best week in almost two months last week.

“Both palladium and platinum are used as emissions reducing catalysts in automobiles but palladium is used more in gasoline engine,” according to Reuters.

There are some tax perks that come along with SPPP, too.

SPPP “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins, and bars,” notes Sprott.

For its part, palladium is on a three-month winning streak, and futures markets indicate more upside could be on the way.

“June palladium futures surged almost 3% to a maximum price value of $2,929, surpassing the previous record set in February 2020,” according to RT News. “The vast majority of the rare metal is extracted from mines in two countries. Over 80% of palladium global output comes as a byproduct from nickel mining in Russia and platinum mining in South Africa.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.