A growing chorus of Wall Street banks forecasting lower yields is beginning to emerge as a murky outlook on global economic growth looms for the capital markets.

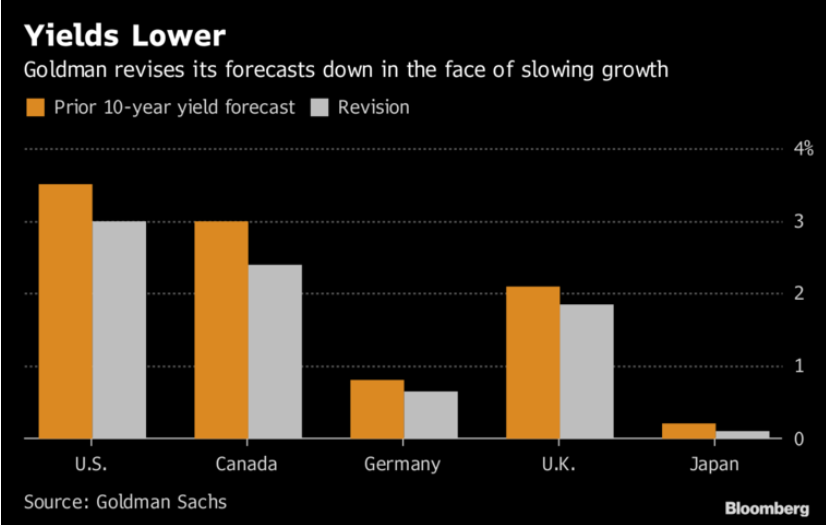

Goldman Sachs Group Inc, JPMorgan Chase & Co. and Bank of America Merrill Lynch are a few names projecting a drop in benchmark Treasury yields. Goldman Sachs recently projected that a 50-basis drop to 3 percent is in store for the 10-year Treasury yield by year’s end.

“We now believe 10-year yields may have peaked for this cycle,” wrote Goldman strategists led by Praveen Korapaty. “Material weakness in growth data, combined with poor risk sentiment and tighter financial conditions have led markets to reconsider the extent of monetary policy normalization possible globally.”

The 10-year note rose to 2.708 on Tuesday while the 30-year note also ticked higher to 2.99.

2016 All Over Again?

JPMorgan Chase & Co. and Bank of America Merrill Lynch are also expecting similar drops as the possibility of less interest rate hikes factor in to the current economic landscape, especially given Federal Reserve Chairman Jerome Powell’s recent comments regarding a more accommodative central bank with respect to interest rate policy. Powell recently referenced 2016 as a prime example of a year that warranted the Fed to be more adaptable with policy.