Just as the markets are recovering from a volatile year’s end to 2018, the last thing investors want to hear is the word “recession.” However, the word has been thrown around the central bank more often, according to the latest CNBC Fed Survey.

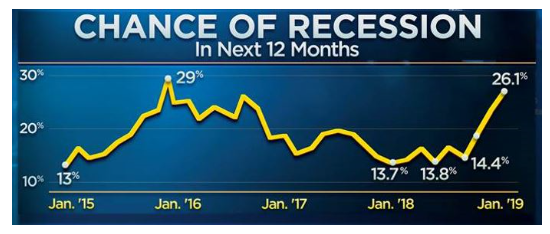

According to the survey, which was conducted while the U.S. was in the midst of a government shutdown, the chance of a recession happening within the next 12 months rose to 26 percent. The last highest level was in 2016 when it reached 29 percent.

The level reached its highest in 2011 when it hit 36 percent.

“When you look at the slide in global growth, it is hard to think that, in a matter of time, the U.S. won’t join the slide,” Kevin Giddis, Head of Fixed Income Capital Markets at Raymond James Financial, wrote in response to the survey. “This prospect has only been enhanced by a lack of a trade deal, the government shutdown, and a completely inefficient cooperation in Washington.” In the video below, Greg Peters, senior portfolio manager at PGIM Fixed Income, Michael Purves, chief global strategist and head of derivatives strategy at Weeden, and Bloomberg’s Luke Kawa discuss the risk of a U.S. recession. They speak with Bloomberg’s Jonathan Ferro on “Bloomberg Markets: The Open.”

In the video below, Greg Peters, senior portfolio manager at PGIM Fixed Income, Michael Purves, chief global strategist and head of derivatives strategy at Weeden, and Bloomberg’s Luke Kawa discuss the risk of a U.S. recession. They speak with Bloomberg’s Jonathan Ferro on “Bloomberg Markets: The Open.”

For more market trends, visit the Fixed Income Channel.