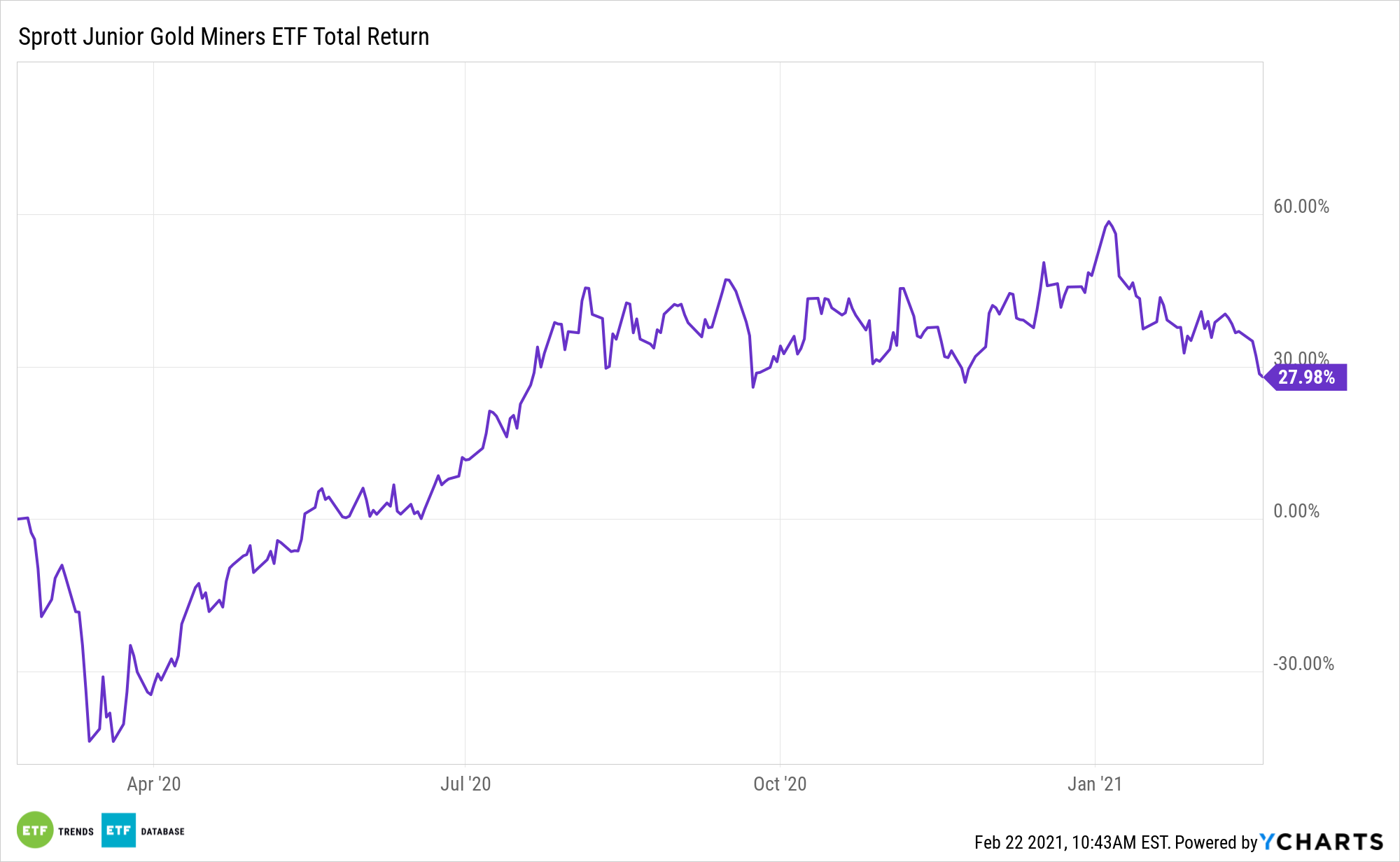

Recent sluggishness in gold prices is clear, but there’s an upside to the precious metal’s recent lethargy. Lower gold prices could lead to opportunities for investors to embrace high-quality mining assets such as the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ).

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. The ETF focuses on price momentum, which helps identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures.

“Owning the mining companies not only gives you exposure to the physical asset, but also to operating leverage,” according to Seeking Alpha. “Until recently, low gold prices were to blame for the lack of capital investment into gold exploration. But with gold prices near $2,000 an announce, at levels not seen since the 2011 to 2012 peaks, new investment in gold exploration makes sense from a return on investment (ROI) standpoint.”

Keep an Eye on SGDJ

Supporting the case for SGDJ, we may continue to see multiple factors come into play to support the gold market in the coming months. For starters, economic expansion has historically been supportive of jewelry, technology, and long-term savings. Risk and uncertainty could further support safe-haven gold demand. The price of competing assets like bonds, currencies, and other assets may also influence investor attitudes toward gold. Lastly, capital flows, positioning, and price trends may ignite or dampen gold’s performance.

“Junior miners are in the sweet spot of the Lassonde Curve, offering heightened risk, but also increased potential for reward, especially given the scarcity of supply for new gold. There have been no major gold discoveries in the past three years,” notes Seeking Alpha.

SGDJ provides investors with cost-efficient and pure exposure to this market segment by implementing quality screens that other gold stock ETFs often lack.

“As the economic outlook improves and interest rates rise from their zero levels, the U.S. dollar has strengthened. And given that gold does not deliver an interest rate itself, it competes somewhat with interest-bearing assets like bonds,” concludes Seeking Alpha. “That is why investing in the price of gold through gold equities, specifically junior miners, who are the most leveraged to rising prices in a gold bull market, is an attractive play in the current market environment.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.