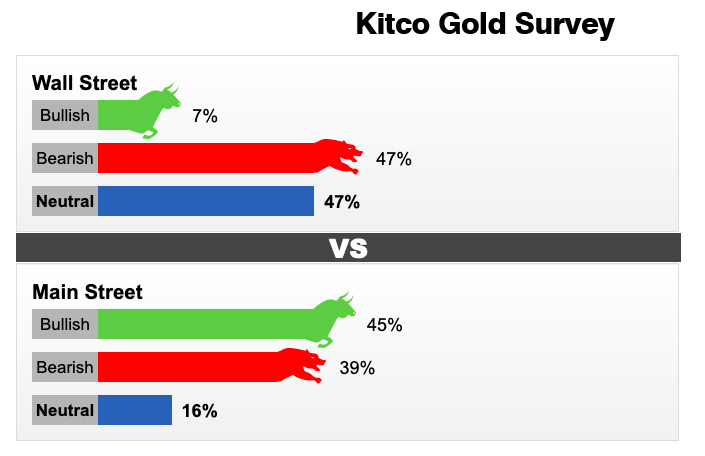

Are investors bullish on gold? It depends on who you ask. According to a Kitco Gold Survey, Main Street says “yes” while Wall Street says “no.”

The safe haven precious metal has been caught in a sideways pattern for quite some time, and at some point, it either has to head up or down. Right now, that undecided sentiment (47%) ties Wall Street’s bearish sentiments (also 47%).

45% of Main Street, on the other hand, thinks that gold can break out to the upside from its current sideways trend. That’s not to say that bearishness is too far behind, with 39% saying that it will head downward, while 16% are neutral on gold.

Why is Wall Street so down on gold? It all leads back to the Federal Reserve and how they respond to the latest economic data.

Right now, the Fed is standing pat on their plans to taper bond purchases through the rest of the year.

“For many analysts, the gold market faces some difficult headwinds next week as the Federal Reserve holds its monetary policy meeting,” the Kitco News report said. “There is growing uncertainty surrounding U.S. monetary policy as some economists have noted that recent economic data could support the Fed releasing its plans to reduce its bond-purchase next week.”

A lot of market experts agree that the $1,800 price, give or take, is the ceiling where gold will be most tested. A push past this price ceiling could portend to a rally.

“I like gold staying soft in the first half of next week. I see $1780 as resistance,” said Marc Chandler, managing director at Bannockburn Global Forex. “When the FOMC meeting is out of the way, we could see some ‘sell rumors of a hawkish fed’ and gold may be bought.”

A Mining Option in Gold

One way to play gold prices is through mining ETFs like the Sprott Gold Miners ETF (SGDM). The fund seeks investment results that correspond generally to the performance of its underlying index, the Solactive Gold Miners Custom Factors Index, which aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U.S. exchanges.

The Index uses a transparent, rules-based methodology that is designed to emphasize larger-sized gold companies with the highest revenue growth and free cash flow yield, as well as the lowest long-term debt to equity. The Index is reconstituted on a quarterly basis to reflect the companies with the highest factor scores.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.