The stock market might be shaking, but precious metals aren’t.

On Monday, the Dow index plunged 700 points, as ongoing COVID fears sparked increased market volatility. But gold and silver have retained support.

Silver prices have stayed above $25/oz, while spot gold prices are at $1,822.10/oz.

June’s 7.17% dip in gold prices was something of a mirage, brought about mostly by stronger-than-expected Fed language regarding inflation during the June Federal Open Committee meeting. However, it’s worth noting that while gold, platinum, palladium, and copper all took substantial hits, silver mostly shrugged it off and it did not take gold long to make back some of its June slide.

In an interview with Markets Insider, veteran investor and Moran Tice Capital Management co-founder David Tice said: “We have come back a long way from the April lows of 2020 after the COVID-19 scare. However, we’re not out of the woods yet and this is a dangerous market.”

“You look at this lack of discipline in monetary and fiscal markets, gold is truly the place to be,” he said. “I would be owning gold, especially gold and silver mining companies.”

In particular, he noted that mining companies are undervalued and have explosive growth potential, especially as gold and silver prices rise.

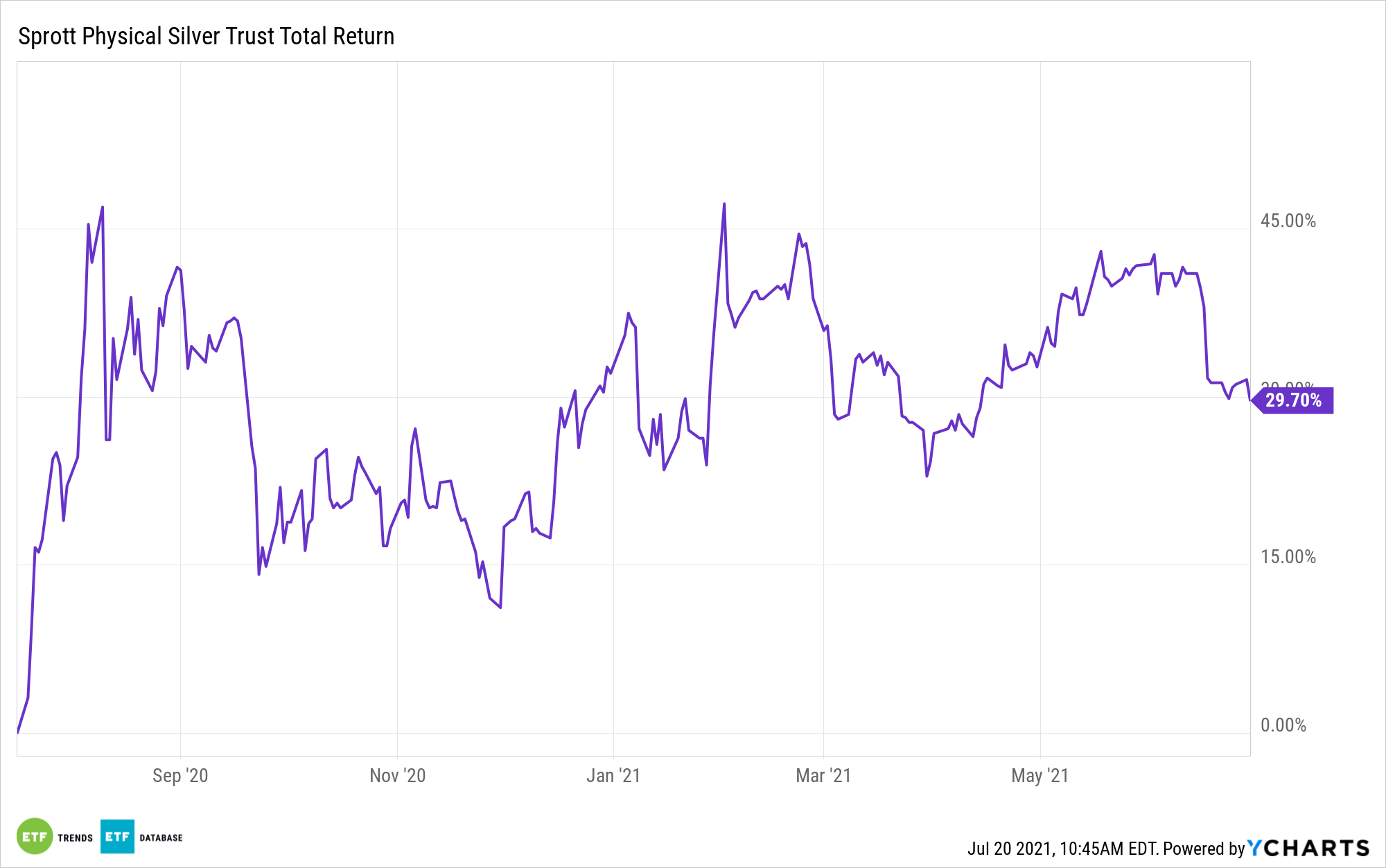

Gold and silver can act as a hedge against inflation, and investors looking to directly access physical exposure to the metals can hold gold bullion with the Sprott Physical Gold Trust (PHYS). The Sprott Physical Silver Trust (PSLV) holds LGD silver bars.

Sprott also offers two actively managed precious metals mining ETFs: the Sprott Gold Miners ETF (SGDM), which tracks gold majors, and the Sprott Junior Gold Miners ETF (SGDJ), which tracks junior gold miners.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.