When it comes to fixed income investing, investors may seek long-term bonds to extract its benefits of higher returns in lieu of additional risk, but in market times like today where trade concerns continue to roil the markets and interest rate spikes lie ahead, a short-term strategy in conjunction with a floating rate component could be the ticket to solid returns as in the case of the iShares Floating Rate Bond ETF (BATS: FLOT).

Ideally, short-term bonds will have the attached benefit of less volatility when compared to its longer-termed bond counterparts. However, in relation to human nature seeking instant gratification rather than waiting for the long-term benefit, the case for FLOT is made.

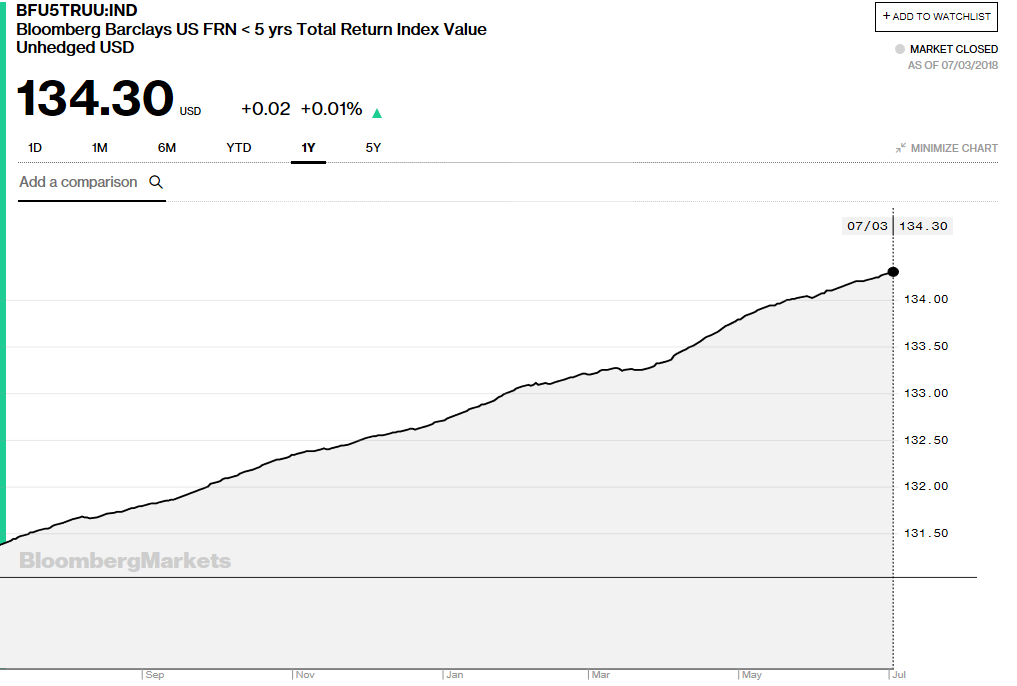

FLOT seeks to track the investment results of the Bloomberg Barclays US Floating Rate Note < 5 Years Index , which measures the performance of U.S. dollar-denominated, investment-grade floating rate notes–this is where 90 percent of its assets are derived. The underlying index itself is up 2.2 percent within the past year.

![]()