In an effort to reignite investor interest in Turkey debt, the country will offer a dollar-denominated bond to the international fixed income market. To facilitate this offering, the country hired BNP Paribas, Citigroup and HSBC to sell a dollar-denominated bond that will mature in 2024, according to the Ministry of Treasury and Finance.

This latest bond offering will mark the fourth time in 2019 the country has sold paper in currencies other than the lira.

“Turkey’s international bond announcement attracted a lot of attention this morning, with many observers raising a logical question about the use of proceeds (in light of the recent currency interventions),” wrote VanEck economist Natalie Gurushina. “The news lifted the mood among bond-holders, but the lira was barely in the black at the time of this note … The consensus is quite bullish—yearly headline inflation is expected to drop to 16.1% and core to 14.65%. These projections underpin the market expectation for sizable rate cuts, with 139bps of easing priced in for the next three months.”

At one point last year in order to help stem the tide of its record low currency levels amid high inflation, Turkey’s central bank raised interest rates by 625 basis points to 24 percent in a move that runs counter to President Recep Tayyip Erdogan’s request to keep borrowing costs low.

The move by the central bank comes as a surprise as the common notion was that President Erdogan was a heavy influencer in terms of monetary policy. Just hours prior to the central bank’s announcement, President Erdogan referred to interest rates as a “tool of exploitation,” positing “I say, let’s drop these high interest rates. Interest is the cause, inflation is the result.”

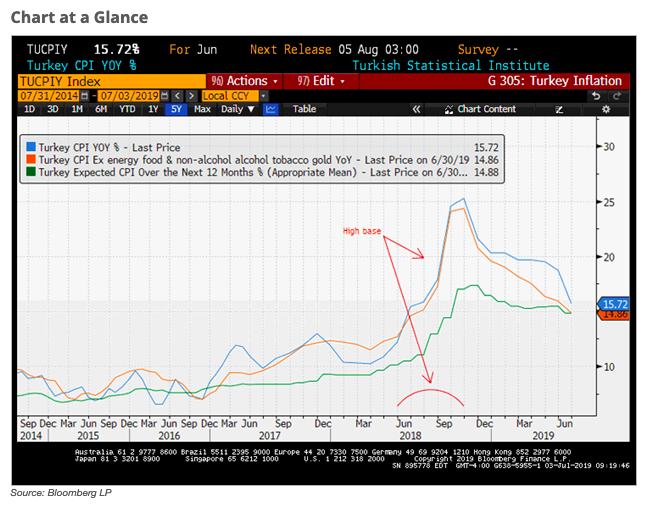

“Turkish local rates staged a rally following the release of lower than expected inflation prints,” Gurushina wrote. “Yearly headline inflation dropped to 15.72% from 18.71% in May, mainly on the back of a very high base effect. Core inflation also moderated in June, albeit less than expected (to 14.86% year-on-year). The base effect (see chart below) should continue pushing inflation lower in the coming months, leaving room for policy rate cuts (barring unexpected events, such as geopolitical twists). The market currently prices in 146bps of cuts for the next three months, which does not look too excessive under the circumstances.”

In 2018, Turkey faced heavy pressure to raise rates as the lira has spiraled downward by more than 40% against the U.S. dollar. However, the latest efforts by the central bank appear to be steadying its value for the time being.

“The government’s willingness or ability to implement policies that will sustain external investor confidence in the economy and financial system by addressing underlying weaknesses remains uncertain,” said credit rating agency Moody’s.

For exchange-traded fund (ETF) investors looking to capitalize on Turkey, they can consider the iShares MSCI Turkey ETF (NasdaqGM: TUR). The investment seeks to track the investment results of the MSCI Turkey IMI 25/50 Index. The fund generally will invest at least 90% of its assets in the component securities of the underlying index and in investments that have economic characteristics that are substantially identical to the component securities of the underlying index. The underlying index consists of stocks traded primarily on the Istanbul Stock Exchange (ISE).

For more market trends, visit ETF Trends.