By Grant Engelbart, CLS Investments

Some of the most common New Year’s resolutions are to work out more, lose a few pounds, or just be more active in general. Despite the overwhelming trend in flows into low-cost, passive, index investment products, investors would be wise to adopt the same resolutions with their investments.

Actively managed mutual funds have been around for nearly a century and still command more than $11 trillion in assets (in the U.S.) However, over the past three years, more than $400 billion has flowed out of active mutual funds, mainly into passive ETFs. There have been many reasons cited for this migration, with the most common being higher costs and underperformance of active managers. But do active managers add value? The answer might surprise you.

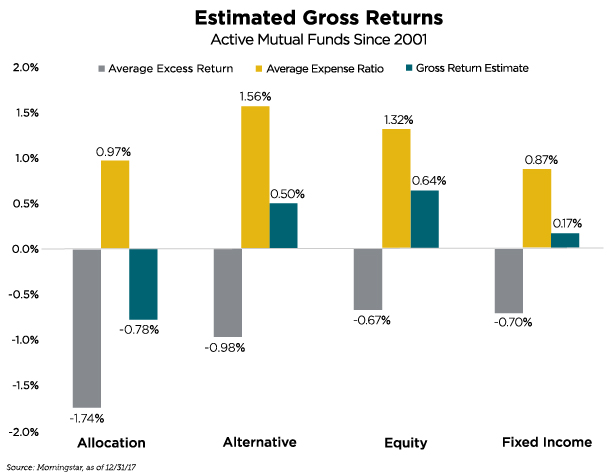

Since 2001, using Morningstar categories as a proxy, active managers on average have delivered negative excess returns relative to applicable benchmarks. Some categories did outperform (high-and low-category returns shown in the boxes below), but on average, active managers failed to add value above and beyond their expenses.

![]()

Those expenses are a key reason for the underperformance. Looking at the current category-level expense ratios (gold boxes below), it’s clear that expenses have eaten away most of the excess returns. Given expenses have undoubtedly come down over time, this likely understates the impact. With these data points, we can create estimated gross returns for active managers over this time period (teal boxes). It turns out – without the effect of fees, active managers can add some value! Who would have thought?

While I hope this seems reasonable to most, looking at flows and the trend of product launches, and maybe some regulatory influence, it seems many are scoffing at active management. However, if active managers in aggregate can add some (gross) value, and there are undoubtedly many high-quality managers who are adding value regardless, simply reducing the overall costs of active management could have a significant impact.