The appeal of cryptocurrencies can be alluring given their bull run in 2021, but gold’s reliable track record is still a draw for a number of investors.

“More than 50 years have passed since President Richard Nixon ‘closed the gold window,’ which led to the creation of the first free market in gold,” a Wealthmanagement.com article says. “During this period of time, gold has delivered capital appreciation equivalent to almost 8% a year on a compound annual growth basis. In light of these past results, the precious metal’s year-to-date drop of 6% has understandably been disappointing; however, it’s important not to lose sight of gold’s unique value proposition.”

The benefits of gold are certainly paramount in today’s market environment. Rising inflation is re-focusing investors on the tangible benefits of gold as an inflation hedge.

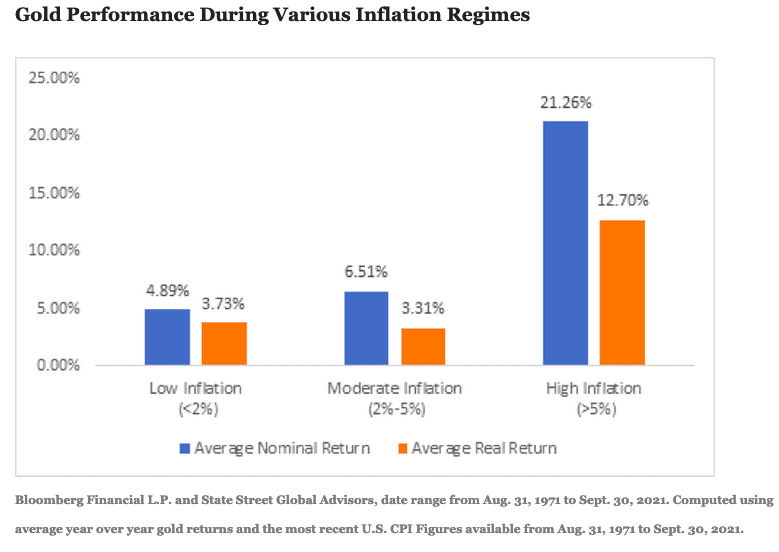

“Looking back over the past five decades, when the rate of inflation has remained below 2% a year, gold has delivered returns averaging around 5% a year,” the Wealthmanagement.com article says further. “During those periods when inflation was greater than 5% a year, the average return on gold has been over 20% a year, which equals an average real rate of return of around 12% during elevated inflationary periods—underscoring gold’s ability to provide protection against inflation for all types of investors.”

An ETF for Physical Gold Exposure

Getting gold exposure doesn’t have to be a trying task with ETFs like the Sprott Physical Gold Trust (PHYS). PHYS gives investors easy access to gold exposure with the option to convert their ownership shares to physical gold.

PHYS invests and holds substantially all of its assets in physical gold bullion. PHYS seeks to provide a secure, convenient, and exchange-traded investment alternative for investors who want to hold physical gold without the inconvenience that is typical of a direct investment in physical gold bullion.

“The Trusts’ precious metals are fully allocated which provides the Trusts with direct beneficial ownership,” Sprott explains on its website. “Unlike other bullion funds, the Trusts do not have an unallocated account that is used to facilitate transfers of bullion between financial institutions that act as authorized participants. Without exception, all of the bullion owned by the Trusts is held in the Trusts’ allocated accounts in physical form.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.