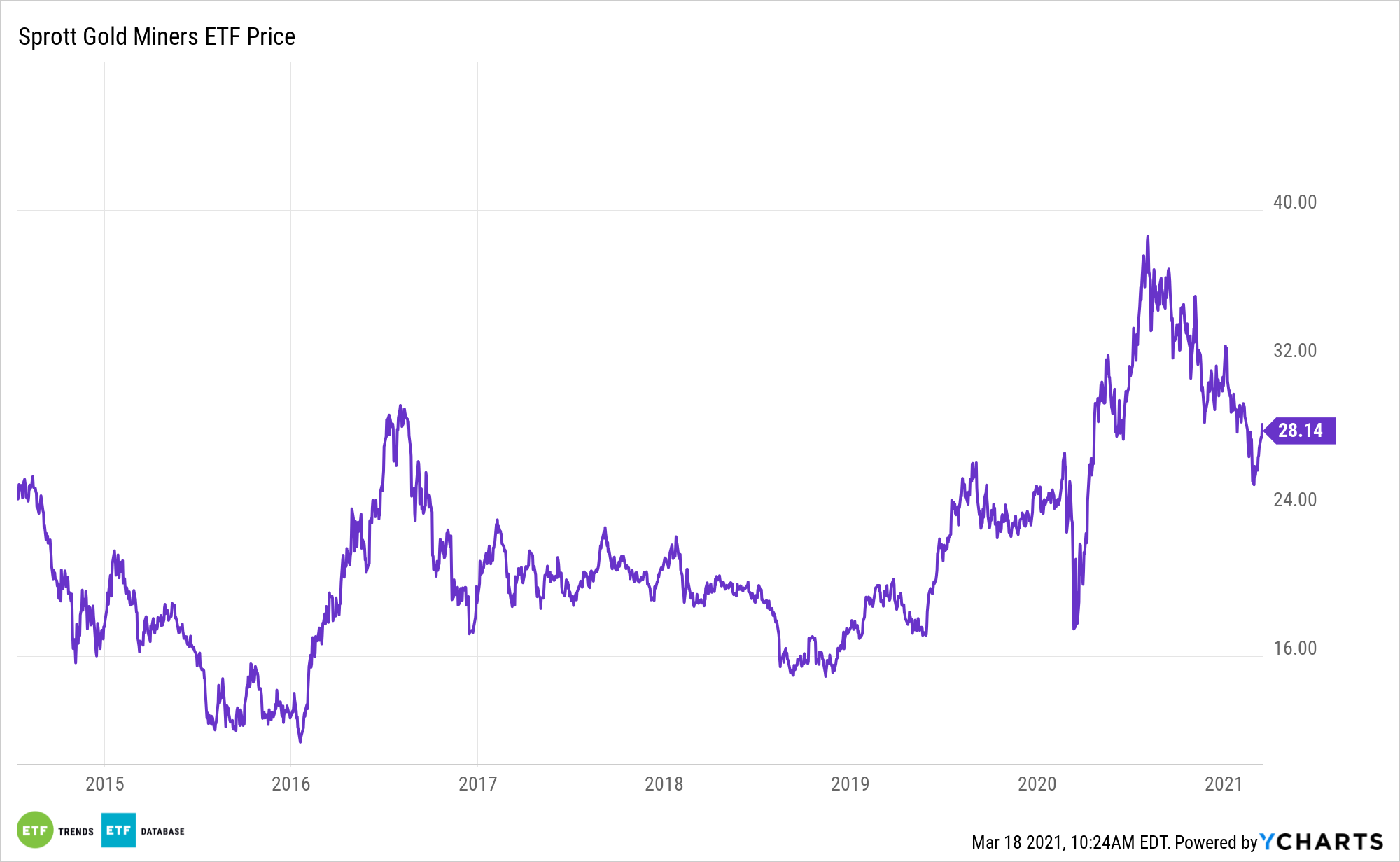

Gold bullion and miners exchange traded funds drifted lower for much of this year, but assets like the Sprott Gold Miners ETF (NYSEArca: SGDM) got some relief Wednesday after the Federal Open Market Committee (FOMC) signaled interest rates will remain low for the foreseeable future.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

“Gold prices (XAUUSD:CUR) settled lower, then moved higher after the Federal Reserve continued to project near-zero interest rates at least through 2023,” according to Seeking Alpha.

Gold has been a popular play for investors to hedge against ongoing volatility, uncertainty, and inflationary risks. The coronavirus pandemic has ravaged economies and fueled heightened uncertainty, which have helped support gold as a safe-haven bet. Meanwhile, the copious amounts of fiscal and monetary stimulus measures have inundated the markets with cash, fueling demand for physical assets that can help investors maintain their purchasing power.

The Case for Sticking with ‘SGDM’

Even with the recent sell-offs, it’s good to be in gold right now. With more market uncertainty ahead, the precious metal is still topping the list when it comes to asset choices, and investors who want gold exposure can look to ETFs to fill that need. Precious metals like gold offer investors an alternative to diversify their holdings, and like other commodities, gold will march to the beat of its own drum compared to the broader market.

SGDM is comprised of global gold miners, with a notable tilt toward Canadian and U.S. mining companies. Stock fundamentals like cost deflation across the mining industry, share valuations below the long-term average, and rising M&A are all supportive of the miner’s space as well.

Supporting the case for SGDM, we may continue to see multiple factors come into play to support the gold market in the coming months. For starters, economic expansion has historically been supportive of jewelry, technology, and long-term savings. Risk and uncertainty could further support safe-haven gold demand. The price of competing assets like bonds, currencies, and other assets may also influence investor attitudes toward gold. Lastly, capital flows, positioning, and price trends may ignite or dampen gold’s performance.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.