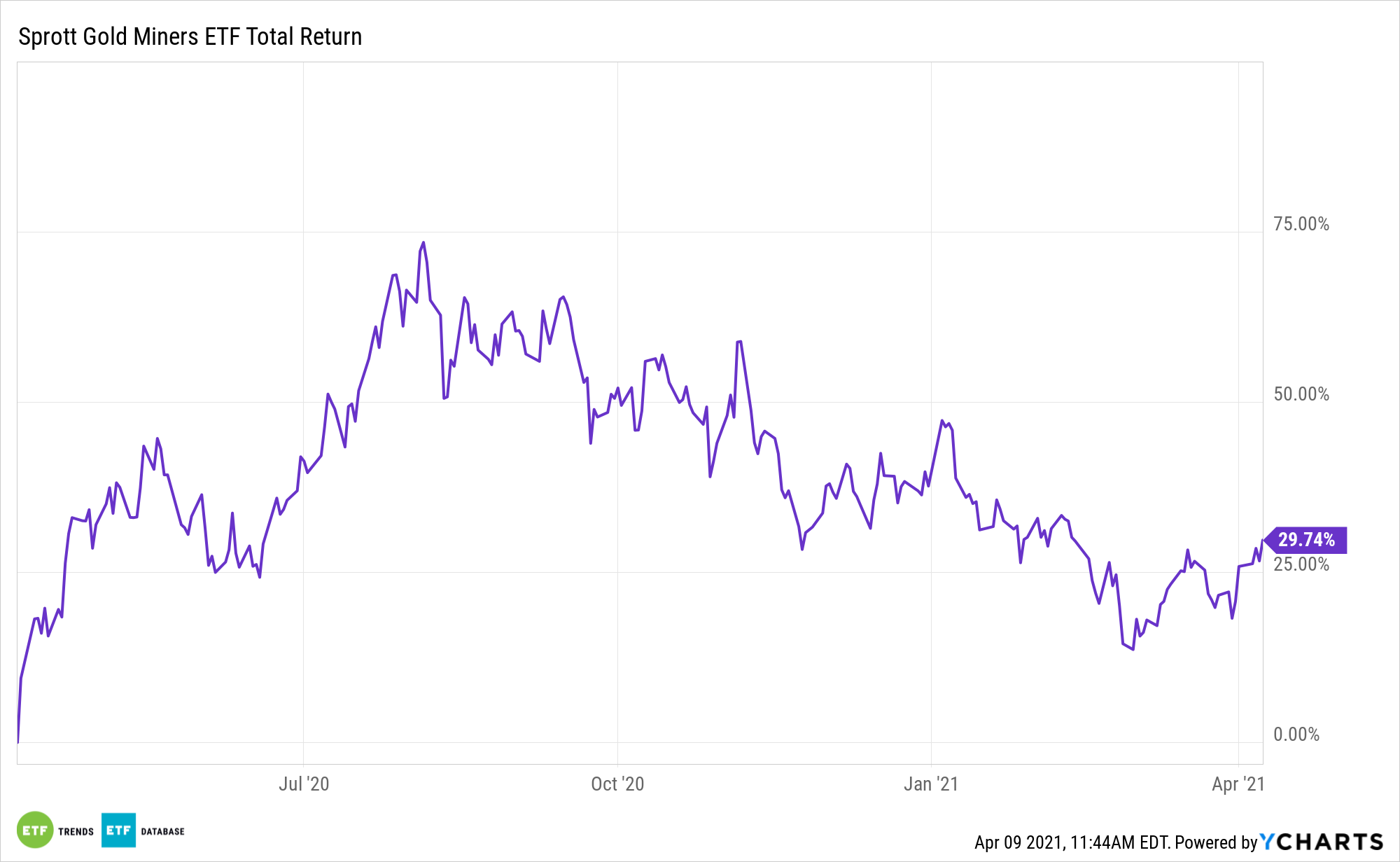

Gold and bullion miners had a rough first quarter, but spring and the second half of the year could bring better things for the Sprott Gold Miners ETF (NYSEArca: SGDM).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

As the dollar and Treasury yields fall back, bullion and SGDM could regain their bullish ways.

“Precious metals miners turned in a strong showing today, as gold futures ended higher to mark the highest finish since February, supported partly by a decline in the dollar and an expected rise in inflation,” according to Seeking Alpha.

The Case for a ‘SGDM’ Rebound

With the federal government stepping in to help shore up the economy, it might seem like gold gains could be tamped down. However, some market experts predict that the U.S. economy will be tested in the coming months, potentially further boosting bullion and ETFs.

“The dollar and U.S. yields are coming off and that’s the key catalyst right now… a pretty unimpressive jobs number is also helping push gold higher,” says RJO Futures senior strategist Bob Haberkorn.

Stock fundamentals like cost deflation across the mining industry, share valuations below long-term averages, and rising M&A are all supportive of the miners space as well, but those fundamentals could be glossed over if the dollar strengthens. Importantly, many currency traders expect the dollar to remain lethargic in the back half of 2021.

Supporting the case for SGDM, we may also continue to see multiple factors come into play to support the gold market in the coming months. For starters, economic expansion has historically been supportive of jewelry, technology, and long-term savings. Risk and uncertainty could further support safe-haven gold demand. The price of competing assets like bonds, currencies, and other assets may also influence investor attitudes toward gold. Lastly, capital flows, positioning, and price trends may ignite or dampen gold’s performance.

Some also point to a weakening U.S. dollar that could further support gold as a better store of wealth. The aggressive fiscal and monetary stimulus measures, along with a shift toward riskier assets, could weigh on the dollar. Since gold is priced in the greenback, a weak dollar makes it cheaper for foreign gold buyers.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.