Weak dollar or strong dollar, it all adds to the volatility of gold, and this week in particular could prove to be a bumpy ride with an outpouring of economic data ahead.

To start the week’s trading session, the dollar decided to take a back seat while gold inched higher.

“After a sluggish start to the day, not to forget downbeat weekly opening, gold regains upside momentum as the US Dollar Index (DXY) fails to extend the previous day’s rebound from a two-week low, down 0.07% intraday around 92.64 at the latest,” a FX Street report said. “In addition to the greenback weakness, cautious optimism in the markets and mildly bid S&P 500 Futures, not to forget a three-day downtrend of the US 10-year Treasury yields, also favor gold buyers of late.”

COVID-19 continues to be a key mover for the markets, so investors are watching the number of cases for signs of dwindling. The FX Street article mentioned that Southeast Asia is starting to see the number of cases ease.

Up ahead, there is the nonfarm payrolls data, which will give an idea on how the jobs market is dealing with the Delta variant of COVID-19. A drop in payrolls could signal a more cautious jobs market that could stagnate the recovery and push gold prices higher.

The Federal Reserve will certainly be watching this data closely as it ponders its stimulus tapering. Fresh off his Jackson Hole speech, Federal Reserve chairman Jerome Powell warned that an “ill-timed policy move” could hurt the recovery.

“With (Federal Reserve) Chair Powell taking a less cavalier attitude to taper than some of his FOMC colleagues, we look for the USD to trade with a softer tone into the upcoming payrolls report which we expect will disappoint consensus,” analysts at TD Securities said. ”That said, dips in the dollar should be shallow and well-marked; in the DXY, we think the post-June Fed ‘range’ lows near 91.50/00 should be solid support.”

Like Gold, but Not Volatility?

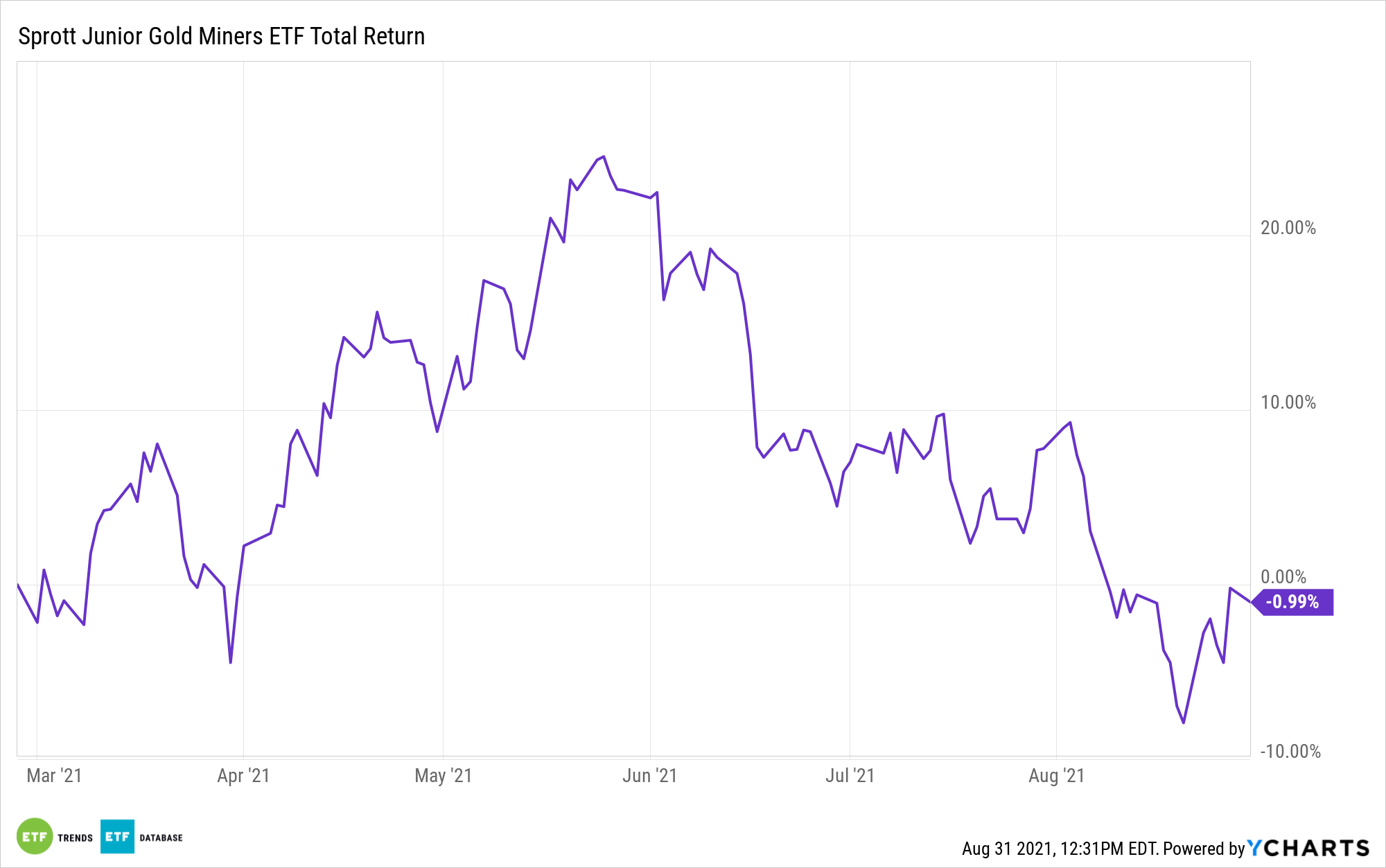

With volatility likely ahead, would-be gold investors could take a different route. One way is with miners via ETFs like the Sprott Junior Gold Miners ETF (SGDJ) — SGDJ tracks small-cap gold mining companies, focusing on small companies with strong revenue growth and price momentum, two factors that have historically predicted long-term stock performance.

The portfolio, which holds roughly 30 to 40 stocks at any given time, tracks the Solactive Junior Gold Miners Custom Factors Index. It is rebalanced semi-annually, ensuring that it reacts to seize opportunities in a timely fashion and keeps its holdings optimized.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.