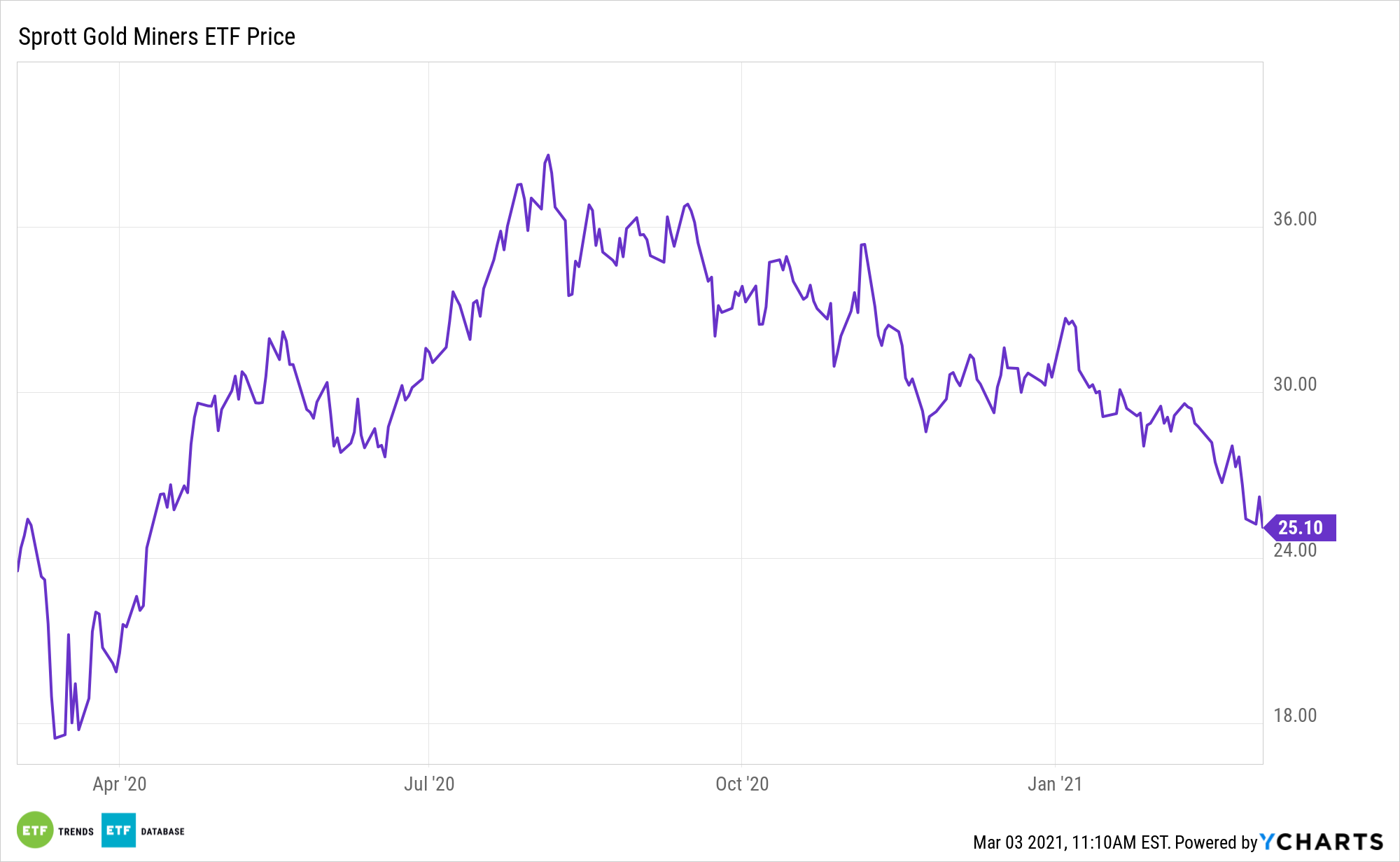

Talk of inflation is increasing, meaning investors are examining a wide range of inflation-fighting tools. Gold ETFs like the Sprott Gold Miners ETF (NYSEArca: SGDM) merit a spot toward the top of the list.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Historically, gold is one of the premier inflation-fighting assets. Inflation fears are further reflected by a sharp rise in benchmark Treasury yields, which may be partially attributed to expectations for greater inflation.

“Gold is a classic fear trade. Prices rallied last year on worries about coronavirus lockdowns crippling the global economy. But gold also does well when investors are worried about inflation — as they are now,” reports CNN Business.

Is Gold Too Expensive?

Gold may not even be all that expensive. Even after 2020’s rally, the spot gold price is still below historical all-time highs when adjusted for inflation, and the precious metal has historically outperformed during periods of high inflation. The price gains have been supported by strong growth in global investments that partially offset weakness elsewhere amid ongoing Covid-19 disruptions. Additionally, the lower demand for jewelry has shown signs of recovery, which may add another layer of demand ahead. Meanwhile, year-to-date inflows into gold-backed ETFs have hit record levels.

“Some investors think inflation fears could run rampant again if the US Senate passes President Joe Biden’s proposed $1.9 trillion stimulus package. There are questions about whether that much money is really needed now that there are multiple Covid-19 vaccines and more people are returning to work,” according to CNN. “The worry is that all the federal stimulus money will eventually cause the economy to overheat, leading to even higher inflation. That, in turn, could boost gold prices further.”

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of their balance sheets as measured by long-term debt to equity. By focusing on balance sheet strength, the fund has greater exposure to companies with a lower long-term debt to equity ratio, which have a greater ability to weather downturns.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.