By Peritus Asset Management

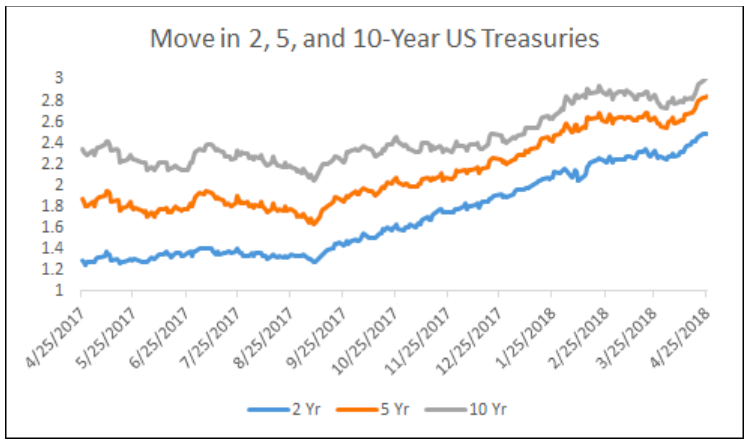

Looking at where we were just a year ago, we have seen a notable move upward in US Treasury yields, with the 2-year yield going from 1.29% at the at the end of April 2017 and nearly doubling to the current level of 2.49%, while the 10-year was at 2.35% a year ago and is now right around the 3% level.(1)

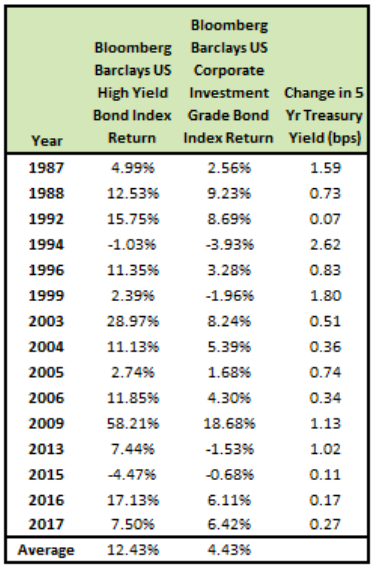

Of note, most of the move in the longer end of the curve, the 5-yr and 10-yr yields, has come in just the past six months. These rate moves have left many questioning just what that means for fixed income investors, especially those in the high yield corporate bond world. If we look to history, that should give us some comfort as we face the potential of higher rates. In the over 30 years of data, since 1986, Treasury yields have increased (i.e., interest rates rose), in 15 of those calendar years. In all but one of those 15 years, high yield has outperformed the investment grade bond market.

Video: Learn About Cash and Cash Equivalents in 1 Minute

The long-term numbers show that over those 15 years when we have seen Treasury yields/interest rates increases, high yield had an average annual return of 12.4% (or 9.2% if you exclude the massive performance in 2009). This compares to only a 4.4% average annual return (or 3.4% excluding 2009) for investment grade bonds over the same period.(2)

![]()

So the data is clear that the high yield bond market has historically not only provided investors with solid returns during years in which we see interest rates increase, but has also dramatically out performed its investment grade counterpart. Looking at this is a different way, below we lay out the historical returns for the high yield index during periods of rising rates. Here we specifically look at how the index performed prior to and following periods when rates rose 30bps, 50bps, 70bps, and 100bps over certain periods of time.(3)