Bond exposure isn’t limited to hedging stocks as part of a traditional portfolio mix, especially when ultra-short bonds offer investors options for a different scenario. That said, when is it best to use them?

For the investor looking to park cash in the interim while earning a return, a common choice might be a money market fund account. However, getting the most out of one’s cash in that short duration is difficult with bottom-of-the-barrel rates in the current market.

This is where ultra-short bonds come into play. The shorter maturity dates limit the duration risk investors are exposed to if they went with bonds attached to longer-dated maturities.

“Ultrashort-term bond funds can be smart choices for investors who want better potential short-term yields than money market accounts but less market risk than short-term bond funds with longer maturities,” an article in The Balance explained.

“Conservative investors tend to like ultrashort-term bond funds because they have less interest-rate sensitivity than short-term bond funds but will typically have higher yields than money market funds,” the article added.

The Federal Reserve recently opted to keep rates near zero in spite of rumblings of inflation appearing in consumer price data. Despite that, the current rate environment makes an ultra-short bond fund a prime option when compared to money market funds with comparatively lower rates.

“So if, in a low-interest-rate environment, an investor wants to get a yield higher than money market funds but interest rates are expected to rise in the near future, ultrashort-term bond funds can be a good idea,” The Balance article added further.

One Ultra-Short Option from Vanguard

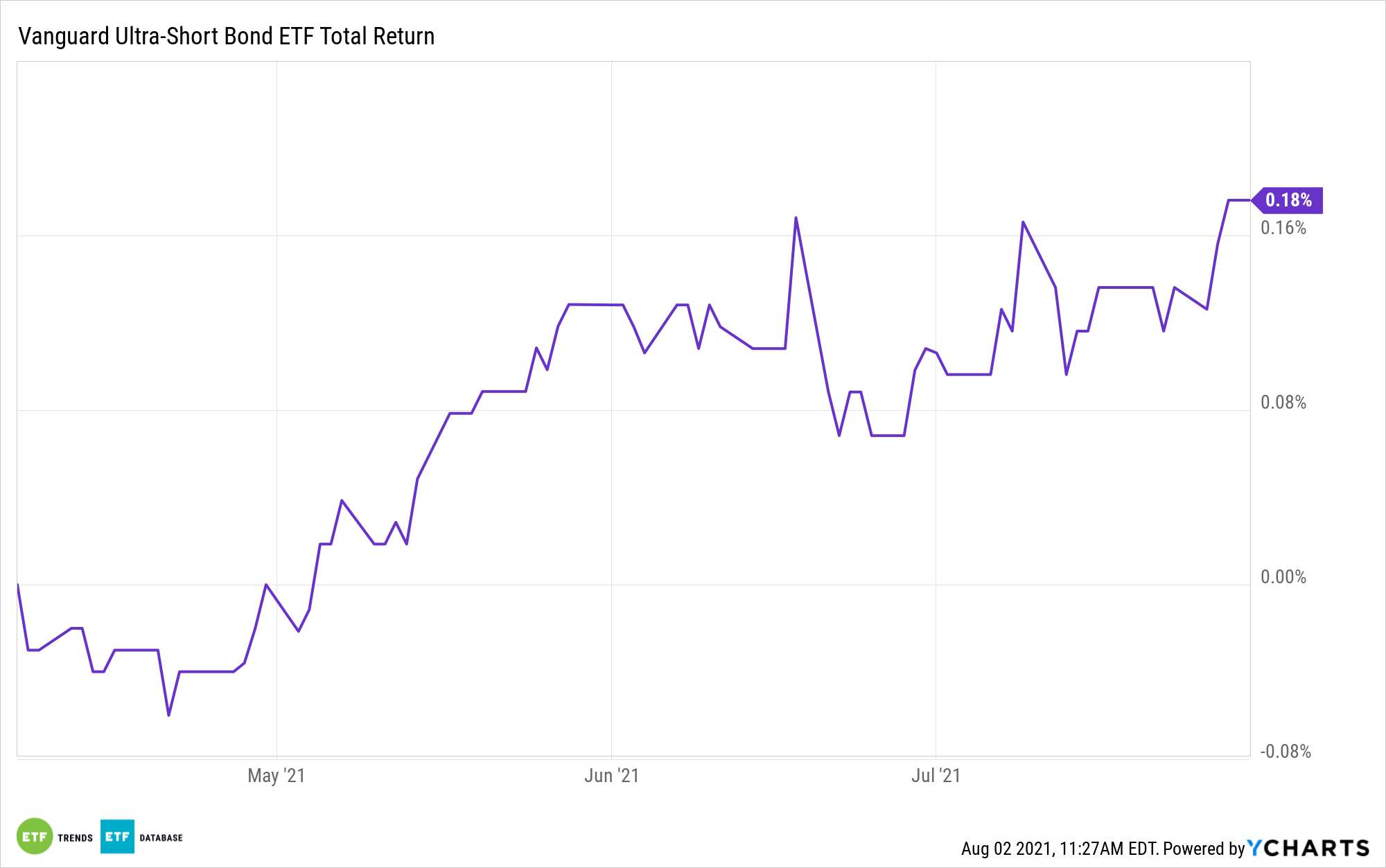

Given a plethora of fund choices out there, one to consider is the Vanguard Ultra-Short Bond ETF (VUSB). It’s just one of the many choices offered by Vanguard, which has a bond fund to fit any investment scenario.

With its low 0.10% expense ratio, VUSB’s investment objective is to seek to provide current income while maintaining limited price volatility. The fund invests in a diversified portfolio of high-quality and, to a lesser extent, medium-quality fixed income securities. It offers a dollar-weighted average maturity of 0 to 2 years.

Under normal circumstances, the fund will invest at least 80% of its assets in fixed income securities. The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities.

For more news, information, and strategy, visit the Fixed Income Channel.