The Columbia Diversified Fixed Income Allocation ETF (DIAL) is the best performing US Multi-Sector bond fund across 354 open-end mutual funds and ETFs in the category of US Multisector Bonds, according to Morningstar’s rating system.

As explained by Columbia, DIAL is a fixed weight multisector bond fund, oriented toward yield balanced by quality. Being a global fund, it can take advantage of a broader yield opportunity. Additionally, rules are set in place to build portfolios with bonds with strong liquidity to ensure the process is repeatable.

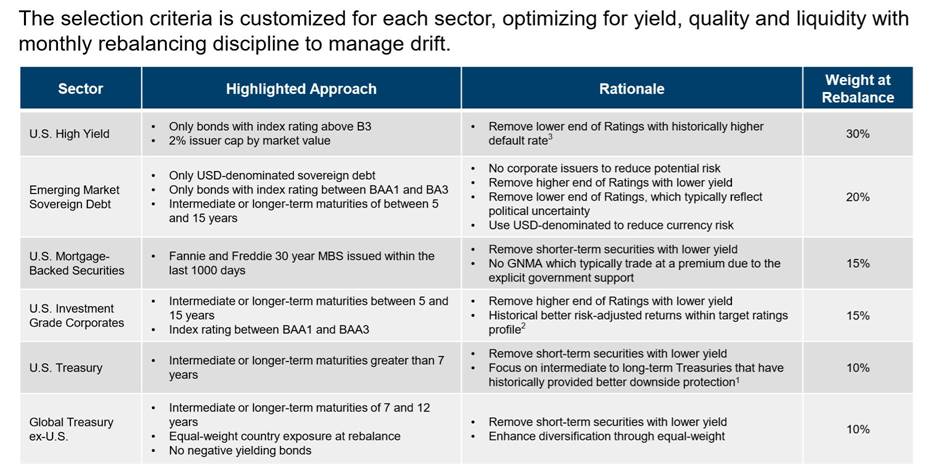

Each rule set is oriented toward producing income without taking on undue risk. For example, with US High Yield (30% allocation), no CCC or lower bonds are used to remove the more volatile parts of the high yield sleeve. Said another way, DIAL allocates to the higher-rated high yield bonds.

With emerging market debt (20% allocation), DIAL only uses cash denominated bonds to reduce currency volatility, and sovereigns with a credit rating of BB or BBB to avoid the very volatile B and below names, as well as the A and above names with minimal yield advantage to treasuries.

DIAL also allows for a maximum maturity to reduce volatility in risk-off environments.

For US Treasuries (10% allocation), DIAL uses longer Treasuries (7+ years) to get a yield, but also act as a useful diversifier to the High Yield and EM exposure.

Determining Worthwhile Fixed Income Investments

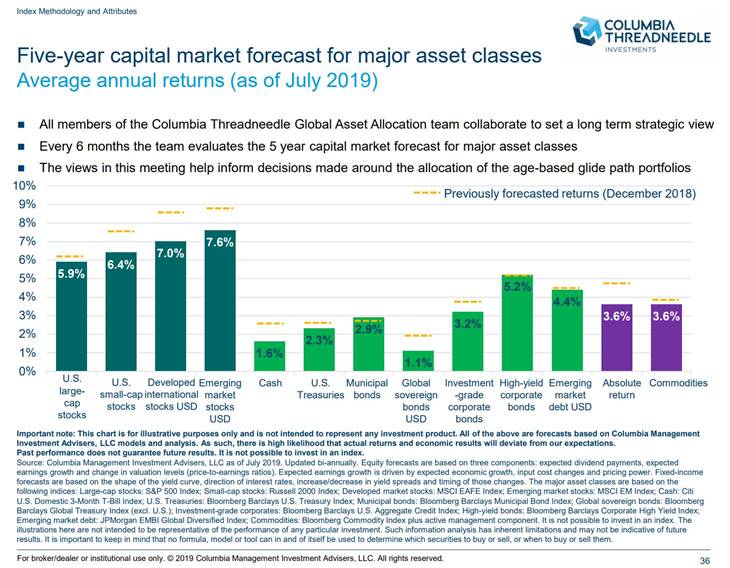

Columbia notes the fixed income investing paradigm has changed after a 40-year declining rate environment, where longer duration treasuries produced equity-like returns. Investors will need to be broader in their opportunity set for income. The sectors that produce the most income may not be as familiar to many investors

To become active fixed income portfolio managers, Gene Tannuzzo and David Janssen of Columbia Threadneedle built the Beta Advantage Multi-Sector Bond Index (BAMSTRUU), based on their experience and insight.

BAMSTRUU has rule sets for six fixed income sectors (detailed in the chart below), which try to optimize yield with balancing risks and quality. Additionally, while tracked by DIAL, the index is made up of 850 bonds. The PM team uses representative sampling from those bonds to build the portfolio.

DIAL Sector Highlights

Columbia explains how every sector is vital in its intentional amount of exposure, as opposed to a traditional bond benchmark. This method was chosen, as bond benchmarks are not optimal as they are built by rewarding the issuers with the most debt and the largest allocation in the index.

Investors always know what they own by sector weight because DIAL allocation percentages do not move. Looking at the Global Treasury sector, for example, which has a 10% allocation in DIAL, it’s built by the equal weighting of 11 country’s treasuries.

Moreover, the traditional Global Treasury Ex US index, which features an issuance weighted approach, allocated approximately 40% to Japan (a large debt issuer). However, Japan has a very low or possibly even a negative yield. So, having 40% in Japan in a global treasury portfolio is not optimal.

Related: A Smart Beta Bond ETF for a Changing Fixed-Income Landscape

Potential Prolonged Low-Interest Rate Environment

DIAL is aligned with the sectors of the market forecast to produce the most income and return while maintaining an investment-grade overall rating. It was built by stack ranking the six sectors of fixed income high to low and then assigning the highest sector with the most weight.

In this case, that would be US High Yield, Emerging Market Sovereign Debt, and US Investment Grade Corporates.

Learn More About DIAL With This Video

For more fixed income strategies, visit our Fixed Income Channel.