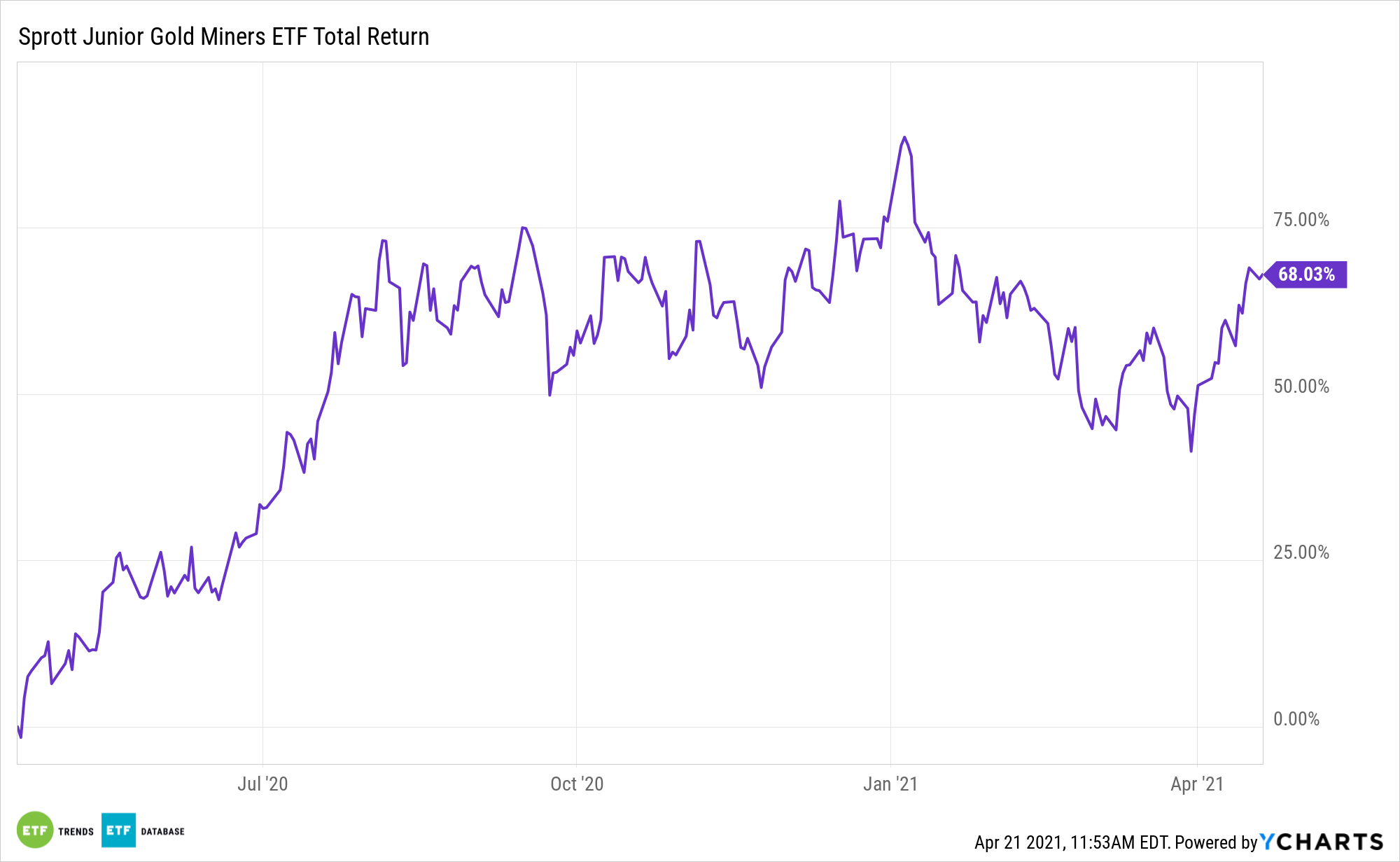

Some commodities market observer believe gold miners are on the cusp of substantial upside. That could be great news for assets like the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ).

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. The ETF focuses on price momentum, which helps identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures.

“All the Gold traders know that when Gold starts a new leg higher, it could mean inflation fears are being amplified in the global markets and/or fear is starting to creep back into the markets,” reports FX Empire. “After the recent rally in the US major indexes and as we plow through Q1:2021 earnings, it makes sense that some fear and inflation concerns are starting to take precedence over other concerns. Will the markets just continue to push higher and higher? Or are the market nearing some type of intermediate-term peak after rallying from November 2020? Only time will tell…”

How ‘SGDJ’ Can Get Going Once More

Stock fundamentals like cost deflation across the mining industry, share valuations below long-term averages, and rising M&A are all supportive of the miners space as well. Many currency traders also expect the dollar to remain lethargic in the back half of 2021.

Supporting the case for SGDJ, we may also continue to see multiple factors come into play to support the gold market in the coming months. For starters, economic expansion has historically been supportive of jewelry, technology, and long-term savings. Risk and uncertainty could further support safe-haven gold demand. The price of competing assets like bonds, currencies, and other assets may also influence investor attitudes toward gold. Lastly, capital flows, positioning, and price trends may ignite or dampen gold’s performance.

With junior miners, “if this current breakout attempt is valid, we will see a continued upward price trend that confirms the breach of this downward sloping trend line over the next 5 to 15+ days. We expect this move to happen fairly quickly given how traders have shifted focus recently into hedging against downside price concerns,” adds FX Empire.

SGDJ is up 5% over the past month.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.