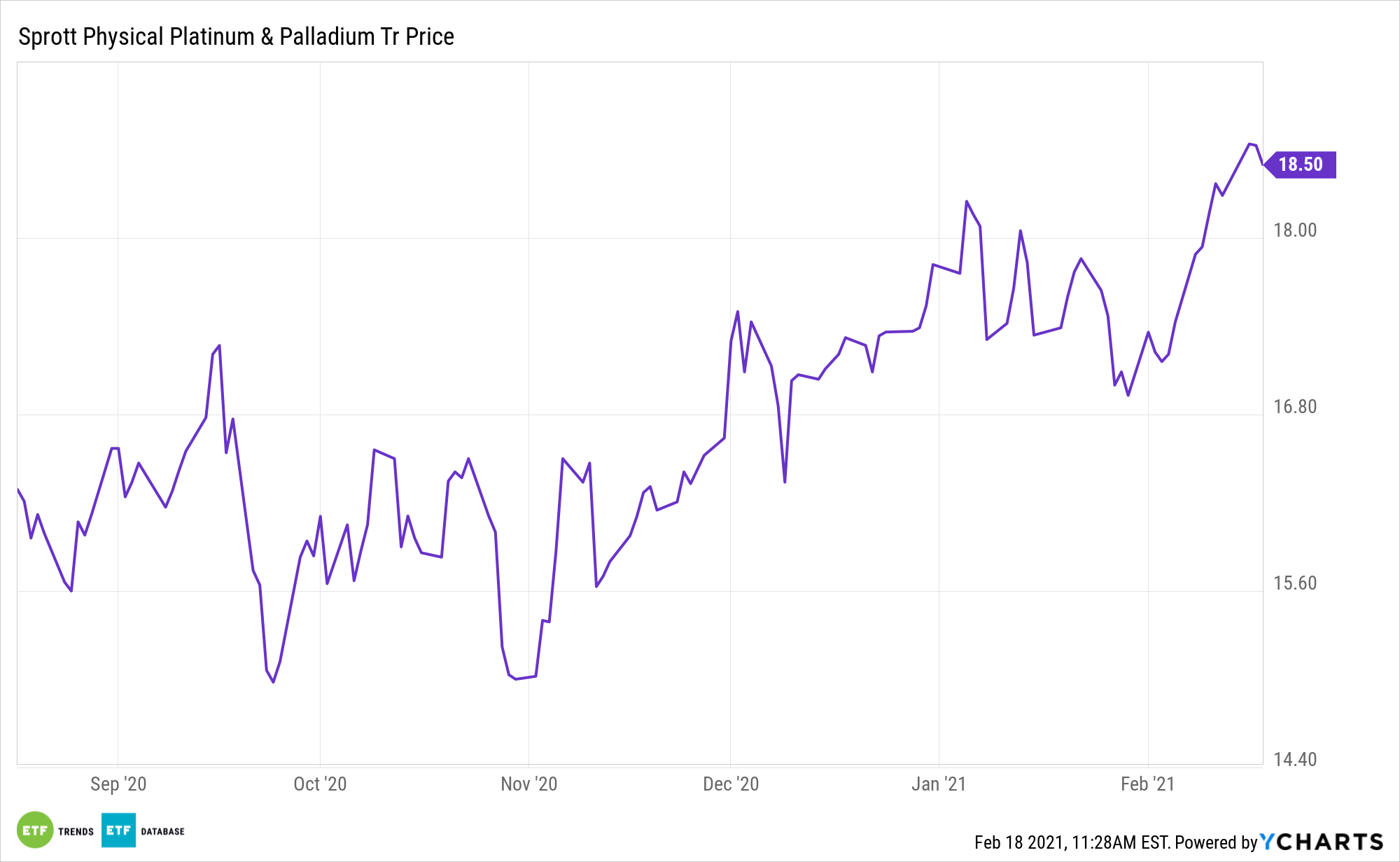

Some commodities market observers are discussing the potential arrival of another supercycle, and while it’s not official yet, investors can prepare for the event with products like the Sprott Physical Platinum and Palladium Trust (NYSEArca: SPPP).

SPPP provides “a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The Trust offers a number of compelling advantages over traditional exchange-traded platinum and palladium funds,” according to the issuer.

The fund merits consideration in a supercycle scenario because palladium and platinum would likely be two of the most responsive commodities.

“Commodity markets may be about to embark on another supercycle – a multi-year, broad-based, and usually large increase in prices – according to research published by some of the top investment banks involved in the sector,” reports Reuters. “But while many prices are likely to increase over the next couple of years, after slumping during the coronavirus pandemic, it is less clear this will mark the start of a supercycle rather than an ordinary cyclical upturn.”

SPPP Offers Benefits Beyond Cyclicality

The return to lower interest rates has also continued to support demand for physical assets, which tend to exhibit an inverse relationship to interest rates since investors are less apt to hold raw materials when bonds offer higher yields in a rising rate environment.

Though it’s not an exchange traded fund, SPPP offers tax benefits too.

SPPP “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars,” notes Sprott.

Economists and market analysts argue that a Biden administration will contribute to tighter environmental regulations and a focus on green energy technology, which may mean tighter regulation on car emissions and increase demand for palladium and platinum in catalytic converters.

“In a typical cycle, rising prices encourage more selling and production, and less buying and consumption, creating conditions for a subsequent price fall, before the pattern repeats,” adds Reuters. “In most cases, the cyclical behaviour of individual prices shows only limited synchronisation across commodity markets.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.