NASDAQ 100 Index vs S&P 500 Index

Source: Bloomberg L.P., as of Nov. 20, 2017, for the period from Sept. 30, 2014, through Sept. 30, 2017. Data is calculated quarterly for underlying companies using the GICS Retailing Industry Group classification.

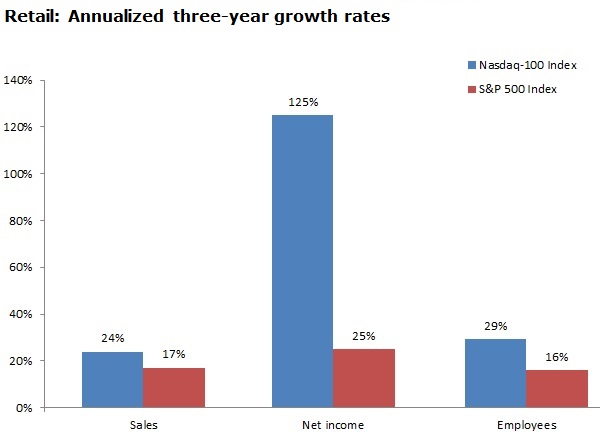

On average, retailers within the Nasdaq-100 Index have generated 174% higher growth rates for these three metrics than have retailers within the S&P 500 Index over the past three years. In turn, the market has rewarded this group of retailing stocks with solid year-to-date returns. The Nasdaq-100’s retail stocks have returned 41.9% through Nov. 24, while S&P 500 Index retailers have returned 24.3% over this same time period.3

Retail as a growth industry?

It’s also interesting to note that while some retailers might be closing stores, retail as an industry is still growing. First, consider employee count. Only four of the 29 retailers within the S&P 500 Index decreased the number of employees over the three-year period ending Sept. 30, 2017.

Those four companies represent just 5% of market capitalization within the GICS Retailing Industry Group. Next, consider revenue and earnings. Only six of 29 retailers within the S&P 500 Index had lower sales than three years ago, while just nine of 29 retailers had lower net income than three years ago. In both cases, these companies represent just 6% of S&P 500 Index retailers’ total market capitalization.

Needless to say, retail is not in as dire a situation as headlines might have you believe. As large retailers reposition their businesses to meet the preferences and behaviors of consumers, they will need to ramp up capital spending — particularly on technology platforms — which can lower near-term earnings growth. But as many of the most successful retailers have demonstrated, investing in technology now can pay off big down the road.

Investors wishing to increase their exposure to well-positioned retailers within e-commerce and omnichannel distribution may wish to consider PowerShares(QQQ), an exchange-traded fund that tracks the Nasdaq-100 Index.

This article has been republished with permission from Invesco Powershares.