One of the original uses of gold and silver was as hard currency. Pending legislation in Kansas could refresh that use and bring upside for assets like the Sprott Gold Miners ETF (NYSEArca: SGDM) and the Sprott Physical Silver Trust (NYSEArca: PSLV).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

“A bill introduced in the Kansas House would recognize gold and silver specie as legal tender and repeal all taxes levied on it. The legislation would pave the way for Kansans to use gold and silver in everyday transactions, a foundational step for the people to undermine the Federal Reserve’s monopoly on money,” reports Zero Hedge.

A Fiat Fight in Kansas

Renewing the idea of precious metals as hard currency is likely born out of central banks’ rapid debasement of global currencies, including the U.S. dollar.

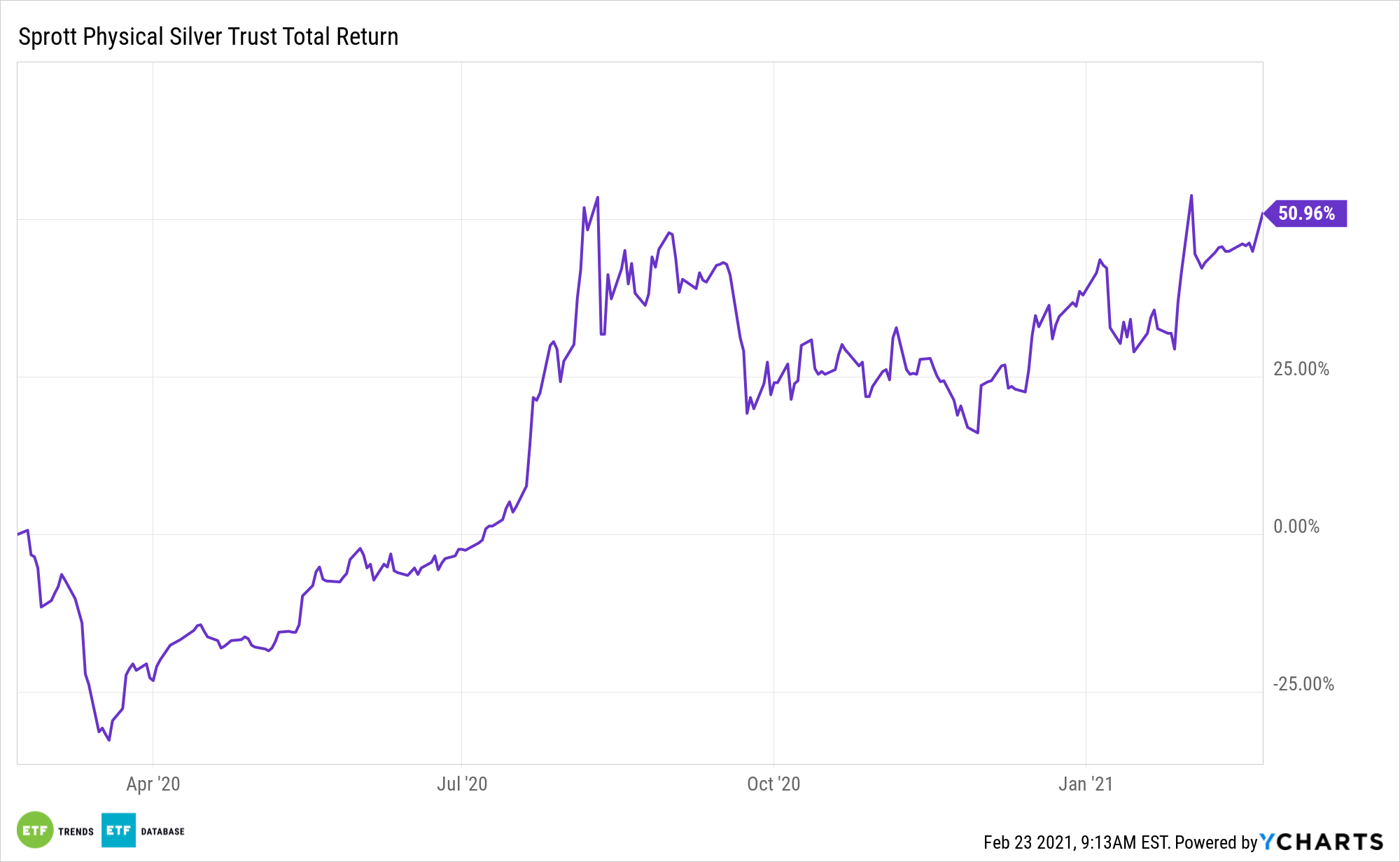

PSLV is a closed-end fund that lets investors redeem large blocks of shares in exchange for delivery of silver bullion. PSLV “provides investors with exposure to physical silver at a time when demand is high, causing excessive premiums for coins and bars,” according to Sprott.

The legislation in Kansas isn’t about abolishing the Fed, but rather about focusing on alternatives to Fed-issued dollars.

“Even though state action can’t end the Fed, there are steps states can take that will undermine the Federal Reserve’s monopoly on money. By passing laws that encourage and incentivize the use of gold and silver in daily transactions by the general public, policy changes at the state level such as the Kansas Legal Tender Act has the potential to create a wide-reaching impact and set the foundation to nullify the Fed’s monopoly power over the monetary system,” adds Zero Hedge.

Easy monetary policies and the weak greenback are clearly beneficial to commodities prices, particularly precious metals, but there are other reasons to believe PSLV will continue shining well into this year.

Amid increased adoption of renewable energy sources, new, fast-growing end markets are emerging for silver. In other words, the expected influx of cash to the renewable energy industry thanks to Biden’s victory is seen as benefiting silver prices.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.