CNBC “Mad Money” host Jim Cramer sees long-term Treasury bonds getting hammered in the coming weeks, which fixed income investors can avoid with the right exchange traded funds (ETFs).

Cramer’s assessment comes after viewing charts that suggest yields will be spiking, which puts downward pressure on bond prices. A main reason is seasonality, as bonds fall in late August and early September.

“The charts, as interpreted by Larry Williams, suggest that long-term Treasury bonds are about to get hammered over the next couple weeks,” said Cramer. “You better believe that will have negative consequences for the stock market … because it often presages rate hikes from the Fed. After this big spike and record high after record high after record high, that’s the last thing we want to see right now.”

Short-term bonds can help diversify a fixed income portfolio while limiting duration risk. With inflationary pressures increasing, the shorter duration limits the damage if interest rates rise in the interim.

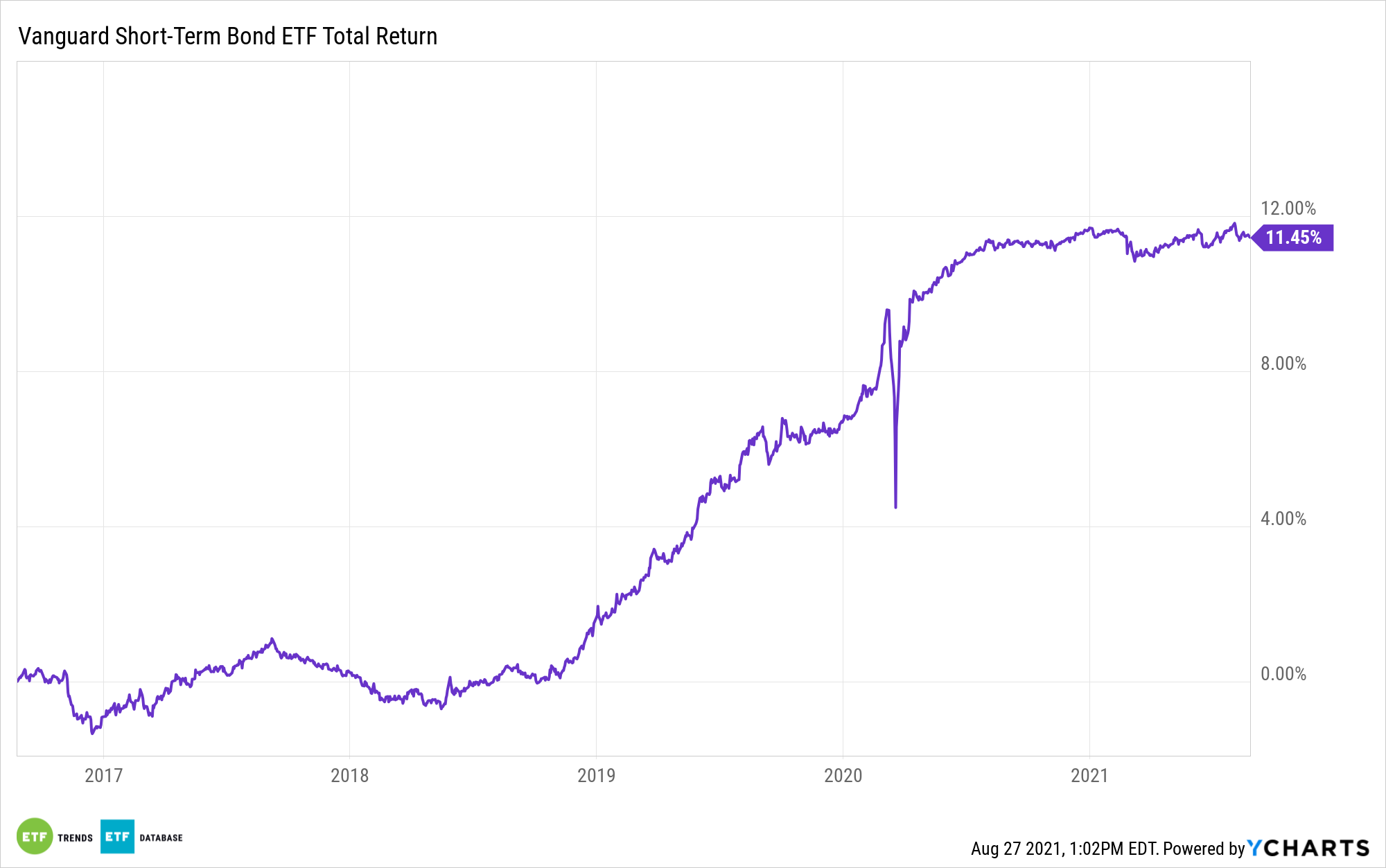

One option to shorten duration is the Vanguard Short-Term Bond Index Fund ETF Shares (BSV). BSV seeks to track the performance of the Bloomberg Barclays U.S. 1-5 Year Government/Credit Float Adjusted Index, which includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between one and five years and are publicly issued.

All of the fund’s investments will be selected through the sampling process, and at least 80% of its assets will be invested in bonds held in the index.

BSV Highlights:

- Seeks to track the performance of the Bloomberg Barclays U.S. 1–5 Year Government/Credit Float Adjusted Index, a market-weighted bond index that covers investment-grade bonds with a dollar-weighted average maturity of one to five years.

- Invests in U.S. government, high-quality (investment-grade) corporate, and investment-grade international dollar-denominated bonds.

- Follows a passively managed, index sampling approach.

Even Shorter Duration

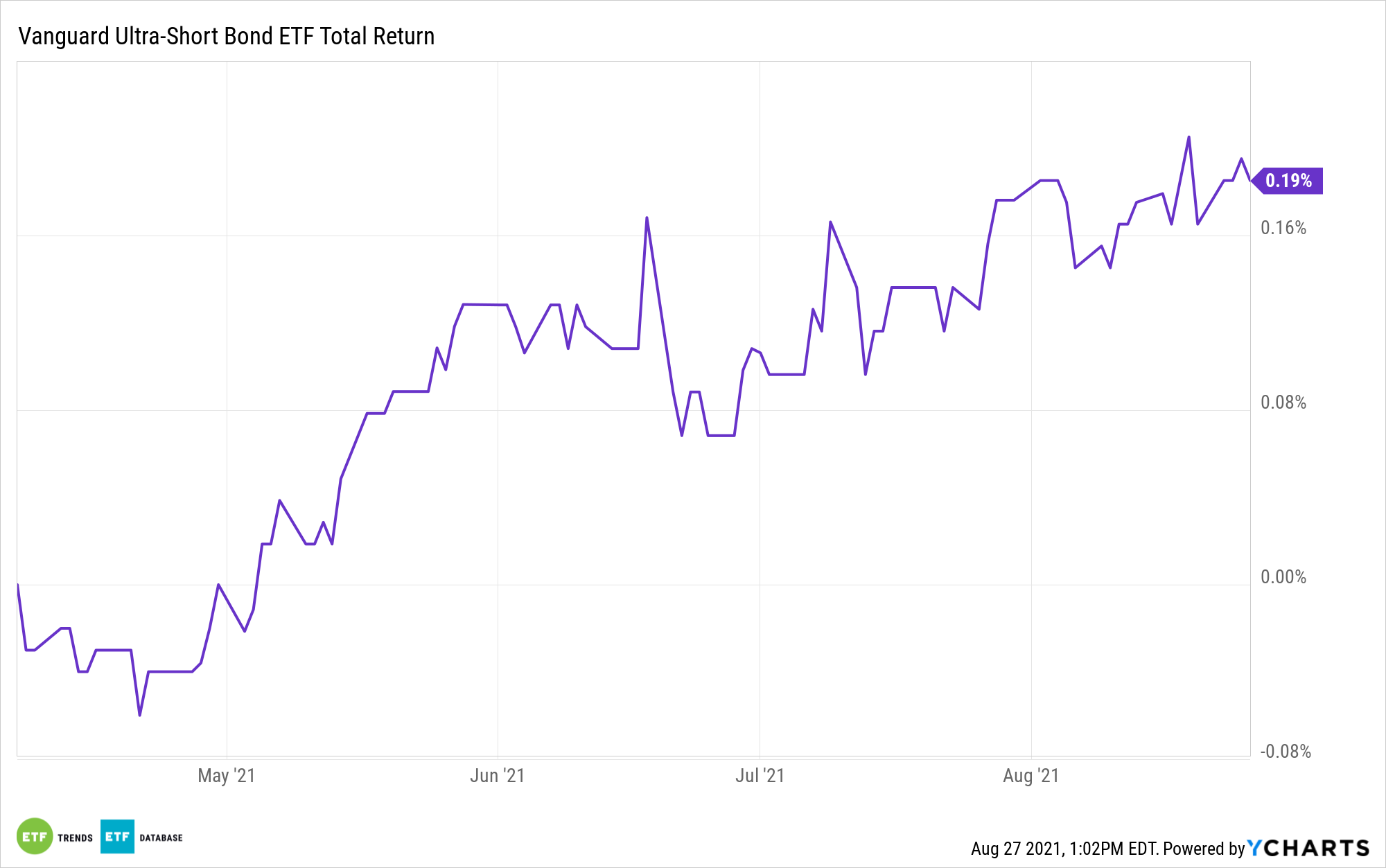

Another option to get even shorter duration is the Vanguard Ultra-Short Bond ETF (VUSB). With its low 0.10% expense ratio, VUSB’s investment objective is to seek to provide current income while maintaining limited price volatility.

VUSB invests in a diversified portfolio of high-quality and, to a lesser extent, medium-quality fixed income securities. It offers a dollar-weighted average maturity of zero to two years.

Under normal circumstances, the fund will invest at least 80% of its assets in fixed income securities. The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities.

For more news, information, and strategy, visit the Fixed Income Channel.