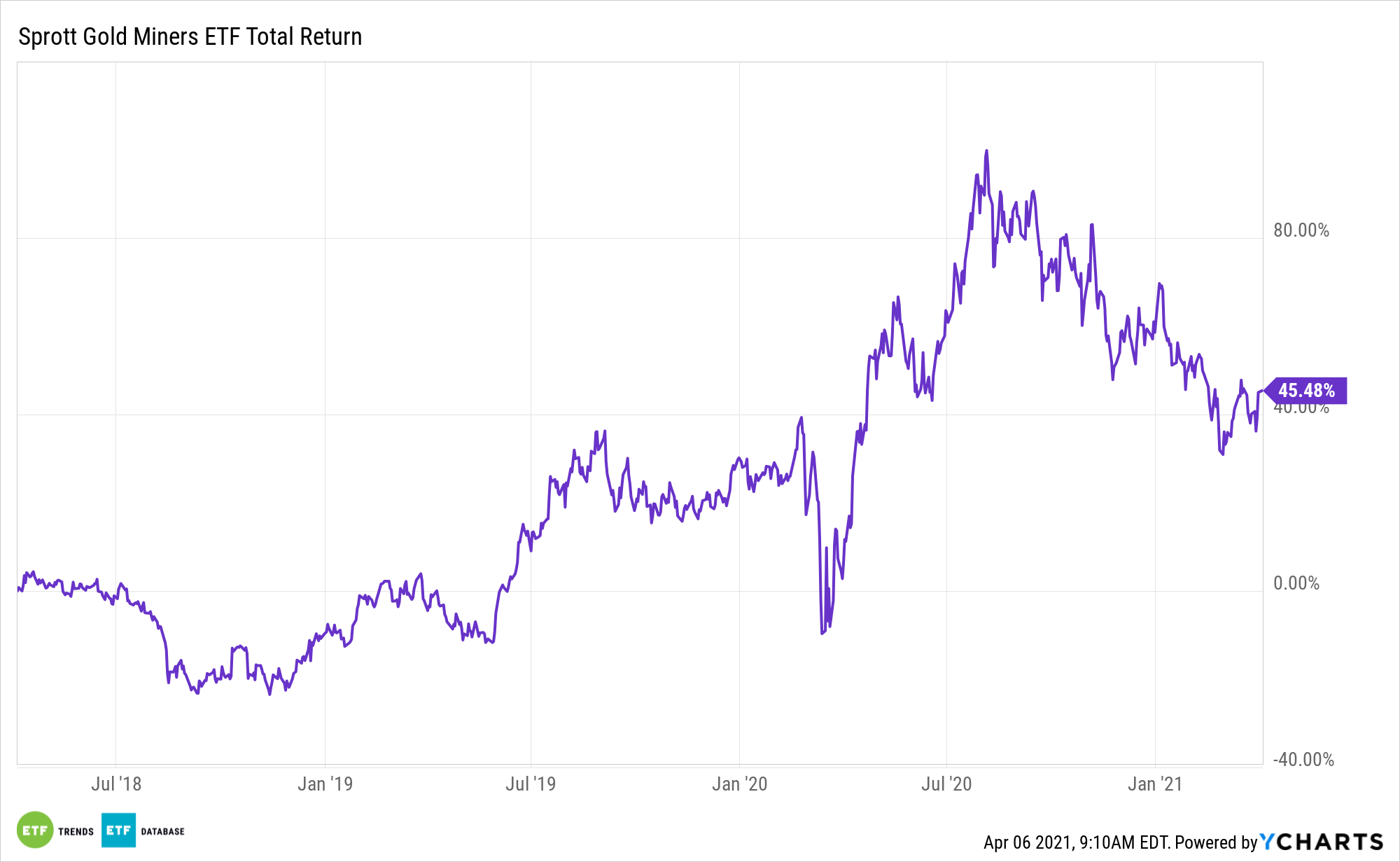

Gold prices are surprisingly weak this year, but the good news is that this scenario is making assets like the Sprott Gold Miners ETF (NYSEArca: SGDM) more attractive.

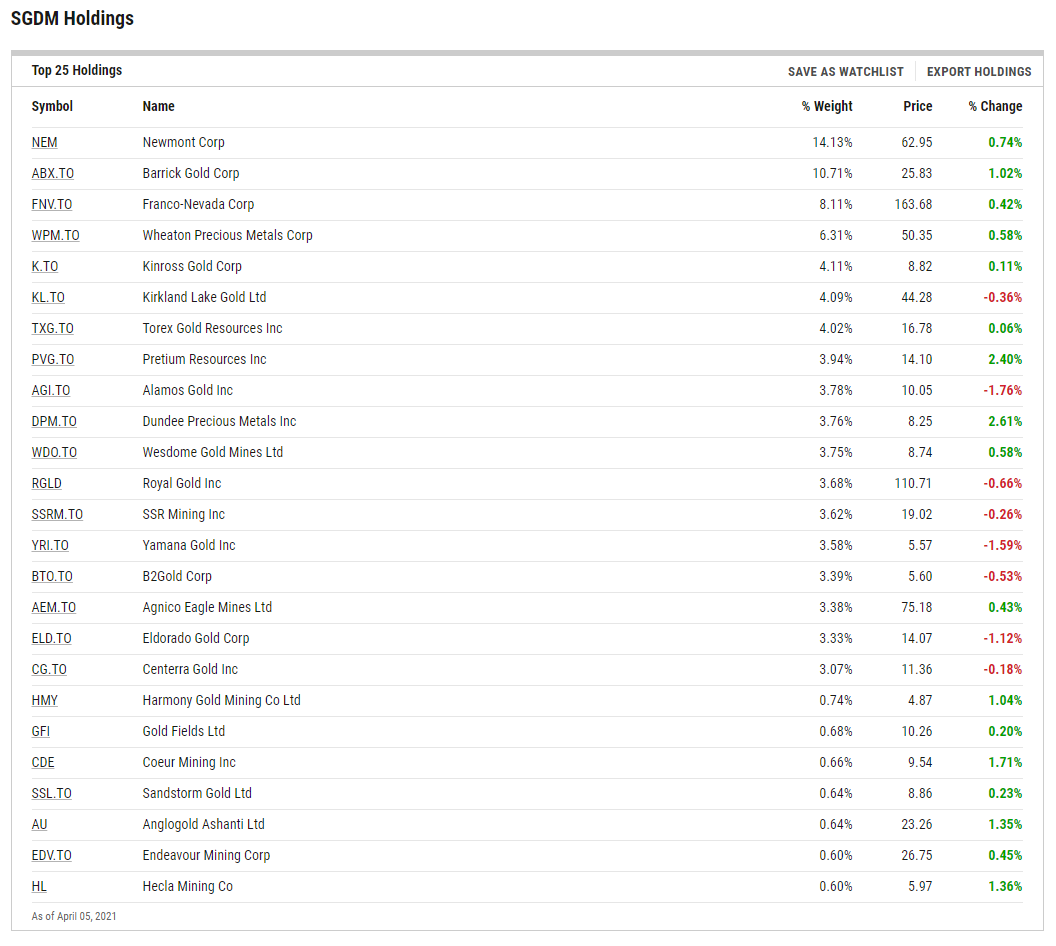

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Some commodities market observers believe that when gold snaps back, gold miners stand to benefit in significant fashion.

“With the selloff, gold looks attractive—and so does mining giant Barrick Gold (ticker: GOLD). Shares of Barrick, at about $20, are down by over a third from their summer peak and look inexpensive, changing hands for 15 times projected 2021 earnings of $1.33 a share and yielding 1.8%,” reports Andrew Bary for Barron’s. “Barrick and other large gold-mining companies are trading cheaply, relative to their histories and to gold, even though they are better run than ever before. Led by South African geologist and big-game hunter Mark Bristow, Barrick has an impressive portfolio of mines.”

Rebound Allure with SGDM

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of their balance sheets as measured by long-term debt to equity. By focusing on balance sheet strength, the fund has greater exposure to companies with a lower long-term debt to equity ratio, which have a greater ability to weather market downturns.

“While higher Treasury rates have diminished the appeal of gold, the backdrop still looks favorable,” according to Barron’s.

Precious metals have had a tough time this year, as stocks have continued to rally. But with interest rates climbing recently, some analysts see more upside ahead.

The market is concerned that unprecedented fiscal stimulus could be inflationary. For the metals, inflation should be supportive, as should stimulus spending. Historically, gold is one of the premier inflation-fighting assets.

“Most investors have little or no exposure to the metal or to goldmining stocks. Despite Bitcoin’s rise, gold remains the time-tested alternative investment. To add it to your portfolio ahead of a revival in its price, there might be no better bet than one on Barrick and its swashbuckling leader,” concludes Barron’s.

Barrick is one of the largest components in SGDM.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.