The adage “the more things change, the more things stay the same” could relate to the Federal Reserve’s 2018-19 interest rate policy–it kept changing (higher) in 2018 and now the capital markets expect them to stay unchanged through 2019.

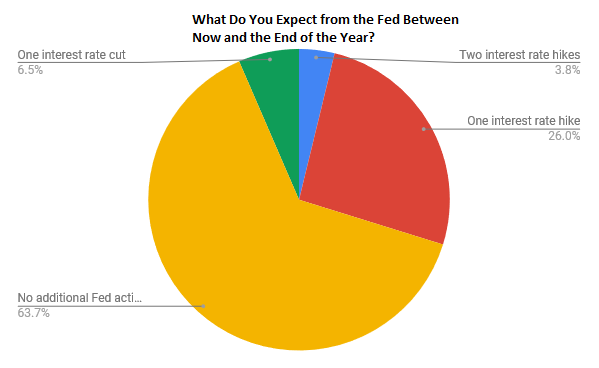

At the ETF Trends-ETFdb 2019 Virtual Summit, that’s exactly what the majority of attendees also think when asked whether they expect to see the central bank take more action on interest rates–upward (one rate hike or two), downward with a rate cut or none at all — 63.70 percent are expecting the latter.

The survey was presented on the Fixed Income Strategies for a Changing Debt World, which featured the following panel of experts:

- Jordan Farris, Managing Director, Head of ETF Product Development, Nuveen

- John Ecklund, Managing Director, Global Fixed Income, Currency & Commodities Group, J.P. Morgan Asset Management

- Tim Urbanowicz, Senior Fixed Income ETF Strategist, Invesco

The experts covered the potential headwinds facing the bond markets, such as inverted yield curves, BBB investment-grade bonds succumbing to junk status and slowing global growth.

In the video below, Megan Greene, Manulife Asset Management MD & Chief Economist, discusses bond moves, the upcoming Fed meetings, and more.

For more market trends, visit ETF Trends.