![]() By Chris Konstantinos, CFA, RiverFront Investment Group

By Chris Konstantinos, CFA, RiverFront Investment Group

“Synchronicity is an ever present reality for those who have eyes to see.” – Carl Jung

The tragedy of Hurricane Harvey has understandably dominated the US news cycle this past week. Our thoughts and prayers here at Riverfront go out to all those affected by the devastation. However, we’d caution investors about extrapolating tragedy with an inevitable economic downturn; the negative economic impact of a natural disaster is often offset by increased spending generated by the reconstruction effort. Goldman Sachs’ economists believe the direct impact from Harvey could drag Q3 US GDP by roughly 0.2 pct in Q3 (mostly due to disruption in the energy patch), but that could be largely offset by business investment.

Almost unnoticed alongside such saddening headlines, global economic growth continues to plug along. The Wall Street Journal (WSJ) noted two weeks ago that all 45 countries tracked by the OECD (The Organisation for Economic Co-operation and Development) were on track to grow this year, with 33 of them set to accelerate from the prior year. This synchronicity across the world has been relatively rare in the past half-century, and suggests to us a global economy that is hitting on all cylinders.

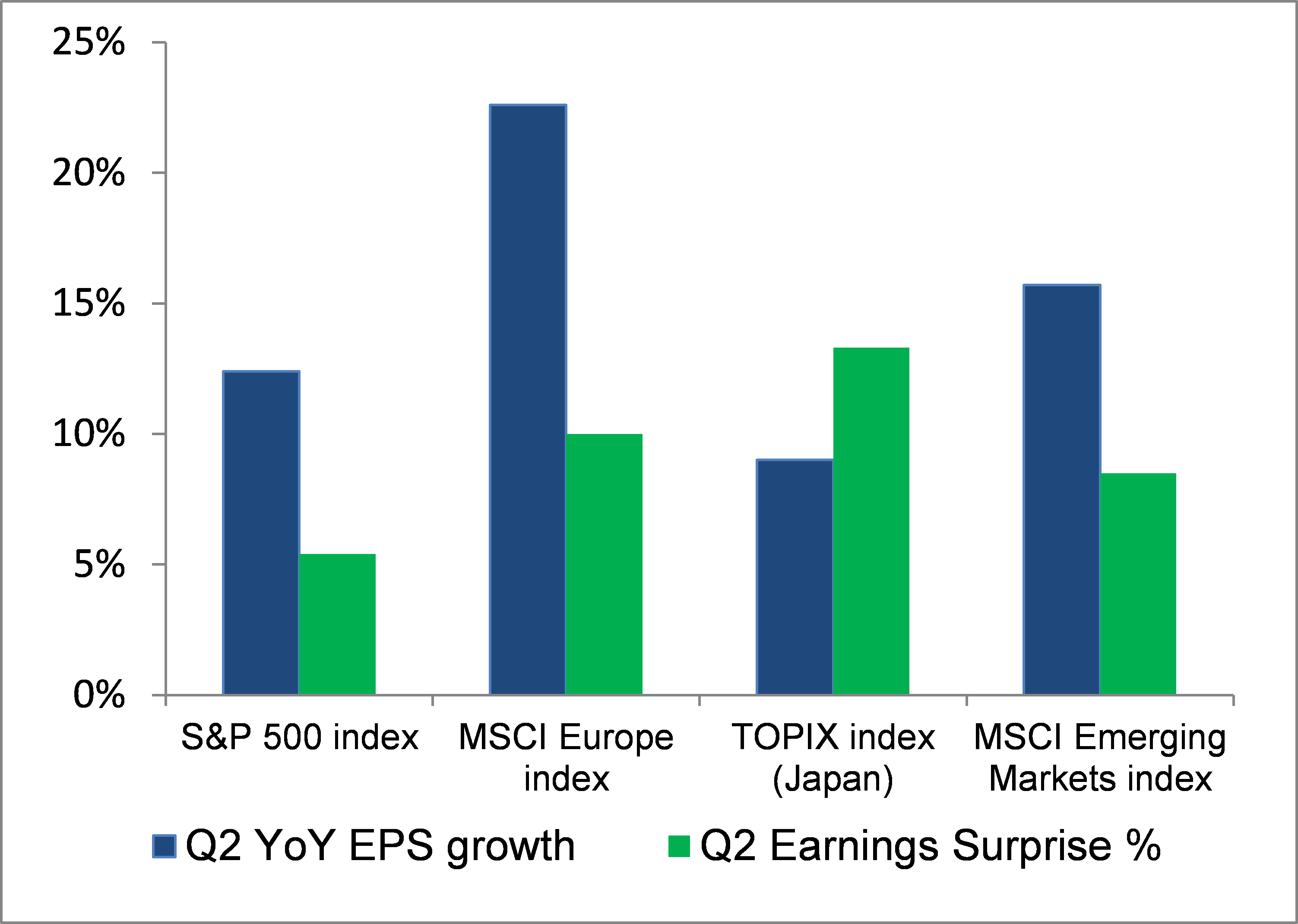

GLOBAL EARNINGS IMPROVING ALONGSIDE ECONOMIC GROWTH

Source: Thomson Reuters Datastream, Riverfront; all data in USD, as of 8/31/17

Global synchronized growth is encouraging, given our view that market sentiment is driven in part by the market’s collective probability of future recessions. However, for equity investors, economic growth is primarily useful insofar as it can help drive the corporate earnings cycle, or the ‘E’ in the P/E (price-to-earnings) equation. Investors have a tendency to directly equate economic growth with earnings growth; while the two are linked, the linkages are often less direct than you might expect.

The good news today is that the strong economic growth occurring across the world is currently mirrored in solid corporate earnings-per-share (EPS) trends as well. As proof, we would point to the just-finished 2nd fiscal quarter– year-over-year earnings growth in all major regions we track was positive (see blue bars of chart to the left), as was ‘earnings surprise’ – the difference between the EPS result and the average of analysts’ expectation prior to the announcement (green bars).

While investors have become accustomed to a growing trend of U.S. corporate earnings throughout the 8-plus year bull market, consistent growth in developed international and emerging markets has been much more fleeting. However, that appears to be changing, in our view. In all major regions of the world (Japan, Europe, US, and emerging markets), year-over-year earnings growth in calendar year 2017 is shaping up to be meaningfully positive. This is a milestone in our opinion. Our belief in the sustainability of this positive earnings trend in international markets is strengthened in part because the ‘top line’ (revenue growth) in most areas is growing as well, suggesting that the positive bottom line trends we are seeing are being driven by actual improving business trends and not just ‘financial engineering’ (moves like share reduction, cost cutting, and/or aggressive accounting treatment). This is consistent with an economy in secular rebound mode, with business and consumer confidence continuing to improve – something we’ve written about earlier this year in areas like the Eurozone and Japan (see Weekly View, dated 7/24/17 for more on this).

WE BELIEVE THE RALLY IN INTERNATIONAL STOCKS RELATIVE TO THE US IS SUSTAINABLE

We get a lot of questions about the sustainability of the year-long relative rally in international markets relative to the US – i.e., has the international rally come too far, too fast? We think not. While the recent USD weakness has perhaps slowed the ascent of FX-driven earnings boosts for international, the strengthening of Eurozone and emerging market currencies represents a lowering of the political and economic risks associated with them…an overall positive for their equity markets. We also believe that European and Asian central banks will remain generally accommodative; a stance that seems confirmed last Thursday by the continued low inflation rates across the Eurozone and Japan.

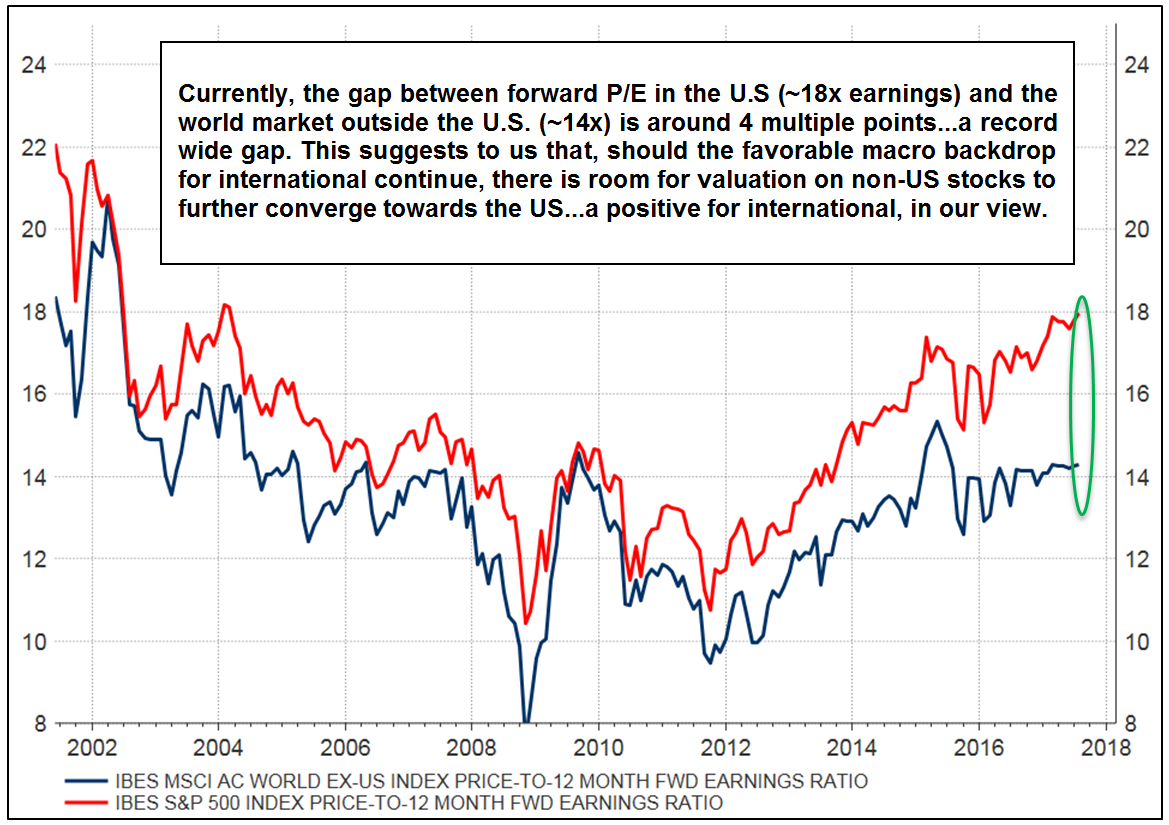

In addition, relative valuation for international appears attractive, in our view. Riverfront’s Price Matters® long-term asset allocation discipline suggests that positive mean reversion potential over the next 5-10 years is much stronger outside of the US than within it. More conventional valuation metrics also appear attractive on a relative basis, in our view; looking a 12-month forward P/E ratio at the MSCI All-Country World Ex-US index, we are currently at the largest valuation gap between US and non-US markets in the 15+ years of data to which we have access.

CHART OF THE DAY: VALUATION IN INTERNATIONAL STILL VERY REASONABLE COMPARED TO THE US

Source: Thomson Reuters Datastream, Riverfront; all data in USD, data from 06/01/2001-08/31/17

This article was written by Chris Konstantinos, CFA, Director of International Portfolio Management at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information:

The comments above refer to generally to financial markets and not RiverFront portfolios or any related performance.