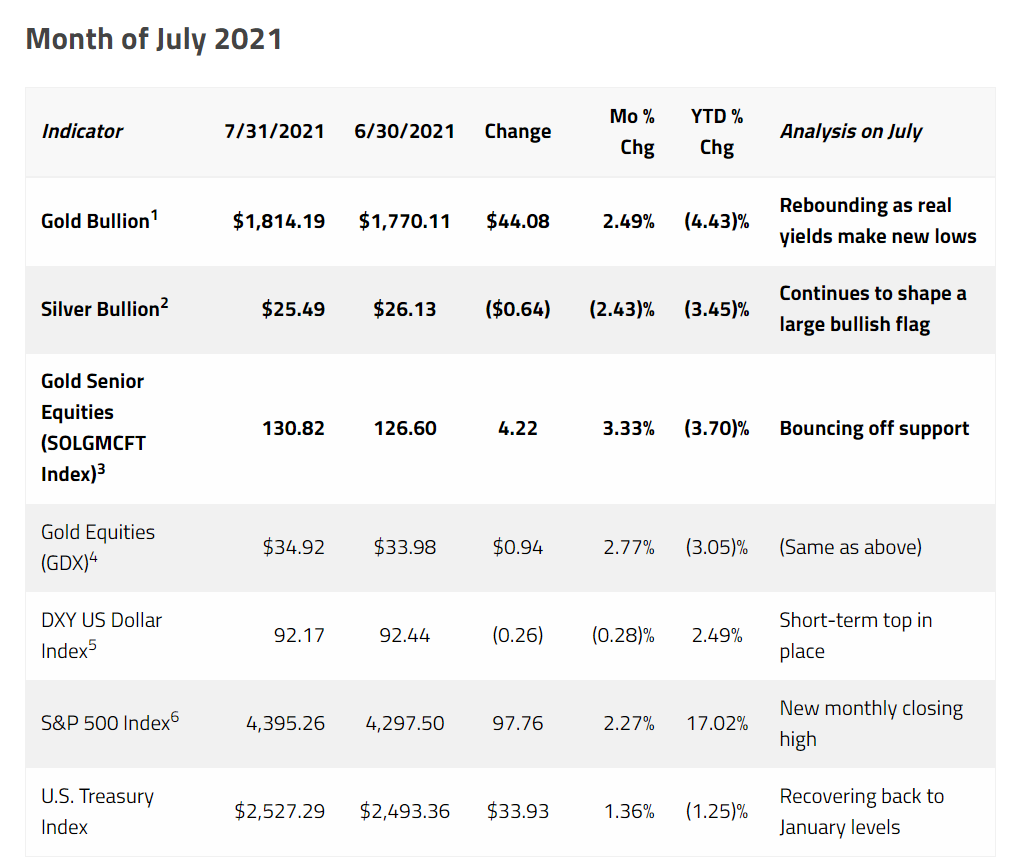

Sprott Market Strategist Paul Wong sees gold as well-positioned for an August-September rally. Gold bullion gained a modest 2.49% in July after a rough June, and mining equities also saw their fortunes recover a bit, rising 3.33%. However, gold is still down 4.43% year-to-date, while silver is down 3.45%. “We view 2021’s weak performance as a mid-cycle correction for precious metals,” Wong said in his report.

He added that: “We believe the June smackdown on gold was more likely due to an across-the-board fund de-grossing event than any fundamental gold driver. July saw a recovery in gold bullion investments as positions were repurchased and the fall in real yields to all-time lows added to the buying rationale.”

Source: Sprott Insights

As the USD tops out and real yields reach new all-time lows, Wong believes that a rally is just around the corner. June’s hawkish FOMC reaction played a key part in gold’s bumpy June, and Wong points out that “the sharp sell-off in gold bullion in Q1 was a reaction to this tapering and tightening fear, a replay of the 2013 Taper Tantrum beating of gold bullion.” The 2013 Taper Tantrum was driven by the Fed, but Wong sees today’s iteration as driven by bond markets.

Concern over another shutdown due to the Delta variant has investors bracing for another hit to the economy. Falling real yields strongly correlate with rising gold prices, and yields are continuing to fall. “In this current cycle, the bond market has initiated the taper tantrum, although the Fed continues to message patience. Real yields continue to make new all-time lows. The DXY is in a multi-year topping pattern after a choppy recovery from its GFC low. The Fed is now on an AIT/ZIRP (average inflation targeting/zero interest rate policy) path, which essentially translates to a dollar debasement and financial repression path. Aside from the phrase ‘taper tantrum,’ market conditions are near the opposite of the 2013 Taper Tantrum.”

Gold Could Set New Highs in the Near Future

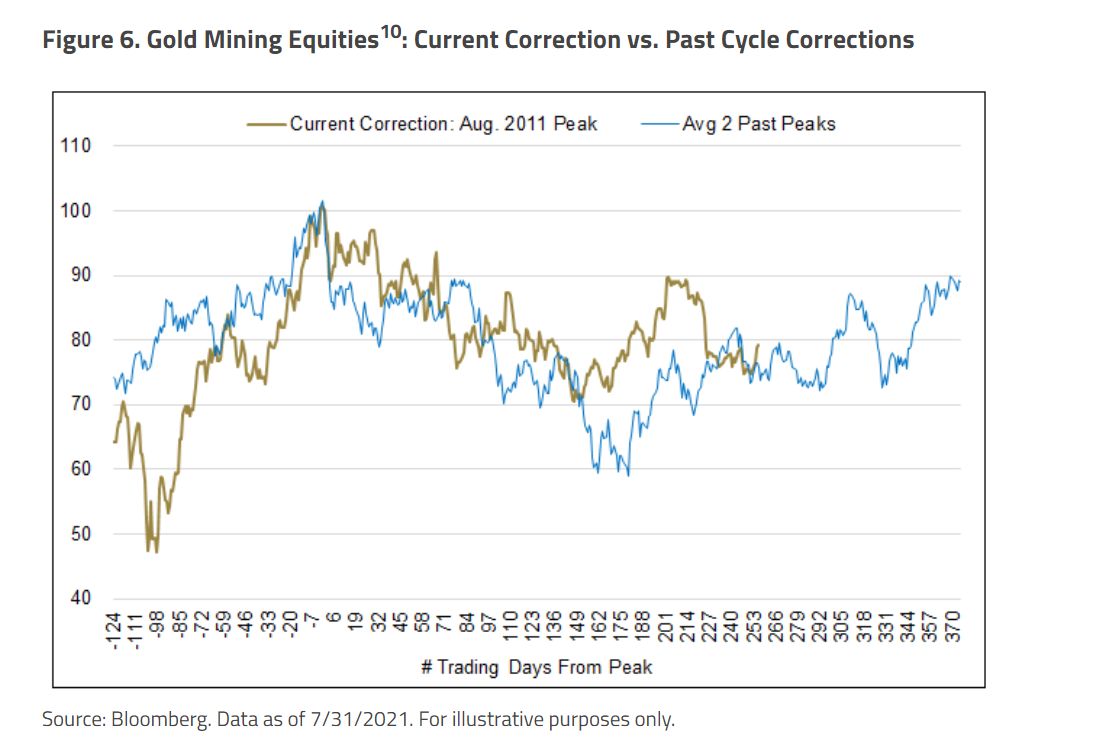

Though gold is currently below its August 2020 highs of $2067/oz, it remains well-supported above where it was in March of 2020. The gold bull market of 2001 to 2011 also saw mid-cycle corrections in 2006 and 2008. “We would expect gold bullion to shape a base breakout pattern to new highs in time. We are convinced the correction lows on gold this past March will hold as they were made on capitulation selling on overblown Fed tightening fears. With new lows in real yields and the DXY unable to break higher (only short-covering buying), we see gold breaking to new highs. If history repeats, we believe the approximate timing will be early 2022.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.