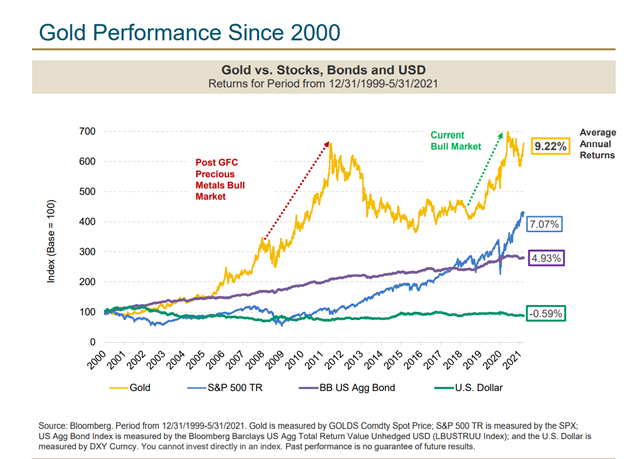

Gold is “largely underrepresented” by both institutions and retail investors, said Sprott senior managing director Ed Coyne in a recent webcast about gold’s place in the COVID-19 recovery economy.

Coyne believes the metal still has tremendous upside, especially in comparison to bonds, which have limited upside in the current environment. “We encourage investors to take advantage of gold’s price weakness to establish and increase long positions,” he said.

Senior portfolio manager John Hathaway added that “even though gold has outperformed other asset classes, its almost a well-kept secret.”

The Macro Consensus Might Be Wrong

With real interest rates expected to be deeply negative, gold price is likely to surge in the years ahead.

Source: Sprott

The CPI increased 5% last year, according to Hathaway. “Employment statistics have been disappointing. Manufacturing orders are weak. The performance of the economy is not up to the very rosy expectations you hear from the consensus… The political establishment won’t have any tolerance for an economic slowdown, so that will lead to more money printing. That again is very bullish for gold.”

If inflation sets in and the market goes into recession, Hathaway sees panic from the political class as leading to additional, potentially reckless monetary policy that could lead the country into a recession. In these conditions, gold and gold mining investments would absolutely thrive.

Gold Equities Full of Opportunity

Senior Portfolio Manager Douglas Groh talked about gold equities, a market that has been largely ignored by investors.

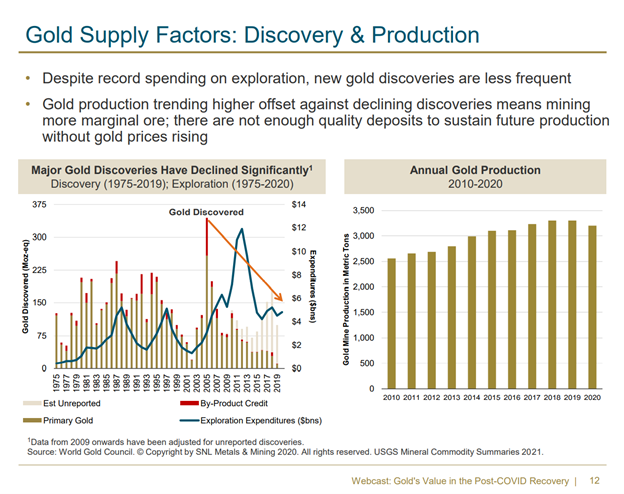

In terms of basic supply and demand, gold has limited availability and conditions are set for supply to be limited. “Over the last 11 years we have not seen a lot of gold discoveries,” he said. “So the supply is tight.”

Source: Sprott

Gold miners have seen share values raise by 155% in the past couple of years. Groh thinks that miners have value beyond generating cashflow. “The sector is very deals-orientated. There’s opportunities to create value through transactions rather its mergers and acquisitions or property sale.”

Every ounce of gold costs about $1100/oz to produce. Groh points out that this already sets miners up for profits of about $750 at the current gold price – and that price is likely to move up. In a rising prices environment, mining companies hold a unique leverage opportunity.

Additionally, the assets that mining companies own will also gain value if gold prices go up. This could lead to further deal-making opportunities. “The sector has become much more focused than it was ten years ago in terms of allocating its capital,” said Groh.

The Sprott Gold Miners ETF (SGDM) tracks gold majors, and the Sprott Junior Gold Miners ETF (SGDJ) tracks junior gold miners. Investors can access physical gold through the Sprott Physical Gold Trust (PHYS).

For more news, information, and strategy, visit the Gold & Silver Investing Channel.