Gold exchange traded products, including the SPDR Gold Shares (NYSEArca: GLD), iShares Gold Trust (NYSEArca: IAU), are showing some signs of life, cobbling together gains of more than 1% over the past week, but gold bulls waiting for shorts to cover their positions may have to wait a while longer.

Recent data suggest short positions in gold are on the rise and with GLD laboring more than 6.40% below its 200-day moving average, it could take more than modest weekly gains to prompt rampant short covering.

“If the metal does continue to rally, the shorts will need to cover, potentially leading to an explosive rally in gold prices and equities. Ryan McKay, a TD Securities analyst in Toronto, says we’re not there yet, though it may be close,” reports Bloomberg.

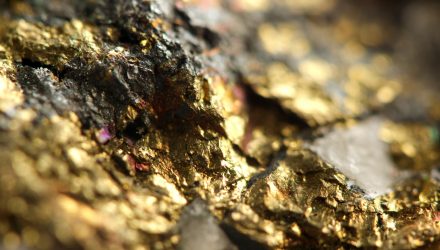

Some gold market observers believe the yellow can firm up and trend higher next year as the dollar retreats. At least one gold bull believes bullion could return to $1,400 for the first time since 2013. The current environment, characterized by economic growth and heightened inflation expectations, provides an ideal backdrop for investors to consider the benefits of real assets.

Getting Close for Gold

Gold’s recent move back above the psychologically important $1,200 area could be the start of some short covering, according to some market observers.

“After the precious metal tumbled to a 19-month low in mid-August, gold futures have been on the rise, and popped above $1,200 an ounce again on Friday to settle at $1,213.30,” reports Bloomberg.